Is Alphabet the Underdog in the Magnificent Seven Stock Group?

The “Magnificent Seven” is a term popularized by CNBC’s Jim Cramer to describe a select group of stocks leading market gains in recent years. This group includes:

- Nvidia (NASDAQ: NVDA)

- Apple (NASDAQ: AAPL)

- Microsoft (NASDAQ: MSFT)

- Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL)

- Amazon (NASDAQ: AMZN)

- Meta Platforms (NASDAQ: META)

- Tesla (NASDAQ: TSLA)

Investors who bought into this group a few years back have likely seen impressive returns. However, with this surge in performance, many of these stocks have become quite expensive.

Alphabet: The Budget-Friendly Giant

Among the “Magnificent Seven,” Alphabet stands out as the least expensive based on its price-to-forward-earnings ratio, which sits at a low 22 times. For comparison, the S&P 500 trades at 23.8 times forward earnings, making Alphabet a potentially attractive option for investors.

This raises an important question: is Alphabet stock a steal, or could it be a dangerous investment?

Strong Quarterly Results for Alphabet

Known primarily as the parent company of Google, Alphabet generates about 75% of its revenue from advertising. This includes earnings from both its Google search engine and ads on YouTube.

While ad sales aren’t typically a huge growth driver, they support Alphabet’s broader business goals. In Q3, advertising revenue climbed by 10.4% year over year, reinforcing Alphabet’s ability to invest in growth areas, such as Google Cloud.

According to Synergy Research Group, Google Cloud holds the third-largest market share in the cloud sector but boasts the fastest growth rate, with revenue increasing by 35% year over year. Its operating margin also jumped from 3.2% to 17%, indicating continued improvements in profitability.

The surge in demand for artificial intelligence (AI) infrastructure contributes to Google Cloud’s success. Companies are increasingly choosing Google Cloud for its efficient AI tools, supported by Google’s advanced GPUs and TPUs that enhance performance.

A Bright Future Ahead for Alphabet

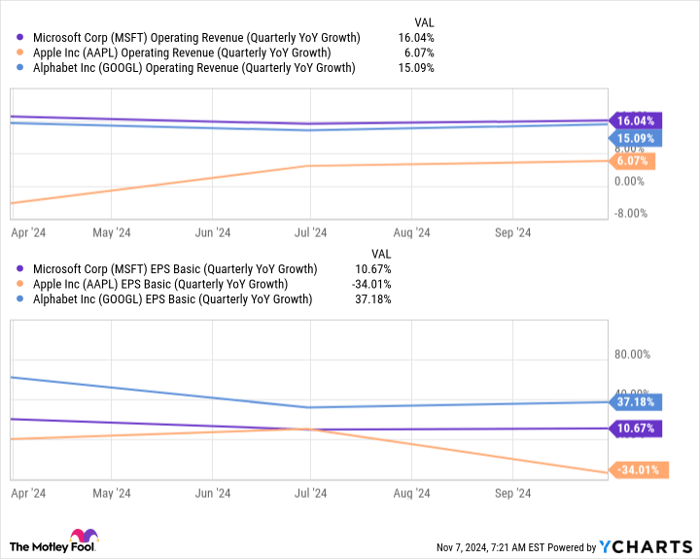

Alphabet’s overall Q3 performance was impressive, with total revenue up 15% year over year, compared to 11% growth earlier in 2023. Thanks to efficiency measures, its operating margin shot up to 32%, leading to a significant earnings per share (EPS) increase from $1.55 last year to $2.12 this year—a growth of 37%.

This exceptional performance eclipses that of other “Magnificent Seven” members like Microsoft and Apple, whose recent earnings growth lagged behind Alphabet’s results. It’s also noteworthy that Alphabet’s stock trades at a considerable discount relative to these competitors.

Valuation Insights: Alphabet’s Potential

If Alphabet were to match Microsoft’s valuation, it would be valued at approximately $3.17 trillion, exceeding Microsoft’s $3.12 trillion market cap as of writing this article. Despite its commanding position in the tech landscape, Alphabet remains undervalued compared to its peers.

This relative undervaluation, paired with strong growth prospects, positions Alphabet as a compelling investment choice. With a strong earnings outlook and an attractive stock price, many analysts believe Alphabet could outperform in the coming years.

Seize Your Chance to Invest

Ever feel like you missed out on buying top-performing stocks? Here’s a timely opportunity for you.

Our expert team is issuing “Double Down” stock recommendations for firms expected to see significant price increases. Historically, such investments have paid off massively:

- Amazon: A $1,000 investment in 2010 would now be worth $23,446!*

- Apple: A $1,000 investment in 2008 would now be worth $42,982!*

- Netflix: A $1,000 investment in 2004 would now be valued at $428,758!*

Currently, we are recommending “Double Down” alerts for three exceptional companies, and this opportunity may not last long.

Explore 3 “Double Down” stock recommendations »

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a member of The Motley Fool’s board. Randi Zuckerberg, a former director at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, and Keithen Drury, who holds positions in Alphabet, Amazon, Meta Platforms, and Tesla, are also on the board. The Motley Fool recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in these companies and recommends related options. The Motley Fool has a disclosure policy.

The views expressed here are those of the author and do not necessarily reflect the views of Nasdaq, Inc.