Skechers Stock Stands Out with Impressive Growth and Strategic Expansion

Strong Performance in a Challenging Market

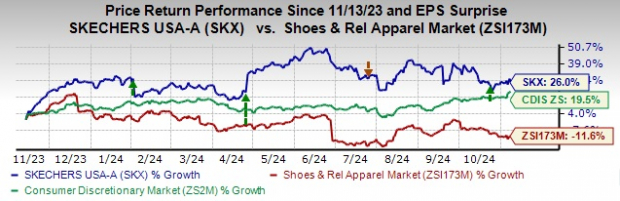

Skechers U.S.A., Inc. (SKX) has seen its shares rise 26% over the past year, while the Zacks Shoes and Retail Apparel industry faced a decline of 11.6%. To adapt to changing consumer preferences, Skechers is investing in omnichannel capabilities and expanding its global market presence, which has resulted in notable growth in both its wholesale and direct-to-consumer (DTC) sectors.

This strategy, coupled with a focus on product innovation and international expansion, has enabled Skechers to surpass the broader Consumer Discretionary sector, which grew by 19.5% in the same period. As of Friday, the company’s stock closed at $62.29, reflecting a 17% dip from its 52-week high of $75.09, reached on June 12, 2024.

Image Source: Zacks Investment Research

Valuation and Current Opportunities

On the valuation front, Skechers shares offer a compelling opportunity, trading at a discount compared to historical trends and industry averages. The company currently has a forward 12-month price-to-earnings ratio of 13.09, lower than both its five-year median of 15.37 and the industry average of 25.31. Additionally, Skechers’ Value Score of A emphasizes its appeal for investors looking to enter the sector.

Image Source: Zacks Investment Research

Diverse Product Offerings Build Momentum

Skechers is enhancing its diverse product line, which includes fashion, athletic, and work footwear. This multi-brand strategy allows for new product introduction without disrupting existing brands, broadening the consumer base. The company is also bolstering its global infrastructure through investments in retail stores, e-commerce, and distribution centers.

Efforts to improve omnichannel capabilities have focused on creating a seamless shopping experience by integrating physical and digital platforms. In the third quarter of 2024, Skechers’ wholesale sales surged 20.6% to $1.42 billion, fueled by a 26% increase in domestic sales and an 18% rise internationally. The EMEA region saw particularly strong growth, with sales up 30.9% year-over-year.

The DTC segment also saw strong performance, with third-quarter sales increasing 9.6% to $931.7 million. International DTC sales rose 14.4%, showing a remarkable 28% growth in the EMEA region and a 3.7% increase domestically. This solid consumer appeal, especially for comfort technology, underscores Skechers’ robust performance across in-store and online channels. International sales now account for 61% of total revenues, highlighting the importance of its global market.

2024 Sales Forecast and Strategic Goals

Skechers has adjusted its fiscal 2024 sales outlook, predicting revenue between $8.93 billion and $8.98 billion, up from its previous estimate of $8.88-$8.98 billion, indicating significant growth from $8 billion in fiscal 2023. The company has also raised its earnings per share (EPS) forecast to between $4.20 and $4.25, up from $4.08-$4.18, which represents solid growth from last year’s EPS of $3.49.

To support its strategic initiatives, Skechers plans to invest $375-$400 million in capital expenditures focusing on store openings, omnichannel expansion, and distribution improvements, all aimed at achieving $10 billion in annual sales by 2026.

Analysts Optimistic on Skechers’ Future

Analysts have responded favorably to Skechers’ outlook, as reflected in increased revisions for the Zacks Consensus Estimate for EPS. In the past month, estimates for the current financial year have risen by 7 cents, reaching a consensus of $4.21 per share. The estimate for the next financial year has also been raised by 4 cents to $4.85 per share. Furthermore, the projected sales for the current and next financial years stand at $8.97 billion and $9.82 billion, indicating anticipated year-over-year growth of 12.2% and 9.4%, respectively.

Find the latest EPS estimates and surprises on the Zacks Earnings Calendar.

Image Source: Zacks Investment Research

Investor Insights

Investors should consider Skechers stock due to its strategic alignment with changing consumer demands and strong growth across various segments. The company’s omnichannel approach and international expansion, combined with a diverse product range, have significantly bolstered both its wholesale and DTC sectors. The multi-brand strategy enhances consumer appeal while minimizing overlap, allowing for a wider market share. With SKX shares currently priced attractively, it’s a noteworthy investment as earnings estimates continue to rise, highlighting its growth potential. The company holds a Zacks Rank #2 (Buy).

Other Notable Stock Picks

Other top stock selections include Gildan Activewear Inc. (GIL), Abercrombie & Fitch Co. (ANF), and Steven Madden, Ltd. (SHOO).

Gildan, a manufacturer of premium activewear, currently holds a Zacks Rank #2, with growth projections indicating a 15.6% increase in earnings and 1.5% in sales from 2023 figures. GIL boasts a trailing four-quarter earnings surprise of 5.4%.

Specialty retailer Abercrombie, also ranked #2, has shown strong performance with a 16.8% earnings surprise last quarter. The consensus for fiscal 2025 suggests growth of 63.4% in earnings and 13% in sales compared to fiscal 2024.

Lastly, Steven Madden, which is known for its fashionable footwear, has a Zacks Rank of 2, with earnings and sales expected to grow by 8.2% and 12.7%, respectively, from last year’s numbers. SHOO has a trailing four-quarter average earnings surprise of 9.8%.

Explore Clean Energy Investments

Energy plays a crucial role in the economy, being a multi-trillion dollar industry filled with some of the largest, most successful companies. Advances in technology signal a shift towards clean energy sources, positioning them to outperform traditional fossil fuels. Significant investment continues to flow into initiatives like solar power and hydrogen fuel cells, presenting exciting potential for future growth.

To uncover top stock choices in this evolving landscape, download Nuclear to Solar: 5 Stocks Powering the Future for free from Zacks.

For today’s latest recommendations from Zacks Investment Research, you can access 5 Stocks Set to Double at no cost.

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

For the full article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.