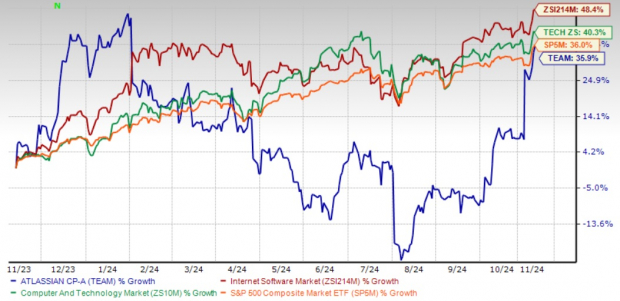

Atlassian (TEAM) shares have increased by 35.9% over the past year. However, this growth lags behind the Zacks Computer Technology sector (40.3%), the Zacks Internet Software industry (48.4%), and the S&P 500 (36%).

As a prominent name in enterprise collaboration and workflow software, this performance raises an important question: Should investors consider buying, holding, or selling Atlassian stock at this time?

Atlassian Faces Slowing Sales Growth

Sales growth at Atlassian has been steadily declining since the pandemic. Over the last two fiscal years, the company reported revenue growth in the low-to-mid 20% range, down from the mid-30% growth seen in fiscal 2022.

For the second quarter of fiscal 2025, TEAM expects revenues between $1.23 billion and $1.24 billion, reflecting a year-over-year growth rate of 16-17%. The Zacks Consensus Estimate anticipates revenue growth of 16.6% and 19% for fiscal 2025 and 2026, respectively.

Additionally, escalating research and development (R&D) costs pose challenges. In fiscal first quarter 2025, non-GAAP R&D expenses surged by 33.9% year over year, while revenue rose by only 21.5%. This imbalance has led to a contraction in the non-GAAP operating margin by 40 basis points.

The slowing growth in the number of customers has also raised concerns about Atlassian’s short-term outlook. Customer growth has slowed to a compound annual growth rate (CAGR) of 14.7% from fiscal 2020 to 2024, compared to a 30% CAGR from fiscal 2016 to 2020.

One Year Performance of Atlassian (TEAM)

Image Source: Zacks Investment Research

Macroeconomic Challenges Ahead

Atlassian may struggle in the near term due to reduced IT spending. Many companies are delaying major IT investments because of a weakened global economy, compounded by various macroeconomic and geopolitical challenges. This trend could negatively impact Atlassian’s growth prospects.

While Atlassian remains a strong player in the competitive collaboration and workflow software industry, it faces tough competition from major firms such as Broadcom (AVGO), Microsoft (MSFT), Alphabet (GOOGL), Salesforce, and IBM.

For example, Atlassian’s JIRA software competes with Broadcom’s Rally Software, Microsoft’s Azure DevOps Server, and IBM’s Rational. Meanwhile, TEAM’s Confluence faces competition from Salesforce Chatter and Google Apps for Work.

Intensifying competition may pressure Atlassian to lower prices in order to maintain market share, which could negatively affect profitability.

Opportunities in Cloud and Digital Transformation

Despite these challenges, there are positive indicators for Atlassian. The demand for better communication and automated systems is rising, positioning the company well to take advantage of this trend. Alongside this, the continual shift towards digital services and cloud-based solutions is beneficial.

A report by Mordor Intelligence suggests that the global enterprise collaboration market could grow from approximately $54.5 billion in 2023 to nearly $90.6 billion by 2028, reflecting a CAGR of 10.7%.

Atlassian is also focusing on selling more subscription-based services, which create stable revenue streams while enhancing profit margins. This high-margin business segment has experienced a CAGR exceeding 43% from fiscal 2020 to fiscal 2024.

Investment Perspective on Atlassian (TEAM) Stock

As a leader in enterprise collaboration and workflow software, Atlassian is well-placed to benefit from the growing need for automation and improved communication tools. Its strategy of focusing on subscription-based services should further enhance its revenue.

Nonetheless, uncertainty in IT spending amid macroeconomic challenges raises concerns about its immediate prospects. The slowdown in sales and customer growth also contributes to a cautious outlook. High investments in R&D may further pressure profit margins in the short term.

Given these considerations, we recommend that investors hold this Zacks Rank #3 (Hold) stock for now. For potential investment opportunities, see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy is essential to the economy, representing a multi-trillion dollar industry that has produced many large and profitable companies.

Cutting-edge technology is enabling clean energy sources to surpass traditional fossil fuels, with trillions now being invested in clean energy initiatives such as solar and hydrogen fuel cells.

Investors should keep an eye on emerging leaders in this sector; they could prove to be the most exciting additions to your portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks free today.

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free now.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Atlassian Corporation PLC (TEAM): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.