Analysts Predict Growth for First Trust NASDAQ-100 ETF Amid Notable Stock Efficiency

In a detailed analysis at ETF Channel, we look into the trading prices of the underlying stocks of various ETFs in our coverage. For the First Trust NASDAQ-100 Equal Weighted Index Fund ETF (Symbol: QQEW), the weighted average implied target price based on these holdings is $143.44 per unit.

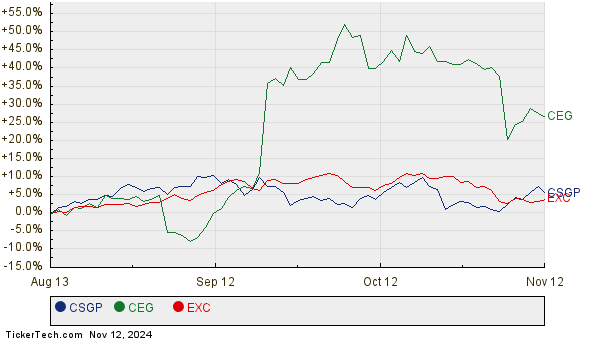

Currently, QQEW trades at approximately $130.80 per unit, suggesting a 9.66% upside according to analysts’ forecasts for the ETF’s underlying assets. Among these assets, three companies stand out for their potential growth: CoStar Group, Inc. (Symbol: CSGP), Constellation Energy Corp (Symbol: CEG), and Exelon Corp (Symbol: EXC). Although CSGP’s recent share price is $75.87, the average analyst target is significantly higher at $90.91, corresponding to an upside of 19.82%. Meanwhile, CEG could rise 16.57% from its recent price of $237.27, with an average target of $276.59. Similarly, EXC’s analysts forecast a target of $43.47, representing a 13.19% increase from its current price of $38.40. Below is a twelve-month price history chart highlighting the performance of CSGP, CEG, and EXC:

Here is a concise summary table of the current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust NASDAQ-100 Equal Weighted Index Fund ETF | QQEW | $130.80 | $143.44 | 9.66% |

| CoStar Group, Inc. | CSGP | $75.87 | $90.91 | 19.82% |

| Constellation Energy Corp | CEG | $237.27 | $276.59 | 16.57% |

| Exelon Corp | EXC | $38.40 | $43.47 | 13.19% |

Are analysts being realistic with these targets, or are they setting expectations too high? Understanding the rationale behind these projections is crucial, especially given the recent performance of these companies and their industries. High price targets can indicate optimism but may also lead to downgrades if they reflect outdated perspectives. Further research is vital for investors looking to navigate these insights.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Related Articles:

• Top Ten Hedge Funds Holding EHIC

• Top Ten Hedge Funds Holding EMMA

• Funds Holding LIAE

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.