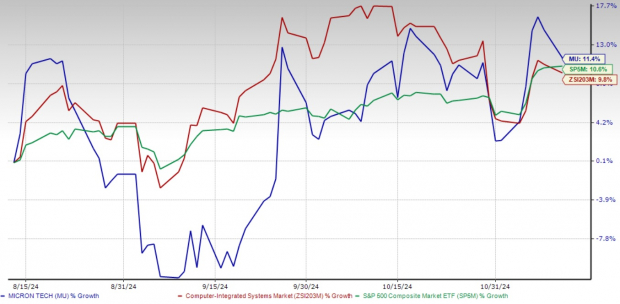

Micron Technology, Inc. (MU) has managed to thrive in a challenging semiconductor market. Based in Boise, ID, this memory chip manufacturer saw its stock increase by 11.4% in the last three months, outpacing the Zacks Computer – Integrated System industry, which gained 9.8%, and the S&P 500, which rose 10.6%. Investors are now debating whether to buy, sell, or hold Micron stock.

Micron’s Impressive 3-Month Performance

Image Source: Zacks Investment Research

Industry Trends Favor Micron’s Growth

Micron stands to benefit from several key trends in the memory and storage markets, particularly in DRAM and NAND sectors. The rise of artificial intelligence (AI) applications has increased the demand for high-performance memory. Micron’s investments in advanced DRAM and 3D NAND technologies position the company favorably to meet this demand, enhancing its competitiveness and potential for long-term profitability.

Beyond AI, Micron is also targeting high-growth segments like automotive, industrial IoT, and data centers. This diverse strategy reduces dependence on consumer electronics, which are often subject to volatile demand, thus supporting more stable revenue streams. By addressing various areas within the tech industry, Micron solidifies its critical role in the rapidly changing semiconductor field.

Strong Product Portfolio and Strategic Partnerships

Micron offers a wide range of products, including DRAM and NAND chips for PCs, servers, and mobile devices, reinforcing its market position. Its GDDR7 graphics memory is currently being tested by Advanced Micro Devices (AMD) and Cadence Design Systems (CDNS). AMD plans to use this memory to enhance gaming performance, while Cadence is testing it for its GDDR7 PHY IP, indicating Micron’s role in advancing technology.

Additionally, Micron’s high-bandwidth memory (HBM3E) will provide power for NVIDIA’s (NVDA) upcoming AI chip, the H200, which aims to succeed the popular H100 chip. Micron has already sold out its HBM supply for 2024 and secured significant orders for 2025. These partnerships highlight Micron’s importance in the tech ecosystem and suggest a bright growth outlook.

Financial Stability Amid Challenges

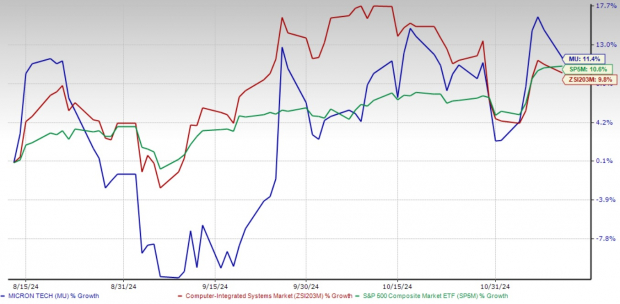

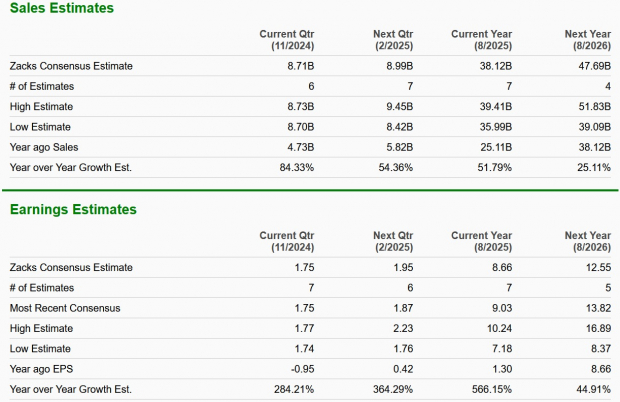

Micron’s financial metrics have significantly improved after struggling in late 2022 and early 2023. The company has surpassed the Zacks Consensus Estimate for earnings across the last four quarters, averaging a surprising 72.7%. This trend indicates a robust recovery, showcasing Micron’s ability to adapt to market changes.

Micron Technology, Inc. Price, Consensus, and EPS Surprise

Micron Technology, Inc. price-consensus-eps-surprise-chart | Micron Technology, Inc. Quote

The projections for fiscal years 2025 and 2026 remain optimistic, bolstered by Micron’s substantial investments in memory technologies and its focus on high-growth markets. These initiatives lay a solid foundation for long-term success.

Image Source: Zacks Investment Research

Potential Challenges Ahead for Micron

Despite a positive outlook, Micron must navigate potential obstacles. A key concern is the risk of oversupply in the high-bandwidth memory (HBM) sector, which risks undermining revenues. HBM products proved crucial for Micron in fiscal 2024, and the company anticipates significant revenue from this area in 2025.

However, an excess in HBM supply could lead to lower average selling prices (ASPs), which would pressure profit margins. With Micron’s growth plan heavily reliant on AI-driven memory demand, a drop in ASPs could hurt future earnings and create uncertainty regarding its growth prospects.

Final Thoughts: Hold MU Stock for Now

Overall, Micron’s solid market presence, diversified products, and strong partnerships highlight its growth potential. However, imminent risks, specifically the threat of HBM oversupply and associated pricing pressures, warrant caution.

In light of this balance between strong fundamentals and prospective challenges, holding onto Micron stock is likely the most prudent decision at this time. Investors should keep an eye on developments in the memory market to reassess their positions regarding this Zacks Rank #3 (Hold) stock as conditions progress. For additional insights, you can view the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Positioned for High Returns

Our experts have selected five stocks they believe could double in value in 2024. While past performance is no guarantee of future success, these recommendations have yielded returns of +143.0%, +175.9%, +498.3%, and even +673.0%.

Many of these stocks are currently flying under Wall Street’s radar, presenting an excellent opportunity to invest early.

Today, you can discover these 5 promising investments >>

To receive the latest recommendations from Zacks Investment Research, you can download the report on 5 Stocks Set to Double for free.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.