Tesla Stock Soars Post-Election, Short Sellers Face Hefty Losses

Short sellers betting against Tesla (TSLA) stock are feeling the heat as the electric vehicle company’s share price leaps following Donald Trump’s electoral victory.

On November 11, TSLA stock rose by another 9%, bringing its overall gains to an impressive 41% over the past five trading sessions. This surge has posed significant challenges for short sellers who had anticipated a drop in Tesla’s stock, particularly in the lead-up to the U.S. presidential election.

Elon Musk, Tesla’s CEO, was a prominent supporter of Trump during the election campaign, and the company’s stock is now reaping the benefits of Trump’s election success. This post-election boost has propelled Tesla’s market capitalization above $1 trillion.

Consequences for Short Sellers

Tesla has long been one of the most shorted stocks on Wall Street. Various factors—including slowing vehicle sales, erratic financial results, and postponed product launches—have prompted many traders to bet against TSLA stock. Up until the election on November 5, Tesla’s shares had remained relatively flat this year, with recent gains occurring in just the last few days.

Currently, around 3% of Tesla’s shares, equating to roughly 79 million shares, are shorted. This figure stands in stark contrast to the 1% short-interest ratio typical of other large-cap technology stocks. The high level of short interest in TSLA has resulted in nearly $7 billion in losses for short sellers since the election less than a week ago.

Should Investors Buy TSLA Stock?

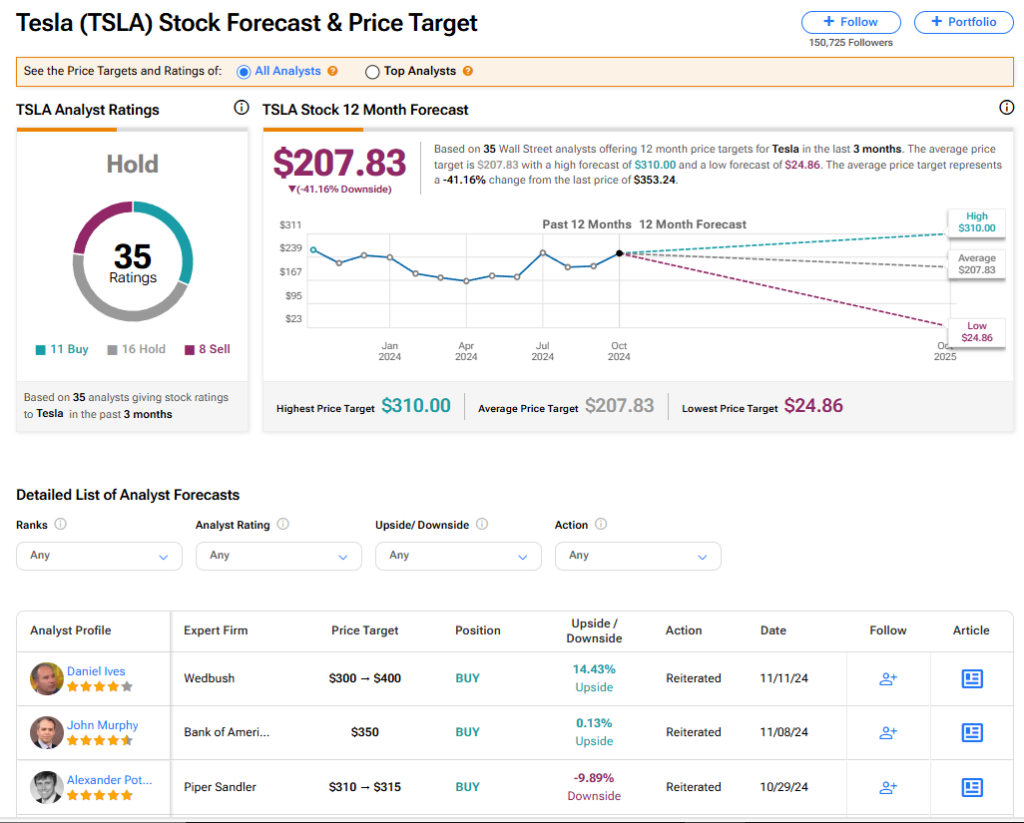

Currently, Tesla stock holds a consensus Hold rating among 35 Wall Street analysts. This rating stems from 11 Buy, 16 Hold, and eight Sell recommendations made in the last three months. The average price target for TSLA stands at $207.83, indicating a potential downside risk of 41.16% from its current level.

Read more analyst ratings on TSLA stock

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.