Pinterest Stock Gains Momentum After Upgrade: Is It Time to Buy?

Pinterest stock (PINS) saw a rise of over 4% on Monday, following an upgrade from analysts at Wedbush, led by five-star analyst Scott Devitt. The rating changed from Hold to Buy, with a new price target set at $38. This upgrade reflects the company’s successful efforts in enhancing user engagement and monetization, particularly noted after its latest earnings report. Wedbush is optimistic about Pinterest’s strategic initiatives, which include partnerships and innovative advertising options expected to boost revenue and profitability.

Growth Forecasts for Pinterest

Wedbush anticipates steady growth for Pinterest, bolstered by its collaborations with major platforms like Amazon (AMZN) and Google (GOOGL). New advertising formats and the increasing use of ad tools are also expected to drive stronger conversion rates for advertisers. Furthermore, Wedbush emphasized Pinterest’s strategy of forging partnerships with resellers in markets that have yet to be fully monetized, highlighting this as a promising avenue to unlock additional revenue potential.

According to Wedbush, the recent decline in Pinterest’s stock price provides a unique opportunity for investors. The stock is currently trading at around 11.6 times its estimated 2026 EBITDA, despite an impressive annual EBITDA growth projection of 27% over the next three years. Additionally, Scott Devitt has a 53% success rate on his stock ratings, achieving an average return of 13.5% per rating.

Wall Street’s Consensus on PINS

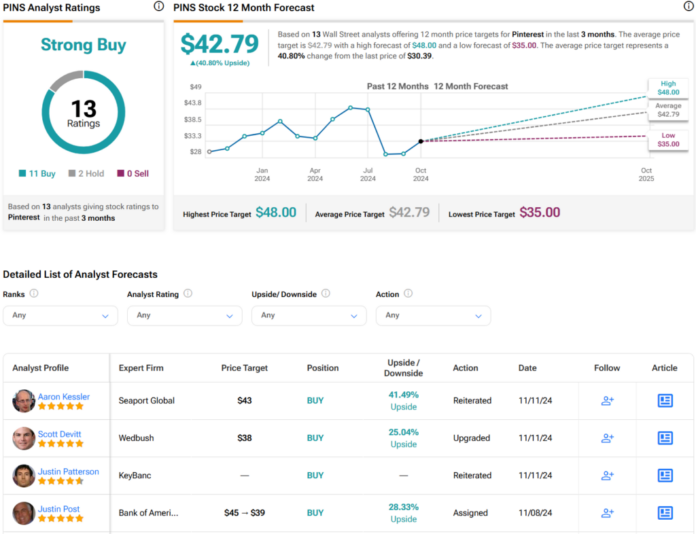

On Wall Street, PINS stock holds a Strong Buy consensus rating. This figure is based on 11 Buy ratings, two Holds, and no Sell ratings received in the last three months. Despite a 3% decline over the past year, the average price target for PINS sits at $42.79 per share, indicating a potential upside of 40.8%.

Explore more PINS analyst ratings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.