Marvell Technology Under New Coverage from Loop Capital

On November 11, 2024, Loop Capital began covering Marvell Technology (WBAG:MRVL) with a Hold recommendation.

Funding Overview: Who’s Investing in Marvell?

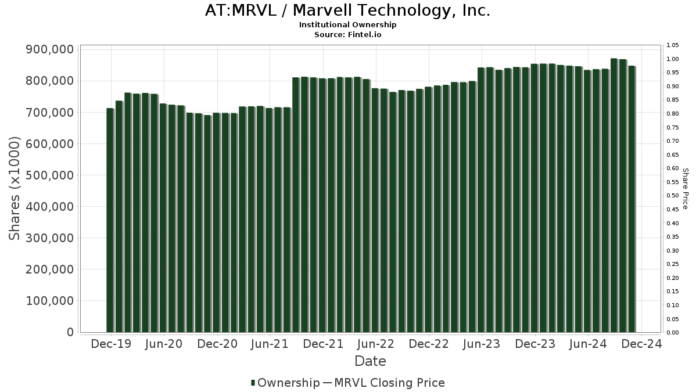

Currently, 1,918 funds or institutions have reported their positions in Marvell Technology. This reflects a decrease of 7 owners, or 0.36%, since the last quarter. The average weight of all funds holding MRVL is 0.46%, which shows a 2.90% increase. Over the past three months, the total number of shares owned by institutions has risen by 1.31%, now totaling 845,707K shares.

Recent Movements Among Major Stakeholders

The Vanguard Total Stock Market Index Fund (VTSMX) now holds 27,377K shares, which is 3.16% of the company. This is an increase from 27,165K shares previously, marking a growth of 0.77%. However, Vanguard decreased its portfolio allocation in MRVL by 3.35% last quarter.

Fidelity Blue Chip Growth Fund (FBGRX) possesses 27,367K shares, also representing 3.16% ownership. The previous holding was 27,629K shares, indicating a decrease of 0.96%. Additionally, Fidelity reduced its portfolio allocation in MRVL by 9.76% over the last quarter.

T. Rowe Price Investment Management holds 25,679K shares, equating to 2.96% ownership. Comparatively, its prior holding was 25,839K shares, reflecting a decrease of 0.62%. T. Rowe Price slightly increased its portfolio allocation in MRVL by 1.10% during the last quarter.

Goldman Sachs Group has increased its stake significantly, now holding 21,220K shares, or 2.45% of the company. This is a remarkable jump from its previous 15,885K shares, indicating an increase of 25.14%. Furthermore, Goldman Sachs raised its portfolio allocation in MRVL by 25.68% compared to the last quarter.

Brown Advisory owns 20,549K shares, which is 2.37% of Marvell. Previously, the firm held 17,481K shares, marking a notable increase of 14.93%. Despite this, Brown Advisory significantly reduced its portfolio allocation in MRVL by 56.28% last quarter.

Fintel serves as a comprehensive investment research platform, catering to individual investors, traders, financial advisors, and small hedge funds, providing essential data on market fundamentals and institutional ownership.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.