Airbnb Faces Downgrade as Analysts Predict Declining Prices

On November 12, 2024, Phillip Securities revised their outlook for Airbnb (XTRA:6Z1) from Neutral to Reduce.

The average one-year price target for Airbnb, as of October 22, 2024, is 120.73 €/share. Predictions vary, with a low of 74.02 € and a high of 187.57 €. This average target indicates a decline of 6.76% from the most recent closing price of 129.48 € / share.

Airbnb’s Projected Revenue Growth

Airbnb’s expected annual revenue stands at 11,263 million €, reflecting a growth of 3.90%. Additionally, the projected annual non-GAAP EPS is 4.05.

Institutional Investors’ Sentiment

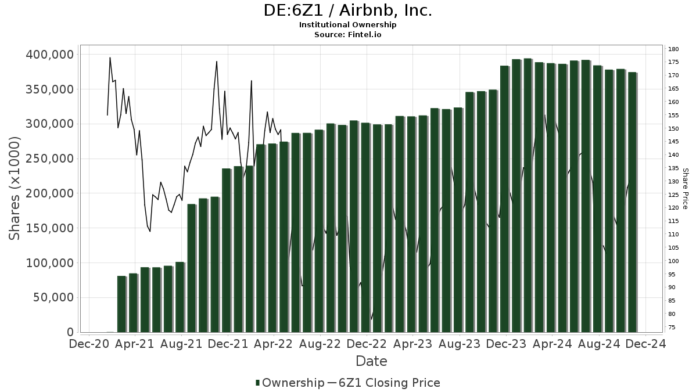

A total of 1,979 funds and institutions are currently invested in Airbnb, which marks a decrease of 49, or 2.42%, from the prior quarter. The average portfolio weight dedicated to 6Z1 by all funds now sits at 0.34%, showing an increase of 11.75%. Institutional ownership rose by 2.77% over the last three months, reaching a total of 379,724,000 shares.

Capital World Investors holds 14,245,000 shares, accounting for 3.29% ownership of the company. This is a notable reduction from their previous holding of 18,117,000 shares, reflecting a decrease of 27.18%. Their allocation in 6Z1 has fallen by 28.79% over the last quarter.

Edgewood Management owns 13,582,000 shares, which is 3.14% of the company. This portfolio increased from their earlier holding of 12,439,000 shares, a rise of 8.42%. However, their weighting in 6Z1 decreased by 9.15% last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 12,555,000 shares, equating to 2.90% ownership, an increase from 11,716,000 shares previously, representing a growth of 6.68%. Nonetheless, their allocation in 6Z1 has decreased by 4.22% quarter-over-quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) holds 11,331,000 shares, or 2.62% ownership. This is up from 10,976,000 shares, marking a 3.13% increase, yet their portfolio allocation in 6Z1 fell by 10.17% in the last quarter.

Jennison Associates now owns 10,816,000 shares, representing 2.50% of Airbnb. This decreased from 13,164,000 shares, indicating a reduction of 21.72%. Their proportionate investment in 6Z1 declined sharply by 64.37% over the past quarter.

Fintel serves as a vital resource for individual investors, traders, financial advisors, and small hedge funds with a comprehensive range of investing research tools, including ownership data, analyst reports, and fund sentiment.

Click to Learn More

This article was originally published by Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.