NVIDIA Receives New Buy Rating as Institutional Interest Grows

On November 12, 2024, Redburn Atlantic started coverage of NVIDIA (WSE:NVDA) with a Buy recommendation.

Institutional Investment Overview

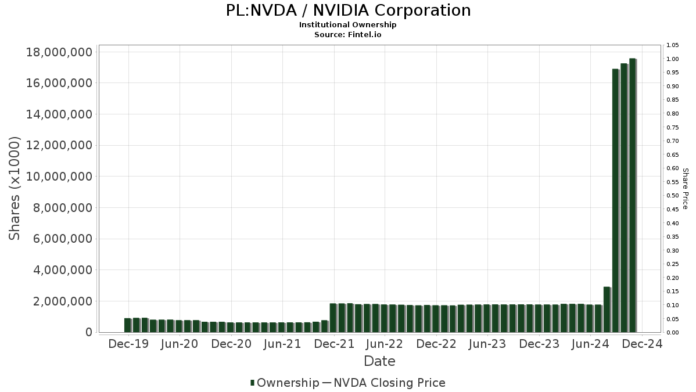

Currently, 6,561 funds and institutions hold positions in NVIDIA, reflecting a rise of 155 owner(s) or 2.42% over the last quarter. The average portfolio weight of all funds in NVDA is now 3.22%, up by 3.28%. Over the last three months, total institutional shares have surged by 221.42%, reaching 17,579,152K shares.

The Vanguard Total Stock Market Index Fund (VTSMX) now holds 738,297K shares, representing 3.01% ownership, with an impressive increase of 89.89% from its previous holding of 74,656K shares. Its allocation to NVDA has grown by 31.49% in the last quarter.

The Vanguard 500 Index Fund (VFINX) owns 631,333K shares, or 2.57% of the company. Previously, it reported 62,245K shares, marking a 90.14% increase. The portfolio allocation to NVDA for VFINX has risen by 31.27% quarter-over-quarter.

Geode Capital Management has 546,079K shares, accounting for 2.23% ownership. This is a slight increase of 2.11% from its prior holding of 534,554K shares, although its total allocation in NVDA decreased by 51.50% in the last quarter.

Price T Rowe Associates increased its stake to 444,582K shares, representing 1.81% of NVIDIA. This is an 89.62% jump from the previous 46,150K shares, with a 28.59% rise in its portfolio allocation recently.

Meanwhile, Jpmorgan Chase holds 406,709K shares, which is 1.66% ownership. Their previous holding was 390,779K shares, reflecting a smaller increase of 3.92%, while their portfolio allocation in NVDA dipped by 5.07% in the past quarter.

Fintel is a leading research platform designed for individual investors, traders, financial advisors, and smaller hedge funds. Our comprehensive data includes fundamentals, analyst reports, ownership statistics, fund sentiment, insider trading information, options activity, and more, bolstered by quantitative models aimed at enhancing investment profitability.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.