Dividend Stocks Stray from Election Rally: Coke, Pepsi, and P&G Hold Steady

The broader market indices surged to all-time highs following the recent election results. However, some industry giants, like Coca-Cola (NYSE: KO), PepsiCo (NASDAQ: PEP), and Procter & Gamble (NYSE: PG), have remained on the sidelines. Here’s an analysis of why these dividend stocks may still be worth considering.

Image source: Getty Images.

Slowing Consumer Staples Sector

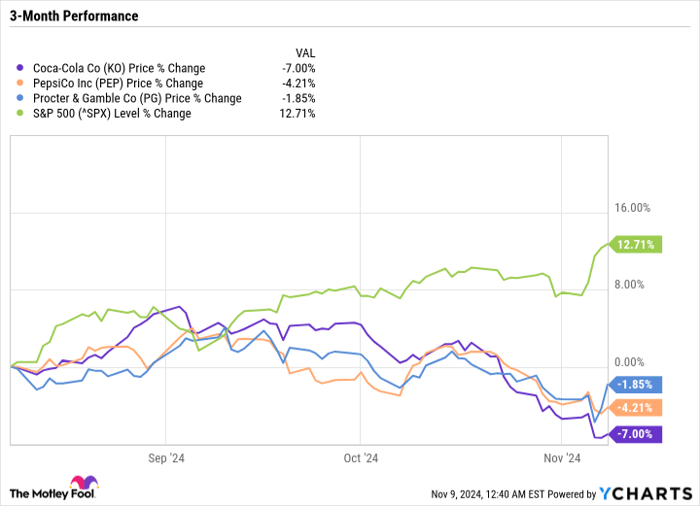

The year has been positive for the consumer staples sector, helped by strong performances from major players like Walmart and Costco Wholesale, both of which have outperformed the S&P 500 and Nasdaq Composite. Earlier this year, Coca-Cola and P&G also reached all-time highs, but their momentum stalled around late September. Over the past three months, Coca-Cola, Pepsi, and P&G have experienced declines, while the S&P 500 climbed 12.7%.

KO data by YCharts

Common Challenges Ahead

Both Coca-Cola and Pepsi are facing similar issues despite predictions of record profits in 2024. Coca-Cola reported a decline in unit case volumes last quarter, which raises concerns as the company has increasingly turned to price hikes to boost earnings. This downward trend suggests that customers are pushing back against rising prices, highlighting a need for Coca-Cola to stimulate demand.

Pepsi, on the other hand, has seen volume decreases across its key product lines, including beverages and snacks like Frito-Lay and Quaker Oats. Unlike Coca-Cola and P&G, Pepsi has struggled with volume declines for more extended periods. In response, management is introducing new strategies to attract buyers, such as increasing package sizes and adding more small chip bags in combo packs.

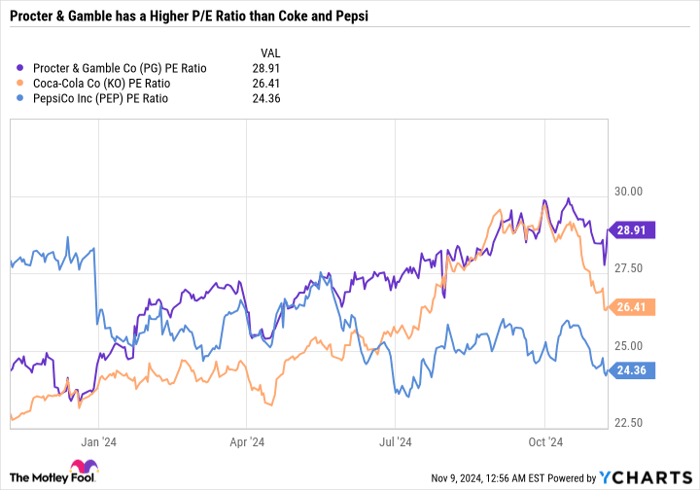

P&G’s recent earnings report also reflected slow sales growth. Nevertheless, P&G maintains significant pricing power, putting it on track for another record profit year, with low single-digit sales growth anticipated. Importantly, P&G’s robust earnings allow it to repurchase shares aggressively, making it the highest-valued stock among the three, while Pepsi holds the lowest valuation.

PG PE Ratio data by YCharts

Investing Opportunities for the Cautious

The strongest performers since the election have been sectors like financials and industrials, which could gain from new administration policies such as deregulation and potential government support for local manufacturing. Meanwhile, traditional growth sectors like technology and consumer discretionary saw gains as big names like Nvidia, Apple, Microsoft, Tesla, Amazon, Alphabet, and Meta Platforms rallied.

Typically, the consumer staples sector thrives during uncertain times, with significant volatility leading up to the election. Now, however, the market appears to favor cyclical sectors expected to drive economic expansion.

Long-term investors might be wise to overlook short-term market fluctuations and avoid shifting between sectors based solely on trend momentum.

Coca-Cola, Pepsi, and P&G are strong dividend stocks that appeal to cautious investors. All three are considered Dividend Kings, having increased their dividends for at least 50 consecutive years. Specifically, Pepsi has maintained a 52-year streak, Coca-Cola for 62 years, and P&G for an impressive 68 years. These companies can provide reliable passive income or support retirement income rather than hoping to outperform the market on a short-term basis.

With reasonable valuations and price-to-earnings ratios lower than the S&P 500, it’s possible that Coca-Cola, Pepsi, and P&G may continue to lag behind in the near future. If this trend continues, they could transition from balanced investments to compelling buys that are too attractive to ignore.

Is Coca-Cola Worth Your $1,000 Investment Now?

Before deciding to invest in Coca-Cola, keep in mind that the Motley Fool Stock Advisor team recently identified its top 10 stocks for investors to consider, and Coca-Cola didn’t make the list. The selected stocks are expected to deliver strong returns in the upcoming years.

For instance, if you had invested $1,000 in Nvidia when it was recommended in April 2005, you would have seen that grow to about $890,169!*

Stock Advisor offers a straightforward guide for investors, including portfolio-building advice, regular updates from analysts, and two new stock recommendations each month. Since 2002, Stock Advisor has more than quadrupled the S&P 500’s returns.*

Discover the 10 best stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, Tesla, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.