Loop Capital Encourages Investment in Cadence Design Systems: A Promising Future Ahead

Fintel reports that on November 11, 2024, Loop Capital initiated coverage of Cadence Design Systems (NasdaqGS:CDNS) with a Buy recommendation.

Analyst Price Forecast Indicates Potential Growth

As of October 21, 2024, the average one-year price target for Cadence Design Systems is $322.70/share. Predictions range from a low estimate of $227.25 to a high of $372.75. This average price target suggests an increase of 8.37% from the latest reported closing price of $297.77/share.

Explore our leaderboard of companies showcasing the largest price target upside.

Cadence’s Revenue and Earnings Insights

The projected annual revenue for Cadence Design Systems is set at $4,334 million, reflecting a slight decrease of 0.46%. The anticipated annual non-GAAP EPS stands at 5.39.

Examining Fund Sentiment Towards Cadence

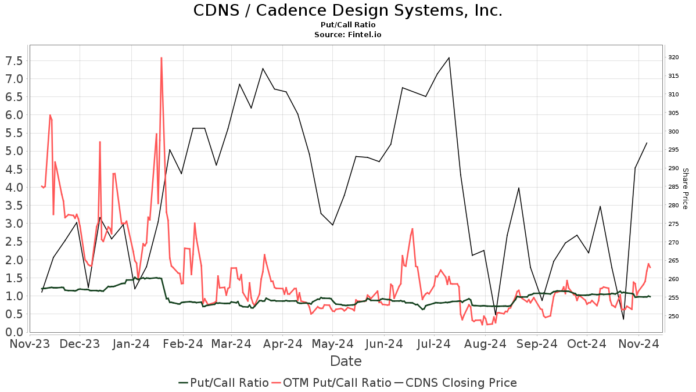

Currently, there are 2,309 funds or institutions reporting positions in Cadence Design Systems, marking a decrease of 33 owners or 1.41% from the last quarter. The average portfolio weight of all funds dedicated to CDNS is 0.43%, an increase of 6.17%. In the past three months, total shares owned by institutions rose by 1.87%, amounting to 274,307K shares.  The put/call ratio for CDNS is 0.98, suggesting a bullish outlook among investors.

The put/call ratio for CDNS is 0.98, suggesting a bullish outlook among investors.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 8,595K shares, accounting for 3.13% ownership. Previously, the firm reported ownership of 8,561K shares, indicating a modest increase of 0.40%. However, the firm reduced its portfolio allocation in CDNS by 3.48% over the last quarter.

Massachusetts Financial Services currently holds 7,881K shares, representing 2.87% ownership. Last quarter, they owned 9,455K shares, reflecting a notable decrease of 19.97%. This firm cut its portfolio allocation in CDNS by 88.99% recently.

Jennison Associates maintains 7,606K shares, equivalent to 2.77% ownership, with a previous filing of 7,408K shares, marking a 2.61% increase. However, they reduced their portfolio allocation in CDNS by 53.11% last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares holds 6,985K shares, making up 2.55% ownership. This is an increase from 6,856K shares reported earlier, which is a 1.84% rise. Nevertheless, they decreased their allocation in CDNS by 4.66% last quarter.

Geode Capital Management holds 5,886K shares, representing 2.15% ownership, down from 6,295K shares previously—indicating a decrease of 6.94%. Their recent allocation in CDNS saw a dramatic drop of 60.24% over the last quarter.

About Cadence Design Systems

(This description is provided by the company.)

Cadence Design Systems Inc. is a key player in the electronic design industry, building on over 30 years of computational software experience. The company employs its Intelligent System Design strategy to provide software, hardware, and IP to transform design concepts into reality. Cadence serves some of the world’s most innovative companies, creating electronic products ranging from chips to systems for diverse applications, including consumer electronics, 5G communications, automotive, and healthcare. For six consecutive years, Fortune magazine has recognized Cadence as one of the 100 Best Companies to Work For.

Fintel stands as a leading investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our comprehensive data encompasses the global market and includes fundamentals, analyst reports, ownership data, fund sentiment, insider trading, options flow, and more. Specific stock picks are derived from advanced, backtested quantitative models for enhanced profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.