Rep. Marjorie Taylor Greene Expands Investment Portfolio Ahead of Election

With her sights set on re-election, Rep. Marjorie Taylor Greene of Georgia recently made significant additions to her investment portfolio. In early November, she invested in several artificial intelligence stocks along with shares from different sectors.

Her recent purchases include Advanced Micro Devices (NASDAQ: AMD), Apple (NASDAQ: AAPL), Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), Digital Realty Trust (NYSE: DLR), Meta Platforms (NASDAQ: META), and Tesla (NASDAQ: TSLA). Although the exact amounts of her investments are unclear, Greene’s regulatory filing indicates that each transaction on November 1 was valued between $1,001 and $15,000.

Greene’s Strong Belief in AI’s Potential

Greene’s ongoing investment in AI companies shows her confidence in the industry’s growth. She first added shares of AMD in 2022. This past May, she purchased more AMD shares, taking advantage of a market dip following the company’s third-quarter 2024 results. While shares were priced at $164.66 on May 21, they closed at $141.86 on November 1.

Greene has also consistently increased her stake in Apple, purchasing shares three times in 2024. Notably, Apple reported robust fourth-quarter 2024 earnings before her latest buy and highlighted its new Apple Intelligence tool for iPhones, iPads, and Macs, showcasing the company’s push into AI.

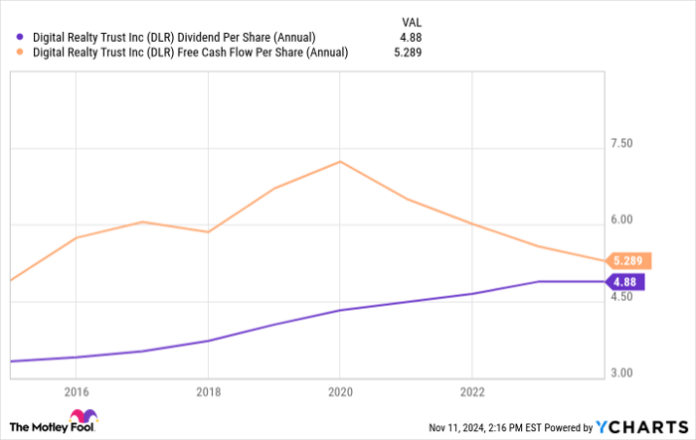

To further diversify her AI investments, Greene raised her ownership in Digital Realty Trust, a real estate investment trust focusing on data centers critical for AI operations. This investment offers her a steady passive income, supported by a 2.7% forward dividend yield and a strong track record of covering dividends with free cash flow for the past decade.

CEO Mark Zuckerberg confirmed during Meta’s third-quarter 2024 conference call that the company is seeing benefits from AI adoption, noting that over 3.2 billion users engage with its apps daily. The rapid growth of Meta AI and its generative AI model, Llama, are becoming industry standards.

Greene’s interest in AI extends to Tesla as well. Her recent buy marks her fourth acquisition of Tesla shares in 2024. Apart from its AI-driven full self-driving feature, Tesla is also working on the humanoid robot Optimus, further enhanced by AI technology.

The Stability of Berkshire Hathaway

While investing heavily in innovative sectors like AI can offer significant returns, combining those investments with a reliable company like Berkshire Hathaway helps mitigate risks. Although it doesn’t provide dividends, Berkshire has grown shareholder value significantly over time, guided by Warren Buffett’s seasoned leadership.

Analyzing Greene’s Stock Investments

In the aftermath of Election Day, Greene’s stock picks have seen elevated valuations, making them less accessible for value-seeking investors. However, many AI stocks have remained at high valuations for months. Investors seeking exposure to leaders like AMD, Apple, Digital Realty Trust, Meta Platforms, and Tesla should not be deterred by their price tags. Berkshire Hathaway remains a sound option for anyone looking to strengthen a portfolio with a proven asset.

Investment Strategies: Where to Use $1,000 Now

When our analysts share stock recommendations, it may be wise to heed their advice. Stock Advisor’s average return stands at an impressive 879%, significantly outperforming the S&P 500’s 176%.*

They recently disclosed their assessment of the 10 best stocks to buy now, with Advanced Micro Devices among those highlighted, along with nine other under-the-radar opportunities.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Berkshire Hathaway, Digital Realty Trust, Meta Platforms, and Tesla. The Motley Fool’s disclosure policy is available for review.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.