Alibaba Set to Disclose Q2 Earnings Amid International Growth

Alibaba Group Holding Limited (BABA) will announce its second-quarter fiscal 2025 earnings on Nov. 15.

The Zacks Consensus Estimate expects revenues to reach $33.47 billion, marking an 8.63% increase compared to the same quarter last year.

For earnings, analysts project a figure of $2.26 per share, which reflects a rise of 5.61% from the prior year’s results. Moreover, this estimate has risen by 8.1% in the last 30 days.

Image Source: Zacks Investment Research

Historically, Alibaba has shown mixed results regarding earnings. In the last quarter, the company achieved an earnings surprise of 2.73%. In the past four quarters, it outperformed the Zacks Consensus Estimate three times while missing once, with an average surprise of 3.71%.

Earnings Surprises: An Overview

Alibaba Group Holding Limited price-eps-surprise | Alibaba Group Holding Limited Quote

Earnings Predictions

Currently, our model does not clearly indicate a likely earnings beat for Alibaba this quarter. A positive Earnings ESP, combined with Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) can suggest a potential beat, but that’s not the situation here. Presently, BABA shows an Earnings ESP of 0.00% and a Zacks Rank of #1.

You can find the complete list of today’s Zacks #1 Rank stocks here.

Key Factors to Watch for Q2

The International Digital Commerce Group at Alibaba is likely to perform well, propelled by strong momentum in its key platforms. The company’s international e-commerce sectors, including AliExpress, Trendyol, and Alibaba.com, are expected to benefit from strategic investments and growing brand awareness.

Integrating AI technology has enhanced user experience with advanced features such as multilingual searches and personalized recommendations. This integration, along with the AI Business Assistant, has bolstered Alibaba’s connections with small and medium-sized enterprises (SMEs) worldwide.

International trade initiatives, particularly the Alibaba Guaranteed platform, have gained traction by easing operations for SMEs and improving supply chain reliability. Additionally, the new Logistics Marketplace aimed at U.S.-based SMEs is likely to have positively impacted their international commerce performance.

Domestically, Alibaba’s retail business, led by Taobao and Tmall Group, remains robust despite ongoing economic challenges in China. The ‘Star Cube Plan,’ a collaboration between Taobao and Tmall Group with Douyin, is designed to convert Douyin users into active buyers, boosting platform traffic.

Meanwhile, the logistics and cloud segments present varied indicators. The Cainiao Smart Logistics Network thrives on strong domestic services while Alibaba Cloud continues to make gains in sectors like financial services, education, and automotive. However, its aggressive pricing strategy, which includes significant discounts for international customers, could influence revenues even as it works to capture more market share.

Nonetheless, Alibaba faces stiff competition from cloud leaders such as Amazon (AMZN), Microsoft, and Google, which complicates its expansion efforts.

Stock Performance & Valuation Metrics

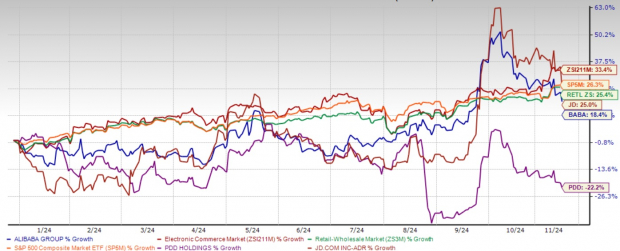

Year-to-date, Alibaba shares have appreciated by 18.4%, although they trailed behind the Zacks Retail-Wholesale sector, which returned 25.4%, and the S&P 500 index, which rose by 26.3%. In comparison to its peer JD.com (JD), which posted a 25% increase, Alibaba outperformed PDD Holdings (PDD), which saw a 22.2% decline year-to-date.

Year-to-Date Price Comparison

Image Source: Zacks Investment Research

Evaluating the current stock price, it appears undervalued with a forward 12-month P/S ratio of 1.49X, which is lower than the industry average of 1.8X.

Valuation Metrics Compared

Image Source: Zacks Investment Research

Investment Perspective

As Alibaba prepares for its second-quarter fiscal 2025 earnings announcement, it presents a notable investment prospect. The international commerce growth from platforms like AliExpress and Trendyol, combined with advancements in AI and strengthened ties with SMEs, offers strong growth potential. Domestically, strategic initiatives like the partnership with Douyin enhance its e-commerce efficacy, while Cainiao’s logistics network shows promise for continued development. Though facing Chinese economic headwinds, Alibaba is positioned for potential growth through its various initiatives and multi-faceted revenue streams.

Final Thoughts

Before Alibaba’s second-quarter fiscal 2025 earnings call, investors might find it beneficial to consider the company’s growth potential in international commerce, cloud services, and logistics. Its dedication to AI technology, combined with expanding global operations and competitive pricing strategies, indicates a commitment to capturing revenue opportunities. Despite challenges in China’s economy, Alibaba’s strategic partnerships and diverse revenue streams suggest a favorable outlook for long-term growth, making current valuations appealing for investors.

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 top stocks from a list of 220 Zacks Rank #1 Strong Buys. These stocks are labeled as “Most Likely for Early Price Pops.”

Since 1988, this selection has outperformed the market more than twice with an average annual gain of +23.7%. Be sure to pay attention to these carefully chosen 7 stocks.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

PDD Holdings Inc. Sponsored ADR (PDD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.