Analysts Predict Upside for Vanguard Utilities ETF and Key Holdings

In our latest analysis at ETF Channel, we’ve examined the Vanguard Utilities ETF (Symbol: VPU) and its underlying holdings. By comparing the current trading prices of these holdings with the projected average analyst 12-month target prices, we calculated a weighted average implied target price for the ETF itself, which stands at $185.67 per unit.

Current Performance and Analyst Forecasts

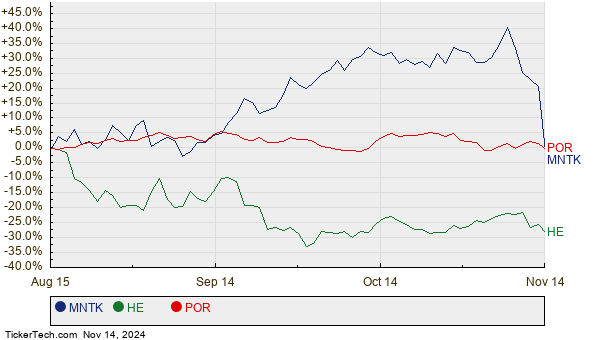

Currently, VPU is trading around $169.33 per unit, suggesting that analysts expect a 9.65% increase. Notably, three significant holdings within VPU present potential for gains based on their respective analyst target prices. Montauk Renewables Inc (Symbol: MNTK), for instance, is trading at $4.11 per share, yet analysts project a target price of $6.56 per share, indicating a substantial upside of 59.66%. Hawaiian Electric Industries Inc (Symbol: HE) also shows a promising forecast, with a 15.98% upside from its current price of $9.70 to an expected target of $11.25 per share. Meanwhile, Portland General Electric Co. (Symbol: POR) is expected to climb to a target price of $51.77 per share, indicating a potential increase of 11.75% from its recent trading price of $46.33. Below, you’ll find a chart showcasing the 12-month price performance of MNTK, HE, and POR:

Analyst Target Summary

The following table summarizes current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Utilities ETF | VPU | $169.33 | $185.67 | 9.65% |

| Montauk Renewables Inc | MNTK | $4.11 | $6.56 | 59.66% |

| Hawaiian Electric Industries Inc | HE | $9.70 | $11.25 | 15.98% |

| Portland General Electric Co. | POR | $46.33 | $51.77 | 11.75% |

Evaluating Analyst Expectations

The question arises: Are analysts on target with their projections, or are their expectations too high? Validating these projections requires careful consideration of recent trends in each company and the broader industry. A price target significantly above the current trading price might signal optimism, but it could also precede potential downgrades if analysts fail to adjust to evolving market dynamics. Investors should pursue further research to assess these prospects.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of NBSE

• FAF Dividend Growth Rate

• J.B. Hunt Transport Services RSI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.