Datadog Reports Strong Q3 Results, Showcasing Growth and AI Focus

Datadog (DDOG) achieved impressive results in the third quarter, illustrating significant growth and effective strategic management. The company reported revenues of $690 million, a remarkable 26% increase year-over-year that surpassed the higher end of its forecast and beat the Zacks Consensus Estimate by 4.15%.

The firm recorded non-GAAP earnings of 46 cents for the third-quarter 2024, reflecting a 27.8% rise from the same period last year, and exceeding the Zacks Consensus Estimate by 17.95%.

With around 29,200 customers, up from 26,800 last year, Datadog is making strides in its market presence. The company also generated $204 million in free cash flow, yielding a solid 30% margin.

Growing Platform Adoption Among Customers

Datadog’s platform strategy has garnered impressive customer engagement, as indicated by rising multi-product usage rates. Currently, 83% of customers utilize two or more products, while 49% rely on four or more. An eye-catching 26% of customers have adopted six or more products, an increase from 21% a year prior, emphasizing strong platform loyalty and growth opportunities.

AI Integration Enhances Growth Prospects

Centrally focused on the AI trend, Datadog has about 3,000 customers currently using its AI integrations. Its LLM observability products are attracting attention, with hundreds of customers already on board. Early reports show substantial efficiency improvements, with case investigation times for LLM-related issues dropping from days to mere minutes.

Success with Major Enterprises and Global Expansion

In the third quarter, Datadog secured notable contracts, including a seven-figure deal with a major Indian e-commerce firm and significant expansions with a European airline and a leading AI model provider. These achievements highlight Datadog’s capability to meet diverse needs across many industries and regions.

As Datadog competes in the crowded observability and monitoring market against players like New Relic, Dynatrace, and Splunk, it distinguishes itself through a unified platform and multi-cloud capabilities. Nonetheless, the presence of technology giants, such as Microsoft and Amazon, with their proprietary monitoring tools, poses potential challenges for Datadog’s market share.

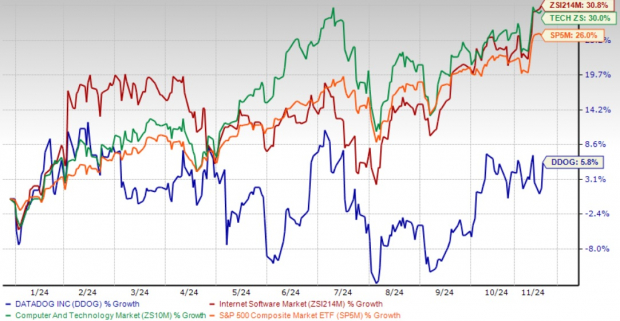

Recently, Datadog’s shares rose by 5.8%, yet this trails the broader increase of 30% within the Zacks Computer and Technology sector.

Year-to-Date Performance Overview

Image Source: Zacks Investment Research

Investors may find Datadog’s valuation somewhat concerning, as the stock trades at a premium compared to the broader Zacks Internet – Software industry. Currently, its forward 12-month P/S ratio stands at approximately 13.89, reflecting high expectations for future growth. This valuation is underpinned by the company’s solid revenue increases, a growing customer base, and rising product usage.

DDOG’s P/S F12M Ratio Indicates Elevated Valuation

Image Source: Zacks Investment Research

Investment Perspective: Reasons to Buy Datadog

Datadog has demonstrated a net revenue retention rate in the mid-110s, with gross revenue retention in the mid-to-high 90s, indicating strong customer loyalty and potential for growth.

The company’s sustained position as a leader in the Gartner Magic Quadrant for Observability Platforms reinforces its technological strengths. A key component of Datadog’s strategy is its capacity to offer comprehensive visibility across multiple cloud environments. By deeply integrating with Amazon (AMZN) services, Alphabet (GOOGL) Cloud, and Microsoft (MSFT) Azure, Datadog allows organizations to oversee, analyze, and optimize their entire cloud activities from a single interface. This cohesive method becomes increasingly important as businesses embrace hybrid and multi-cloud strategies for greater flexibility and to avoid vendor dependence.

The growth of AI-native clientele, now constituting over 6% of ARR (up from 2.5% year-over-year), positions Datadog to capitalize on the AI market boom.

Datadog features 15 products with over $10 million in ARR, highlighting its strong product-market fit and innovative edge.

Future Projections and Recommendations

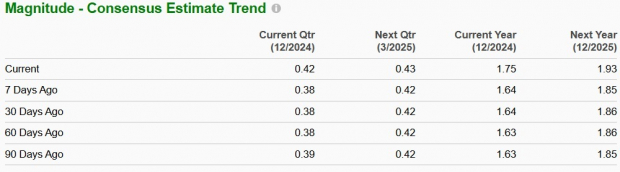

Datadog’s guidance for Q4 2024 estimates revenues between $709 million and $713 million, representing a year-over-year growth of 20-21%. For the entirety of 2024, revenues are expected to range from $2.656 billion to $2.660 billion, with non-GAAP earnings per share anticipated between $1.75 and $1.77.

The Zacks Consensus Estimate for 2024 is set at $2.66 billion in revenues and $1.75 in earnings per share, signifying a 24.9% increase in revenue and a 32.5% improvement in earnings year-over-year. The earnings estimate has increased by 6.7% over the last month.

Image Source: Zacks Investment Research

Check the latest EPS estimates and surprises on Zacks Earnings Calendar.

Given the stable market, strong customer engagement, and strategic positioning in lucrative sectors like AI, Datadog represents an appealing investment opportunity. Existing shareholders should hold onto their positions due to the company’s solid execution and financial health. New investors should consider Datadog’s exceptional growth prospects, market leadership, and strategic moves in AI, especially those looking for exposure in cloud computing and AI observability.

Currently, DDOG carries a Zacks Rank #2 (Buy) and has a Growth Score of A, suggesting a favorable investment situation as per the Zacks proprietary model.

Free: 5 Stocks to Buy as Infrastructure Investment Increases

Trillions of federal dollars are being invested to repair and enhance America’s infrastructure, encompassing not just roads and bridges but also significant allocation toward AI data centers and renewable energy.

In this report, discover five surprising stocks positioned to gain from the early phases of this spending boom.

Download “How to Profit from the Trillion-Dollar Infrastructure Boom” absolutely free today.

Want the latest recommendations from Zacks Investment Research? Download “5 Stocks Set to Double” for free today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Datadog, Inc. (DDOG): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.