Spotify Surges 15% Despite Earnings Miss: What Investors Need to Know

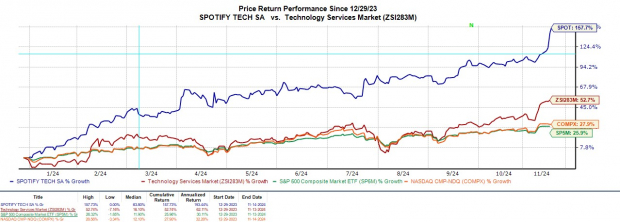

Spotify Technology SPOT shares have increased by more than 15% since the company announced its Q3 results on Tuesday. While the music streaming service did not meet earnings expectations, several positive aspects in the report could appeal to investors.

Image Source: Zacks Investment Research

Highlights of Spotify’s Q3 Performance

Spotify reported a remarkable 341% increase in its Q3 EPS, reaching $1.59 this year compared to $0.36 last year. Despite this impressive growth, the earnings fell short of the Zacks EPS Consensus of $1.75. However, the revenue for the quarter was $4.38 billion, exceeding expectations of $4.36 billion, and representing a 20% increase from $3.65 billion a year earlier.

The company also achieved a record operating income of $478 million and a gross margin of 31.1%. Their Monthly Active Users (MAUs) grew by 11% year-over-year, reaching 640 million, while paid subscribers increased by 12% to total 252 million. For context, Spotify’s paid subscribers more than double those of Apple AAPL Music, which has 93 million subscribers.

Future Subscriber Projections

Looking ahead, Spotify anticipates adding 25 million MAUs in Q4, bringing the total to 665 million. The company expects its subscriber count to grow by 8 million in the same period, reaching 260 million.

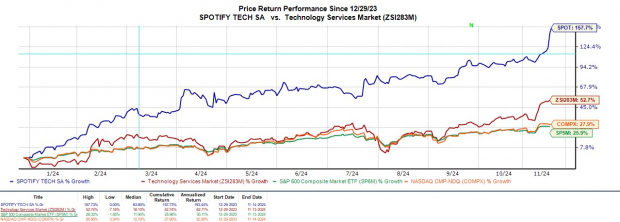

For Q4, Spotify projects sales of $4.31 billion, slightly below the Zacks Consensus of $4.41 billion, reflecting an 11% growth. Estimates suggest Spotify’s total sales will rise by 17% in fiscal 2024 and another 15% to $19.29 billion in fiscal 2025.

Annual earnings are forecasted to skyrocket to $6.19 per share in fiscal 2024, a significant turnaround from last year’s adjusted EPS loss of -$2.95. Furthermore, FY25 EPS is predicted to increase by 44% to $8.92, based on available estimates from Zacks.

Image Source: Zacks Investment Research

Assessing Spotify’s Valuation

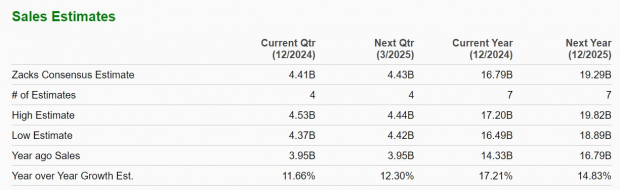

Spotify’s stock has a price-to-sales (P/S) ratio of 5.4X, which aligns with the S&P 500 yet shows a significant premium over its sector average of 1.7X within the Zacks Technology-Services Industry.

Image Source: Zacks Investment Research

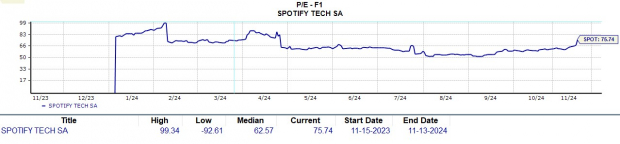

On a forward price-to-earnings basis, Spotify’s forward P/E multiple stands at 75.7X, below its one-year high of 99.3X but slightly above the median of 62.5X.

Image Source: Zacks Investment Research

Final Insights

While investors appear willing to pay a premium for Spotify’s impressive growth, the stock currently holds a Zacks Rank #3 (Hold). Future buying opportunities might depend on earnings estimate revisions in the coming weeks, given that Spotify’s financial health has improved significantly, though revenue guidance fell short of expectations.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds are being allocated to repair and upgrade America’s infrastructure. This investment will not only cover roads and bridges but also extend to AI data centers and renewable energy sources.

In this report, you’ll discover 5 unexpected stocks positioned to benefit most from this spending spree that is just beginning.

Download “How to Profit from the Trillion-Dollar Infrastructure Boom” absolutely free today.

Want the latest recommendations from Zacks Investment Research? Download “5 Stocks Set to Double” for free.

Apple Inc. (AAPL): Free Stock Analysis Report

Spotify Technology (SPOT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.