Marvell Technology: A Strong Performer in the Semiconductor Sector

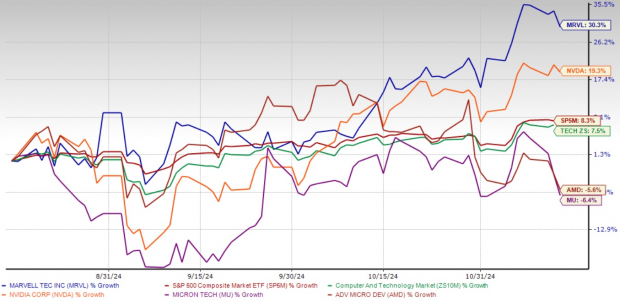

Marvell Technology, Inc. MRVL has seen its shares grow more than 30% in just three months, well above the broader market’s gains. The S&P 500 has increased by 8.3%, while the Zacks Computer and Technology sector has moved up by 7.5% during the same period.

In comparison to major semiconductor players like NVIDIA Corporation NVDA, Advanced Micro Devices, Inc. AMD, and Micron Technology, Inc. MU, Marvell stands out. Over the past three months, NVIDIA’s stock climbed 19.3%, whereas shares of Advanced Micro Devices and Micron declined by 5.6% and 6.4%, respectively.

Three-Month Stock Performance Overview

Image Source: Zacks Investment Research

Given this strong performance, many investors are contemplating whether to take profits or continue holding MRVL. Here’s why keeping it might be the best approach.

Growth Potential in AI Markets

Marvell’s future is closely linked to the booming artificial intelligence (AI) sector, which holds vast potential for growth. Gartner projects that the global AI semiconductor market will rise by 33% to $71.25 billion in 2024, followed by a 29% growth in 2025. Marvell’s advanced chips are vital in processing and transferring the massive data generated by AI applications.

The company’s high-performance electro-optics solutions, such as PAM DSPs and ZR interconnects, are essential for efficient data transmission in AI-optimized data centers. This technology situates Marvell at the forefront of developing next-generation data infrastructure, crucial for the accelerating adoption of AI worldwide. By tailoring its products to meet the rising demands of AI, Marvell is well-positioned to take a significant share of this burgeoning market.

Innovative Custom Silicon Solutions and Data Center Growth

Marvell’s focus on custom silicon solutions for cloud service providers gives it a distinct advantage. In its second quarter of fiscal 2025, the data center segment experienced notable growth due to an increase in custom AI compute programs. Management anticipates high-teen sequential growth in data center revenues for the third quarter, indicating strong demand for AI-centric solutions.

Investments in advanced technologies, including PCIe Gen 6 retimers and innovative interconnect products, illustrate Marvell’s forward-looking strategy to enhance data center capabilities. These steps are vital as the industry prepares to meet the demands driven by AI, emphasizing Marvell’s role as a key player in this long-term growth area.

Operational Strength Amid Challenges

Marvell’s second-quarter performance for fiscal 2025 demonstrated its resilience, despite a tough macroeconomic climate. The company achieved non-GAAP earnings per share (EPS) of 30 cents, up from 24 cents in the previous quarter. This increase reflects Marvell’s adept cost management and operational efficiency.

The company has successfully navigated supply chain challenges while maintaining profitability, showcasing its effective execution. Strategic pricing and solid portfolio management have contributed to sustaining profit margins.

Investors remain optimistic; the Zacks Consensus Estimate predicts a 35% increase in year-over-year revenue and a 71% rise in earnings for fiscal 2026. Such forecasts bolster confidence in Marvell’s ongoing growth potential.

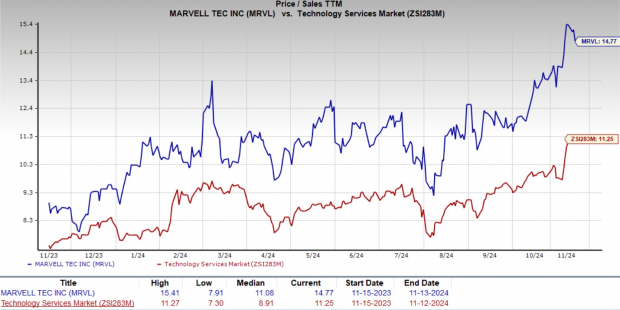

Image Source: Zacks Investment Research

Challenges on the Horizon

While the long-term outlook appears bright, Marvell does face several near-term risks. A key concern is the tightening of U.S. semiconductor export controls to China. This situation is particularly important since China represented over 46% of Marvell’s total revenue in the second quarter of fiscal 2025. Further restrictions could potentially hinder the company’s sales and competitive position.

Additionally, Marvell’s stock is valued relatively high, trading at a trailing 12-month price-to-sales (P/S) ratio of 14.77. This is above the Zacks Technology Services industry’s average of 11.25, making it susceptible to declines if market sentiment shifts negatively.

Image Source: Zacks Investment Research

Conclusion: Holding MRVL Stock Makes Sense

Though Marvell showcases notable strengths in AI markets, custom silicon offerings, and operational adaptability, it is wise to remain cautious about near-term uncertainties like U.S.-China trade issues and elevated valuations. Therefore, maintaining MRVL stock positions investors to benefit from Marvell’s sound fundamentals and strategic stance amid the evolving semiconductor landscape.

Currently, Marvell holds a Zacks Rank #3 (Hold). Investors can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Get Ahead: 5 Stocks to Consider as Infrastructure Spending Rises

Trillions of Federal dollars are set for the repair and upgrade of America’s infrastructure. Significant funds will flow into AI data centers, renewable energy, and other areas.

Discover five surprising stocks poised to benefit from this spending surge that is just beginning.

Download your free guide on how to profit from the Trillion-Dollar Infrastructure Boom today.

Want up-to-date recommendations from Zacks Investment Research? Download your complimentary report on 5 Stocks Set to Double.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.