AMD Cuts Workforce to Boost AI Chip Development

Advanced Micro Devices (AMD) will lay off approximately 4% of its global workforce, equating to around 1,000 employees. This strategic move aims to sharpen its focus on artificial intelligence (AI) chips to compete more effectively with major players like Nvidia (NVDA).

Revenue Surge Sparks Changes

Recent growth in AMD’s Data Center segment has prompted this decision, as the company reported a remarkable 122% increase in revenue during the third quarter. This surge is largely attributed to heightened demand for chips supporting generative AI applications, including those used by ChatGPT. Notably, AMD has revised its sales expectations for the segment in 2024, raising it to $5 billion from an earlier estimate of $4.5 billion.

In response to this burgeoning demand, AMD is significantly investing in research and development. Plans are underway to begin mass production of the new MI325X AI chip in the fourth quarter. However, challenges have arisen regarding scaling production due to limited manufacturing capacity, prompting job cuts to allocate more resources toward AI initiatives.

Tech Sector Layoffs Continue

The layoffs at AMD echo a wider trend in the tech industry, with major companies like Chegg (CHGG), Microsoft (MSFT), and Intel (INTC) also announcing job cuts recently. These layoffs stem from economic uncertainty, fierce competition, and the growing need to invest in AI technology.

For example, Chegg has revealed plans to cut 21% of its workforce due to increasing competition from AI products like ChatGPT. Intel announced its decision to eliminate 2,000 positions in the U.S. earlier this month, while Microsoft has laid off 650 employees from its gaming division, following 1,900 cuts earlier this year.

AMD Stock Assessment

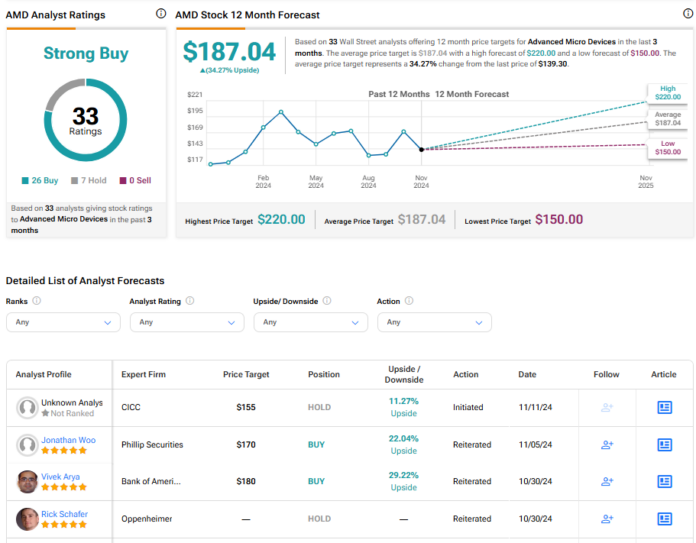

On Wall Street, AMD has received a Strong Buy consensus rating, supported by 26 Buy and seven Hold recommendations over the past three months. Trading at $187.04, the average price target for AMD suggests a potential upside of 34.27%. However, shares have decreased by 5.5% year-to-date.

See more AMD analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.