UBS Initiates Coverage of EPR Properties’ Preferred Stock with Neutral Outlook

Latest Trends in Fund Ownership

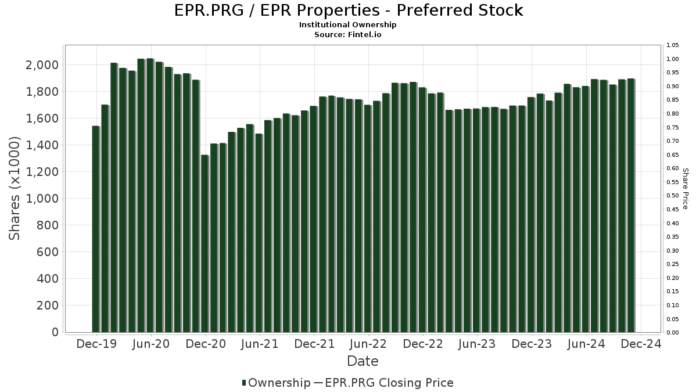

According to Fintel, on November 14, 2024, UBS began coverage of EPR Properties – Preferred Stock (NYSE:EPR.PRG) with a Neutral recommendation. Currently, there are 16 funds or institutions that have reported positions in EPR Properties’ Preferred Stock. This marks an increase of 1 owner or 6.67% from the previous quarter. The average portfolio weight of all funds invested in EPR.PRG is now 0.63%, a rise of 1.99%. Total shares held by institutions have seen a modest increase of 0.60% over the past three months, reaching 1,900K shares.

Insight into Shareholder Activity

PFF – iShares Preferred and Income Securities ETF currently holds 526K shares. Previously, it reported ownership of 564K shares, which indicates a decrease of 7.20%. Nonetheless, the firm increased its portfolio allocation in EPR.PRG by 0.08% over the last quarter.

PFFA – Virtus InfraCap U.S. Preferred Stock ETF holds 427K shares, up from 392K shares in its last filing, showing an increase of 8.02%. The allocation to EPR.PRG has also grown by 6.97% in the last quarter.

PGX – Invesco Preferred ETF now holds 267K shares, down from 274K shares earlier, reflecting a decrease of 2.61%. However, its portfolio allocation in EPR.PRG increased by 13.62% over the past quarter.

Griffin Institutional Access Real Estate Fund has raised its holdings to 165K shares, a slight increase of 2.45% from its last report of 161K shares. The fund’s portfolio allocation to EPR.PRG grew by 9.54% in the last quarter.

Cohen & Steers Quality Income Realty Fund maintains its position at 132K shares with no changes reported in the last quarter.

Fintel provides in-depth investing research services for individual investors, traders, financial advisors, and small hedge funds. Our extensive datasets include fundamentals, analyst assessments, ownership information, fund sentiment, and much more. This empowers investors with valuable insights to enhance their trading strategies.

For more information, click to learn more.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.