Unlock Passive Income: Why Dividends Matter for Investors of All Ages

Many investors overlook the significance of dividends. While retirees often appreciate high-yield dividend stocks for their ability to cover living expenses, younger investors can also benefit greatly.

Stock prices can be unpredictable, but dividends consistently provide value. They represent real cash in hand and remain in your account once paid. Historically, dividends have contributed about 34% of the S&P 500‘s total returns since 1940. Moreover, reinvesting those dividends can significantly amplify your wealth; since 1960, reinvested dividends have accounted for 85% of the S&P 500’s total returns.

If you’re aiming for decades of passive income that can grow into considerable wealth for future generations, consider this investment. The following exchange-traded fund (ETF) may serve as an ideal long-term choice.

Benefits of Dividend Diversification: Exploring the Schwab U.S. Dividend Equity ETF

The Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD) is often regarded as an exceptional dividend ETF. The primary advantage of this fund is straightforward: it promotes diversification. Experts frequently advise against concentrating too much investment in one area, and ETFs provide a built-in way to spread risk.

Specifically, the Schwab U.S. Dividend Equity ETF contains 103 distinct stocks, mirroring the Dow Jones U.S. Dividend 100 index. Owning a share of SCHD means you acquire fractional stakes in these 103 companies.

Among them, key sectors include:

- Financials: 18.2%

- Healthcare: 15.8%

- Consumer staples: 14%

- Industrials: 13.4%

- Energy: 11.9%

Other sectors make up less than 10% of the fund, with technology at only 8.8%. Leading individual holdings encompass Bristol-Myers Squibb, BlackRock, Cisco Systems, Home Depot, Chevron, Texas Instruments, Lockheed Martin, Verizon, Amgen, and United Parcel Service (UPS).

No single stock commands more than 4.55% of the fund, contrasting with the S&P 500, where Nvidia represents over 7% of the index. In this regard, SCHD offers superior diversification compared to the S&P 500.

Image source: Getty Images.

The Power of Reinvesting Dividends

Reinvesting dividends can gradually increase your passive income, much like a snowball that gathers size as it rolls downhill. The calculations for this “snowball” effect depend on the initial dividend yield and the rate at which dividends grow. In general, a higher initial yield may result in slower growth over time.

Retirees often prefer higher yields for immediate income, while younger investors may seek companies with growing dividends, even if their current yield is lower. The challenge lies in balancing these factors based on individual financial goals.

One of the strengths of SCHD is its ability to strike this balance. Currently, the fund yields just under 3.5%, a rate that outshines most stocks, particularly when contrasted with the S&P 500’s yield of just 1.3%.

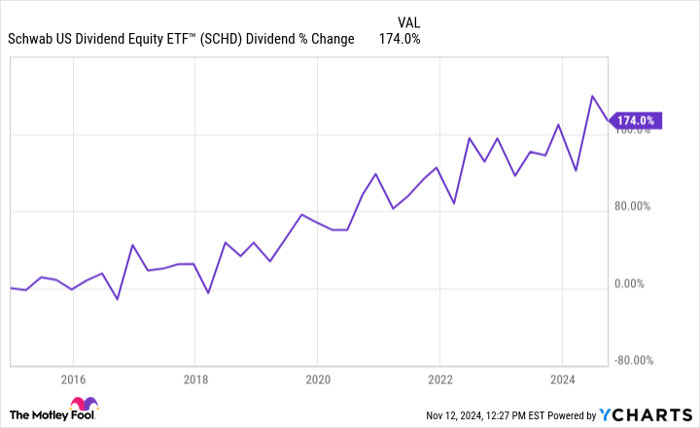

Moreover, the fund’s dividend has grown by 174% over the past decade.

SCHD Dividend data by YCharts.

The Dow Jones U.S. Dividend 100 index, followed by SCHD, uses a rigorous selection process to choose stocks based on various financial metrics. This index prioritizes financially sound companies that produce high returns on equity and consistently increase their dividends.

However, SCHD has a lower representation in the technology sector, which has hindered its performance relative to the S&P 500 since early last year. Still, it remains a solid option for those seeking to grow their passive income from dividends.

A Unique Opportunity Awaits Investors

Have you ever felt you missed out on buying popular stocks? There’s good news.

Occasionally, our research team identifies specific stocks deemed ready for significant growth, labeled as “Double Down” stocks. If you’ve been hesitant, now might be the perfect time to invest before the opportunity slips away. The data illustrates substantial past success:

- Amazon: A $1,000 investment when we doubled down in 2010 would be worth $24,113!*

- Apple: A $1,000 investment from 2008 would now yield $42,634!*

- Netflix: Invest $1,000 when we doubled down in 2004, and it could grow to $447,865!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this may be one of your last chances.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Justin Pope holds shares in Chevron. The Motley Fool has interests in and recommends Bristol Myers Squibb, Chevron, Cisco Systems, Home Depot, Nvidia, and Texas Instruments. The Motley Fool also recommends Amgen, Lockheed Martin, United Parcel Service, and Verizon Communications. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.