Exploring Promising Growth Stocks for Long-Term Gains

Growth stocks have been significant players in the stock market this year, showing no signs of slowing down. The S&P 500 officially entered a bull market in January and has celebrated new peaks since then, aiming for a 25% yearly gain following a 24% increase last year. Historically, bull markets tend to last much longer than bear markets, favoring the performance of growth stocks.

Importantly, investing in quality stocks can yield top returns over the long haul. So regardless of whether the market continues its upward trend or takes a breather, well-selected stocks can offer substantial rewards over several years.

Thinking of starting? With just $200, you can invest in a leading tech firm trading at an appealing valuation, as well as a younger artificial intelligence (AI) company in its formative growth stages. Here are two top contenders with the potential to double your investment in the long run.

Image source: Getty Images.

1. Alphabet: A Search Engine Giant

You likely recognize Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) for its widely-used tool, Google Search. Currently, Google controls about 90% of the global search market. This dominance has been instrumental in Alphabet’s robust earnings growth, attracting advertisers who want to target their audiences effectively.

As a result, Alphabet has consistently increased its revenue and profits into the billions. Additionally, the company is advancing in cloud computing, with Google Cloud surpassing $10 billion in quarterly revenue and over $1 billion in quarterly operating profit this year. The most recent figures show revenues exceeding $11 billion and operating profits nearing $1.9 billion.

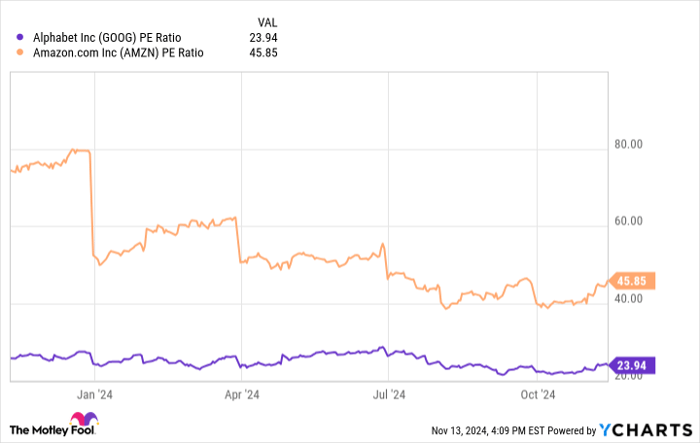

Presently, Alphabet shares are priced at just 24 times their trailing 12-month earnings, making them significantly more affordable compared to rivals like Amazon.

GOOG PE Ratio data by YCharts

If Alphabet’s stock price were to double from the current level of around $180, maintaining the earnings per share of $7.53, it would reflect a price-to-earnings ratio of 48—slightly above Amazon’s. However, expectations indicate that EPS will likely rise, with projections suggesting a double-digit annual increase over the next five years. This positions Alphabet for considerable growth while retaining a reasonable valuation as a growth stock.

2. SoundHound: Leading AI Voice Technology

SoundHound AI (NASDAQ: SOUN) is making waves in the field of AI-driven voice technology. This company boasts over 200 patents on its platform, which converts speech directly into meaning, skipping the usual text intermediary. SoundHound is already making strides in industries like automotive and hospitality, with ambitions to expand into finance and healthcare. The total addressable market is projected to be around $140 billion, providing ample room for growth.

SoundHound has demonstrated remarkable growth, with the most recent quarter showing an 89% increase in revenue. The company also raised its full-year revenue forecast to a range of $82 million to $85 million, up from over $80 million.

Customer diversity has improved, with only 12% of revenue coming from the largest client, and various industries contributing between 5% and 25% of total revenue.

Although SoundHound is not yet profitable, focusing on growth is a valid strategy at this early stage. The company has recently acquired Amelia, enhancing its presence in healthcare, finance, and insurance.

You can currently purchase SoundHound shares for under $7. While the stock trades at 27 times forward revenue estimates—which might seem high—it’s worth remembering that this metric looks at short-term profitability. Over the long term, this AI stock holds significant potential to grow, possibly doubling your investment.

A Unique Opportunity Awaits

Ever feel like you missed out on some of the most successful stocks? This might be your chance to rectify that.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies they believe are about to rise. If you’re concerned that you’ve already missed your opportunity, now could be the perfect time to invest before it’s too late. The figures tell a compelling story:

- Amazon: a $1,000 investment made when we doubled down in 2010 is now worth $24,113!*

- Apple: a $1,000 investment from our double down in 2008 has grown to $42,634!*

- Netflix: if you invested $1,000 when we doubled down in 2004, it would be worth $447,865!*

We are currently issuing “Double Down” alerts for three exceptional companies, and another opportunity like this may not arise soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Alphabet and Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.