Is Broadcom Still a Smart AI Investment? An Analysis After Major Hedge Fund Move

Investors are buzzing about artificial intelligence (AI) stocks in 2023, with major interest projected to carry on into 2025. Broadcom(NASDAQ: AVGO) has seen its stock surge roughly 60% this year, making waves in the market.

Yet, confidence in Broadcom isn’t universal. Point72, led by billionaire Steve Cohen, trimmed its investment in the company significantly, offloading two-thirds of its shares in the second quarter. Following this sale, Broadcom constitutes only 0.79% of Point72’s portfolio, a notable reduction considering its largest holding is 1.98%.

Should individual investors mirror this hedge fund’s approach, or is this merely profit-taking?

Broadcom Offers a Diverse Range of Products

Hedge funds often assess performance differently than retail investors. Their focus on quarterly returns can lead to decisions that favor short-term success, potentially overlooking long-term gains.

Steve Cohen’s decision to divest from Broadcom may be prudent. Broadcom operates across various segments within the hardware and software realm. Its software offerings include cybersecurity, mainframe software, and enterprise solutions, with VMware standing out as its marquee acquisition from last year for $69 billion.

VMware’s technology empowers clients to operate multiple desktops from a single computer, thereby optimizing computing resources. This product’s popularity highlights Broadcom’s innovative approach.

In terms of hardware, VMware is closely linked to AI. Its networking switches, like the Tomahawk 5 and Jericho3-AI, streamline network flow in data centers for AI companies, providing efficient data traffic management. Moreover, they produce custom AI accelerators outperforming traditional GPUs, as seen in applications for Alphabet(NASDAQ: GOOG) (NASDAQ: GOOGL).

This sector has experienced remarkable growth, with Ethernet switch sales surging over 300% year over year in Q3, while AI accelerators grew by more than 250%. However, Broadcom’s vast operations include underperforming segments that can overshadow these successes.

Assessing Broadcom’s Q3 Results: A Closer Look

In Q3 of fiscal year 2024 (ending August 4), Broadcom reported a 47% year-over-year revenue increase, a figure that seems impressive at first glance. However, after adjusting for the VMware acquisition, the growth rate dwindles to a mere 4%. Such modest growth raises concerns among investors about whether Broadcom can effectively leverage the AI surge given its extensive business model.

Expectations, nonetheless, remain cautiously optimistic for fiscal year 2025. A consensus of 37 Wall Street analysts anticipates a 17% growth in revenue and a 28% increase in earnings per share (EPS). While these projections are promising, the question arises: are expectations too high?

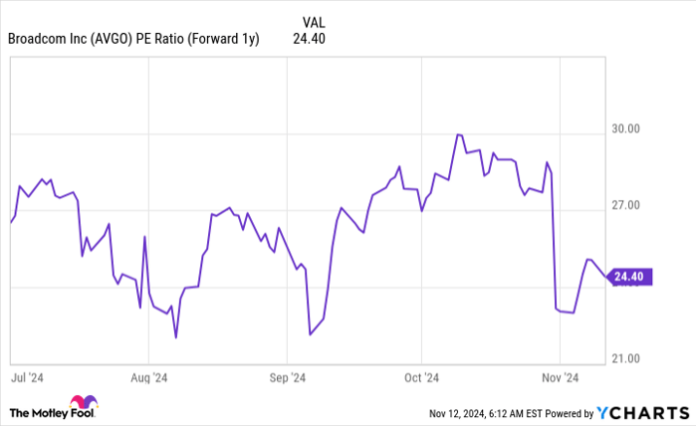

Currently, Broadcom trades at 24 times its estimated 2025 earnings. Although this valuation may not seem exorbitant, it nonetheless raises eyebrows.

AVGO PE Ratio (Forward 1y) data by YCharts.

When compared to other AI frontrunners like Taiwan Semiconductor(NYSE: TSM), Meta Platforms(NASDAQ: META), and Alphabet, Broadcom’s growth and valuation position it nearly in the same tier.

AVGO PE Ratio (Forward 1y) data by YCharts.

Among these, Broadcom’s price-to-FY 2025 earnings is the highest, yet its future prospects into 2025 remain comparable.

Investors must weigh whether Broadcom is a favorable choice in the AI landscape. Despite possessing a successful portfolio in certain areas, the company’s struggles in others make it appear less attractive than its competitors.

Is Now the Right Time to Invest $1,000 in Broadcom?

Before deciding to invest in Broadcom, here are some considerations:

The Motley Fool Stock Advisor team recently highlighted what they believe to be the 10 best stocks for investment right now—and Broadcom was notably absent from this list. The chosen stocks are projected to yield substantial returns in the years ahead.

Consider the case of Nvidia, which was recommended on April 15, 2005. If you had invested $1,000 at that time, it would now be worth $896,358!*

Stock Advisor provides a clear roadmap for investors, including portfolio-building strategies, regular analyst updates, and two new stock suggestions each month. Since its inception in 2002, the service has more than quadrupled the returns of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is also on the board. Keithen Drury holds positions in Alphabet, Meta Platforms, and Taiwan Semiconductor Manufacturing. The Motley Fool has vested interests in and recommends Alphabet, Meta Platforms, and Taiwan Semiconductor Manufacturing, while it also recommends Broadcom. The Motley Fool maintains a comprehensive disclosure policy.

The views and opinions here reflect those of the author and may not represent those of Nasdaq, Inc.