Evaluating the Future of Chipmakers: AMD, Intel, and TSMC in the AI Era

Advanced Micro Devices (AMD), Intel (INTC), and Taiwan Semiconductor Manufacturing (TSM) play crucial roles in the chipmaking and artificial intelligence (AI) industries. However, their successes over the last two years have greatly differed, especially when compared to Nvidia’s (NVDA) remarkable achievements. While I hold a pessimistic view of Intel and TSMC, I remain optimistic about AMD’s potential for market share gains and rising stock prices in the medium term.

AMD may not achieve the explosive growth Nvidia has shown, but the stock is set for positive trends in the next three to five years. Conversely, TSMC faces significant geographical concentration risks, and Intel appears too risky after a history of technological underinvestment.

AMD: The Contender in AI Growth

Focusing on AMD, the stock has risen significantly over the past two years but lags behind Nvidia. Nevertheless, it is a key competitor in the expanding data center and AI sectors. AMD is making notable advancements in creating a “full-stack” offering, which includes software to enhance its hardware solutions and strengthen its position in the AI market.

The acquisition of ZT Systems represents an important move for AMD towards this comprehensive software strategy. This step is expected to improve system integration, shorten the time to market for AI products, and broaden AMD’s presence among major hyperscale clients.

There is ample room for market growth. Currently, AMD holds less than 5% of the GPU market share for AI and around 11% of the overall AI market share, which includes CPUs. The company’s EPYC processors and Instinct accelerators are said to deliver excellent performance for AI workloads, particularly in data centers.

Assessing AMD’s Valuation

Despite these promising developments, AMD’s growth expectations are considerably priced into its valuation. The stock is currently trading at 44.4 times forward earnings with a price-to-earnings-to-growth (PEG) ratio of 1.08. While a 40% annual earnings growth is anticipated in the medium term, the high forward price-to-earnings (P/E) ratio indicates potential downside risks. Nonetheless, I maintain a positive outlook on AMD.

Expectations of earnings growth will likely persist as hyperscale companies seek alternatives to Nvidia, aiming to diversify supply chains. Although AMD’s stock might appear overvalued, I believe the momentum from AI-related demand will continue to benefit the company.

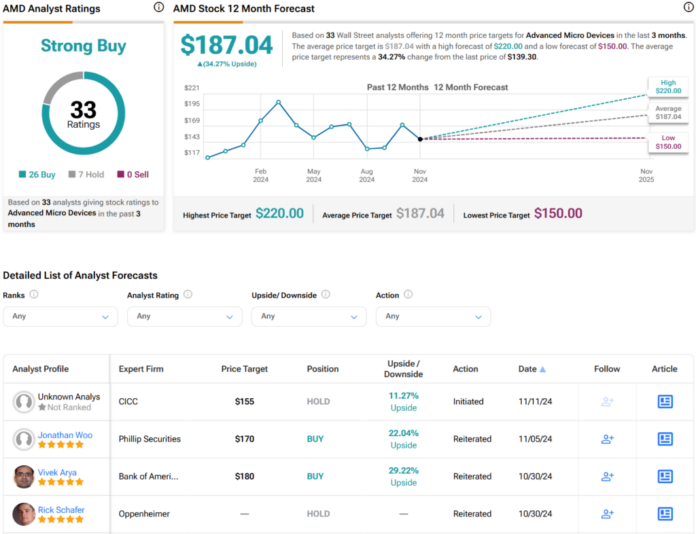

According to TipRanks, AMD holds a Strong Buy rating with 26 Buys, seven Holds, and no Sell ratings from Wall Street analysts in the past three months. The average stock price target for AMD is $187.04, suggesting a potential upside of over 34.3%.

See more AMD analyst ratings

Intel: Struggles Amid AI Opportunities

Intel has largely missed the wave of AI popularity that has lifted competitors like Nvidia and AMD in 2024. Although Nvidia has led the AI accelerator market, and AMD has made significant progress, Intel continues to lag in its AI product offerings.

However, the company may be positioned for recovery in 2025 as it enhances its AI strategies. Intel is investing heavily in next-generation AI products, with the upcoming Lunar Lake and Arrow Lake processors scheduled for late 2024 and early 2025. These processors are designed to better manage AI tasks on both PCs and servers.

Intel aims to ship over 100 million AI PCs by 2025, presenting a chance to regain market share. Furthermore, its partnership with Amazon’s (AMZN) AWS to create custom AI fabric chips and Xeon 6 processors represents a significant opportunity in the AI-focused cloud market. This multi-year, multi-billion-dollar deal could enhance Intel’s AI portfolio.

Intel’s Challenges Ahead

Nevertheless, Intel’s foundry services face both obstacles and potential. As these services are consolidated into a subsidiary, they could either become integral to Intel’s AI strategy or be sold off, a sale that might be difficult to execute.

Should Intel attract more third-party businesses for its chip production, it could become a key component in the AI hardware landscape. Yet, the fact that many of Intel’s production processes rely on proprietary tools may hinder wider market engagement.

On TipRanks, INTC has received a Hold rating based on one Buy, 22 Holds, and seven Sell ratings from analysts in the past three months. The average stock price target for INTC is $24.43, indicating approximately a 2% downside risk. Personally, my investment approach leans bearish on Intel. The potential for recovery exists, but the associated risks make it unappealing for me as an investor.

See more INTC analyst ratings

TSMC: A Strong Player with Risks

Interestingly, TSMC has stated it will not pursue the acquisition of Intel’s foundry business, despite its financial capabilities. This decision raises eyebrows, as Intel’s foundries are widely spread, including locations in Ireland and Israel. In contrast, TSMC primarily operates in Taiwan, which carries its own geopolitical risks due to claims from Beijing.

TSMC’s focus on its own expansion strategy, including development projects in the U.S., Japan, and Europe, is likely a significant factor in this decision.

Overall, TSMC is well-placed to benefit from the increasing demand for advanced chips in AI, 5G, and high-performance computing. Continuous investments in state-of-the-art technology should sustain its competitive edge while supporting other companies’ successes, particularly as a supplier to firms like Nvidia.

TSMC’s Valuation and Outlook

However, TSMC’s operations face geopolitical uncertainties between China and Taiwan, usually leading to the stock trading at a discount compared to peers. Currently, TSMC trades at 27.2 times forward earnings, which reflects a 6.9% premium over the technology sector average. Despite this, a PEG ratio of 0.8 suggests that the stock could be undervalued.

According to TipRanks, TSM is rated as a Strong Buy, backed by five Buys, zero Holds, and no Sell ratings from analysts over the past three months. The average stock price target for TSM is $205, indicating a potential upward movement of about 9.8%.

See more TSM analyst ratings

Taking into account the geopolitical risks that TSMC faces, I find myself turning bearish on the stock’s future. Its current price near $200 per share feels steep given these ongoing risks.

Disclosure

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.