Analysts Forecast Growth for Invesco S&P MidCap Quality ETF

In a recent analysis of the Invesco S&P MidCap Quality ETF (Symbol: XMHQ), we examined the trading prices of its underlying holdings and compared them to analysts’ 12-month target prices. As a result, we found that the implied analyst target price for XMHQ is $114.38 per unit.

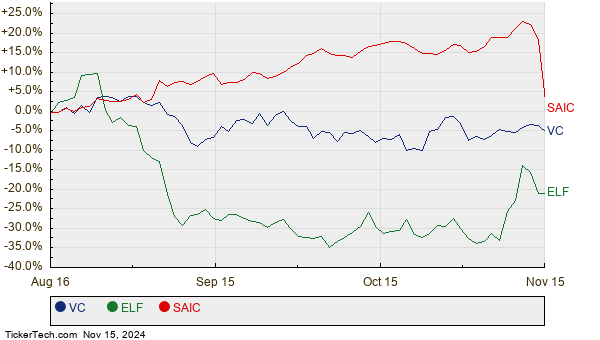

Currently, XMHQ is priced at approximately $103.64 per unit, indicating a potential upside of 10.36% according to analyst expectations based on the ETF’s holdings. Three significant holdings in XMHQ that show considerable upside potential include Visteon Corp (Symbol: VC), e.l.f. Beauty Inc (Symbol: ELF), and Science Applications International Corp (Symbol: SAIC). For instance, Visteon trades at a recent price of $92.11, while the average analyst target is 33.79% higher at $123.23. Meanwhile, e.l.f. Beauty is trading at $123.11, with a target price of $158.07, suggesting an upside of 28.40%. Additionally, SAIC’s current price is $125.91, with analysts predicting a target of $150.12, representing a 19.23% increase. Below is a chart outlining the stock performance of VC, ELF, and SAIC over the past twelve months:

Here is a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P MidCap Quality ETF | XMHQ | $103.64 | $114.38 | 10.36% |

| Visteon Corp | VC | $92.11 | $123.23 | 33.79% |

| e.l.f. Beauty Inc | ELF | $123.11 | $158.07 | 28.40% |

| Science Applications International Corp | SAIC | $125.91 | $150.12 | 19.23% |

Do analysts have valid reasons for their targets, or are their expectations too high? It’s essential for investors to consider whether the optimistic target prices reflect genuine growth prospects or if they stem from outdated evaluations. High target prices can indicate a positive outlook, yet they may also lead to downward revisions if driven by past performance rather than current market conditions. Further research is encouraged for those looking to invest.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Preferred Stock ETFs

• EPRX Average Annual Return

• Funds Holding TARK

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.