Kulicke and Soffa Reports Mixed Quarter Amid Industry Challenges

Kulicke and Soffa Industries (KLIC) announced its fourth-quarter fiscal 2024 results, revealing non-GAAP earnings of 34 cents per share. This figure fell short of the Zacks Consensus Estimate by 5.56%. The earnings also represented a 33.3% decrease compared to the same quarter last year.

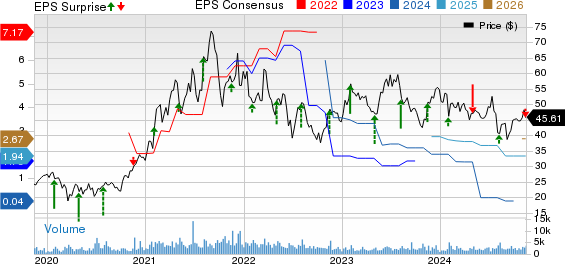

KLIC has faced mixed earnings performance over recent quarters; it missed expectations in two out of the last four quarters, delivering an average negative surprise of 117.34% during this period.

For updated EPS estimates and surprises, visit Zacks Earnings Calendar.

Despite a revenue decline of 10.4% year over year to $181.3 million, the figure slightly exceeded the consensus estimate by 0.73%.

While KLIC’s stock has dropped 16.6% this year, contrasting with a 29.3% increase in the Zacks Computer and Technology sector, shares remained steady in after-hours trading following the results.

Stock Performance and Market Reach

Kulicke and Soffa Industries, Inc. price-consensus-eps-surprise-chart | Kulicke and Soffa Industries, Inc. Quote

Revenue Breakdown by Market

In the fourth quarter, General Semiconductor revenues increased by 11% sequentially (excluding contributions from the TCB business), totaling $84 million.

Revenues from the Automotive and Industrial sector surged 42.3% year over year, reaching $37 million.

Conversely, the LED segment struggled, generating only $2 million amid challenges in the wire bonded and high-bright lighting markets. Despite these setbacks, the company continues to push for its Luminex system, a laser-based technology for mini-LED placement.

The Memory segment showed impressive growth, soaring to $19 million from just $2 million a year earlier.

However, the APS segment reported a 2.4% decline year over year, with revenues of $40 million compared to $41 million the previous year.

Operating Performance Overview

During Q4 fiscal 2024, Kulicke and Soffa experienced an expansion in gross margin, which improved by 100 basis points (bps) year over year to $87.7 million, reflecting 48.3% of net revenues.

Operating expenses rose by 11.3% year over year to $85 million, largely driven by a 14.1% jump in selling, general, and administrative costs, alongside a 3% increase in research and development expenses.

The non-GAAP operating income fell sharply by 51.7% from the prior year, amounting to $12.7 million, and the operating margin decreased by 600 bps to 7%.

Financial Position and Outlook

As of September 28, 2023, Kulicke and Soffa’s cash, cash equivalents, and short-term investments totaled $577.1 million.

The company reported cash flow from operating activities of $31.6 million, an increase from $26.9 million in the previous quarter.

Adjusted free cash flow turned positive at $29.2 million, compared to a free cash outflow of $24.2 million in the prior quarter. Additionally, the company repurchased 1 million shares of its common stock for $42.7 million.

Q1 Fiscal 2025 Guidance

Looking ahead to the first quarter of fiscal 2025, KLIC expects net revenues of $165 million, with a variance of +/- $10 million.

The company forecasts non-GAAP operating expenses to rise to $70.5 million (±2%).

Non-GAAP earnings guidance stands at 28 cents per share (±10%), which is below the Zacks Consensus Estimate of 37 cents per share, unchanged over the last month.

Investment Rankings and Opportunities

Kulicke & Soffa currently holds a Zacks Rank #3 (Hold).

Investors may consider looking into NVIDIA (NVDA), Dell Technologies (DELL), and Workday (WDAY), which are ranked higher in the sector.

NVIDIA enjoys a Zacks Rank #1 (Strong Buy), while both Dell Technologies and Workday have a Zacks Rank #2 (Buy). Notable is NVIDIA’s remarkable 196.3% share price increase this year, with its third-quarter results scheduled for November 20. Dell Technologies has risen 75.8% year to date and will report on November 26, while Workday has seen a slight decline of 1.7% and is also set to report on November 26.

Sector Trends: Solar Industry Outlook

The solar industry is poised to recover as technology companies pivot towards clean energy sources amidst the transition from fossil fuels.

With projected trillions of dollars in clean energy investments, analysts expect that solar will dominate the renewable energy market growth, presenting significant profit opportunities in the immediate and long-term future. Investors should carefully select stocks to capitalize on this trend.

Find Zacks’ most promising solar stock recommendation FREE.

For the latest insights from Zacks Investment Research, you can download the report on 5 Stocks Set to Double for free.

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Kulicke and Soffa Industries, Inc. (KLIC) : Free Stock Analysis Report

To view the complete article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.