Intel Faces Competition as AMD’s Ryzen Processors Gain Traction

In a recent display of market competition, chip manufacturer Intel (INTC) finds itself at a disadvantage against rival Advanced Micro Devices (AMD). A report by Venture Beat highlights that in several scenarios, Intel processors are being outperformed by AMD’s latest offerings. Interestingly, this news did not significantly alter investor sentiment; Intel shares showed a slight increase during Thursday afternoon’s trading.

AMD’s New Ryzen Processors Set a Higher Standard

AMD recently introduced its new AI 300 series of Ryzen processors, which promise impressive performance enhancements for laptops. These processors can reportedly achieve speeds up to 75% faster than those of Intel’s competing models, specifically the Intel Core Ultra 7 258V.

While gaming laptops often face criticism for their noisy cooling fans and bulkiness, AMD’s new processors are designed to deliver significant gaming power in a lighter, more portable format. Features such as Fluid Motion Frames 2, FidelityFX Super Resolution (FSR), and Radeon Anti-Lag enhance the gaming experience significantly, putting AMD in a stronger position while posing challenges for Intel.

Intel’s Innovative Approach to AI

Despite challenges from competitors, Intel is developing a composable artificial intelligence (AI) platform that could provide a competitive edge. As interest in AI and open-source projects grows, Intel’s initiative named the “Open Platform for Enterprise AI” (OPEA) aims to simplify the development of generative AI applications.

According to a report from Silicon Angle, this “vendor-neutral” platform will include over 30 common microservices necessary for building AI applications, promoting a more streamlined environment for developers.

Intel’s Stock Performance: Insights and Outlook

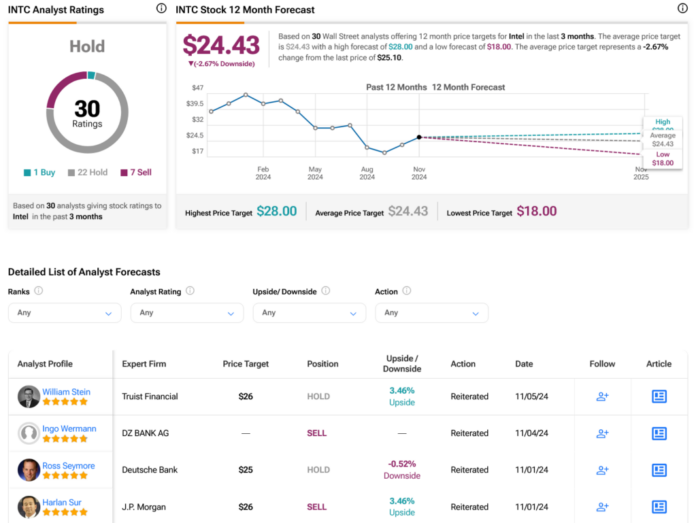

On Wall Street, analysts currently hold a consensus rating of Hold on Intel’s stock. This rating comprises one Buy, 22 Holds, and seven Sells over the past three months. Following a significant 37.28% decline in its share price over the last year, the average target price for INTC shares stands at $24.43, suggesting a potential downside risk of 2.67% from its current levels.

See more INTC analyst ratings

Disclosure

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.