NICE Soars Past Earnings Expectations, But Stock Still Struggles

NICE reported adjusted earnings of $2.88 per share for the third quarter of 2024. This figure not only surpassed the Zacks Consensus Estimate by 7.46% but also marked a 27% increase from the previous year.

Non-GAAP revenues totaled $690 million, exceeding forecasts by 1.07% and reflecting a 15% year-over-year rise. The growth was mainly fueled by the strength of its cloud business and expanding customer base.

In the Americas, revenues reached $587 million, marking a 17% increase from last year. In EMEA, revenues totaled $69 million, up 14% year over year. However, APAC saw a decline of 12% in revenues, totaling $34 million.

Despite these gains, NICE’s shares have dipped 8.6% year to date, while the Zacks Computer & Technology sector has risen by 29.3%. However, increased guidance could help NICE’s stock recover.

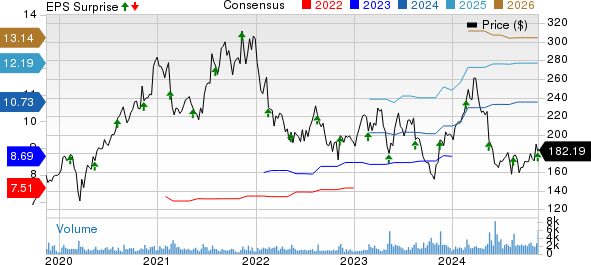

NICE Earnings and Price Performance Overview

NICE price-consensus-eps-surprise-chart | Nice Quote

NICE Revenue Insights

Cloud revenues, which comprised 72.5% of total revenues, amounted to $500 million. Although this fell short of the Zacks Consensus Estimate by 1.27%, it represented a 24% year-over-year increase.

The company has focused heavily on its cloud offerings, particularly the CXone platform, which has become a key driver of growth.

NICE also exceeded the $2 billion mark in Annual Recurring Revenue for its cloud business in the third quarter, demonstrating significant growth and scalability.

AI-powered customer service automation has increasingly influenced this growth. The introduction of AI capabilities, such as CXone Copilot and AutoSummary, has been particularly well-received.

In this quarter, CXone Copilot saw a six-fold increase in annual contract value, underscoring the demand for AI-enhanced customer service solutions.

Product revenues, which accounted for 5.8% of total revenues, hit $40 million, exceeding expectations by 45.51% and rising 5.8% year over year.

Service revenues contributed $150 million, beating the consensus by 0.80% but experiencing a decline of 6.5% compared to last year. Meanwhile, Customer Engagement revenues rose 15% year over year to $578 million.

Financial Crime & Compliance revenues increased by 8% year over year to $111 million, boosted by cloud revenues and strong contributions from on-premise products.

NICE Operational Highlights

On a non-GAAP basis, the gross margin decreased by 120 basis points (bps) to 71.1%. The product margin dropped by 130 bps to 84.8%. In contrast, the services margin fell 170 bps year over year to 71.9%.

The cloud margin contracted 70 bps year over year to 69.7%.

Research & development expenses, as a proportion of revenues, decreased by 80 bps to 13.3%. Sales & marketing expenses contracted 180 bps to 22.1%. General & administrative expenses rose by 40 bps to 10.8% year over year.

Overall, operating expenses, on a non-GAAP basis, shrank by 260 bps year over year to 39.1%. The operating margin expanded 140 bps to 32% year over year.

NICE Balance Sheet and Financial Position

As of September 30, NICE reported cash and cash equivalents (including short-term investments) of $1.52 billion, a slight rise from $1.50 billion at the end of June 2024.

Long-term debt stood at $458.4 million, compared to $457.9 million as of June 30, 2024.

The cash flow from operations in the third quarter was $159 million, slightly down from $169.7 million in the previous quarter.

NICE allocated $86.4 million for share repurchases during this quarter.

NICE’s FY24 Guidance Released

Looking ahead, NICE anticipates non-GAAP revenues for 2024 will fall between $2,715 million and $2,735 million, reflecting a projected 15% growth at the midpoint.

Estimated non-GAAP earnings are expected to be in the range of $10.95 to $11.5 per share, suggesting a growth of 26% at the midpoint.

NICE’s Zacks Rank & Other Stock Insights

NICE currently holds a Zacks Rank #3 (Hold).

Other well-ranked stocks in the broader Zacks Computer & Technology sector include Tuya (TUYA), NVIDIA (NVDA), and NetApp (NTAP). While Tuya and NVDA have a Zacks Rank #1 (Strong Buy), NTAP holds a Rank #2 (Buy) at this time.

Year to date, Tuya’s shares have declined 33.1%. TUYA is set to announce its third-quarter results on November 18.

NVIDIA has seen its shares soar by 196.3% this year and is scheduled to report its third-quarter fiscal 2025 results on November 20.

NetApp’s shares have increased by 33.9% year to date, with reports for second-quarter fiscal 2025 expected on November 21.

An Opportunity in Solar Stocks

The solar industry is poised for a rebound as technology companies and the economy shift from fossil fuels in order to support the AI surge.

With trillions of dollars expected to be invested in clean energy in the upcoming years, analysts project solar will make up 80% of renewable energy growth. This creates significant opportunities for investment, but selecting the right stocks is crucial.

Discover Zacks’ carefully selected solar stock recommendation for free.

For the latest recommendations from Zacks Investment Research, download “5 Stocks Set to Double” at no cost.

NetApp, Inc. (NTAP): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

NICE (NICE): Free Stock Analysis Report

Tuya Inc. Sponsored ADR (TUYA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.