Walmart’s Stock Shines Bright Amidst Disappointing Retail Trends

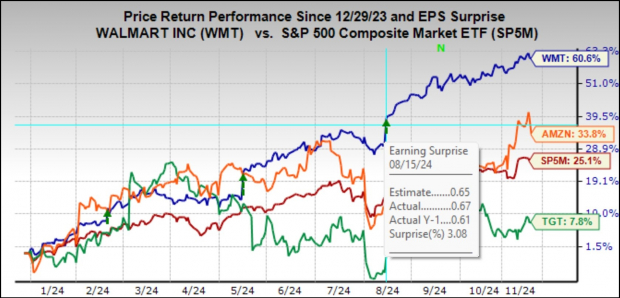

Walmart’s (WMT) shares have distinguished themselves this year, significantly outpacing not only broader market indexes but also competitors like Target (TGT), Amazon (AMZN), and other members of the Magnificent 7 group.

Examining Walmart’s Strong Performance

With Walmart set to announce its quarterly results on Tuesday, November 19th, investors are eager to see if the stock can sustain its positive momentum. Following a successful quarter showcased on August 15th, where it exceeded expectations, Walmart has continued on an upward trajectory.

The year-to-date performance of Walmart shares is strikingly positive, having surged by +60.6% compared to the S&P 500 index’s modest increase of +25.1%, Amazon’s +33.8%, and Target’s +7.8%.

Image Source: Zacks Investment Research

Upcoming Retail Reporting

This week will also see quarterly results from Target on Wednesday, November 20th, and Lowe’s (LOW) on November 19th. Lowe’s faces challenges similar to Home Depot, which has released positive quarterly results but operates in an industry hampered by ongoing high mortgage rates that have persisted despite the Fed’s easing efforts.

Demand for major home remodeling projects and other large purchases remains low, as existing home sales hit a 20-year low. Although home prices have risen, many homeowners are reluctant to give up their low-rate mortgages for new ones at higher rates.

Like Home Depot, which saw a sales boost from recent hurricanes in the Southeast, Lowe’s may experience similar gains. However, management cited weak demand for discretionary home goods due to current economic conditions.

A shift in consumer spending behaviors has emerged in the post-COVID landscape, with individuals favoring services like travel, dining, and entertainment over major purchases. This shift has especially hurt retailers like Target, which rely heavily on discretionary merchandise.

Walmart’s Strategic Position

In contrast, Walmart’s strong presence in groceries and essential items provides more stability during economic fluctuations. The retailer’s focus on value and its effective digital strategies have helped it gain market share among higher-income shoppers.

Despite reaching higher-income consumers, Walmart continues to cater to lower-income customers who face financial pressures due to inflation. The company has mitigated the impact of weaker spending from lower-income households by effectively attracting those with more disposable income.

What to Expect from Walmart’s Earnings

Walmart is anticipated to report earnings of $0.53 per share (EPS) on revenue of $167.6 billion, reflecting year-over-year increases of +3.9% and +4.2%, respectively. Recent trends indicate weak performance in Walmart’s non-grocery sectors. However, management previously noted early signs of stabilization in some discretionary categories during their last earnings call. If positive trends emerge in discretionary products, it could signal good news for Target as well.

Retail Sector Earnings Overview

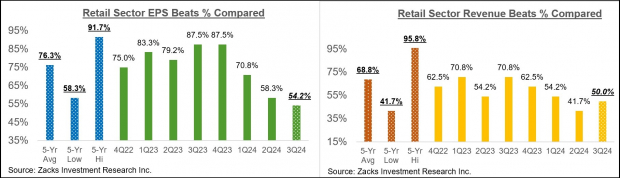

With 24 out of 34 retailers in the S&P 500 index having reported their Q3 results, it is crucial to understand the broader context. The Zacks Retail sector encompasses various companies, including traditional retailers and online vendors such as Amazon.

Among the 24 reporting retailers, earnings have risen by +14.9% year-over-year, alongside a +6.3% increase in revenues. Additionally, 54.2% surpassed EPS estimates while 50% exceeded revenue forecasts.

Image Source: Zacks Investment Research

The retail sector has shown a notable struggle with meeting estimates in Q3, particularly among online retailers and restaurants, tracking below a 20-quarter low in EPS beats.

Amazon, which reported a significant +71.6% increase in Q3 earnings on +11% higher revenues, contributes to the contrasting higher growth seen in others. Over time, the line separating digital and brick-and-mortar operators has blurred, with Walmart increasingly entering the online space and vice versa for Amazon.

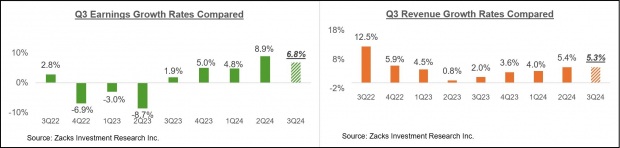

Progress on Earnings Growth

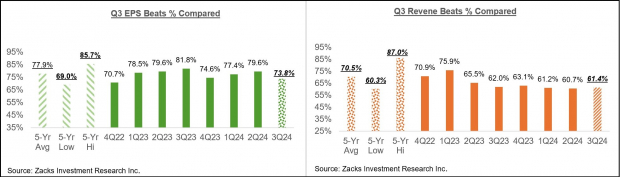

As of Friday, November 15th, a total of 461 S&P 500 members have reported Q3 results, constituting 92.2% of the index. Another 14 companies, including Nvidia and Deere & Company, are scheduled to release their results this week.

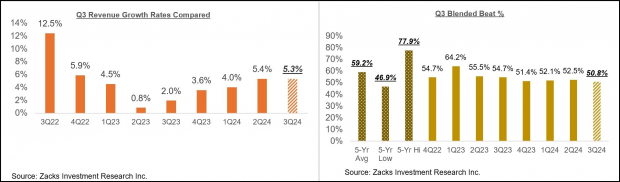

The earnings for these 461 companies collectively increased by +6.8% compared to last year, with revenues rising by +5.3%. Notably, 73.8% of these companies exceeded EPS expectations, while 61.4% surpassed revenue estimates.

Approximately 50.8% of the companies reported better than expected results in both EPS and revenue.

Q3 Earnings Show Mixed Results Amid Sector Variability

Insights into Q3 Earnings Performance

Recent charts showcase how Q3 earnings have performed historically, reflecting both challenges and successes across the market.

Image Source: Zacks Investment Research

Another set of charts highlights the percentage of companies in the S&P 500 that beat revenue expectations.

Image Source: Zacks Investment Research

Below, you can see data illustrating revenue performance and beat percentages among 461 index members.

Image Source: Zacks Investment Research

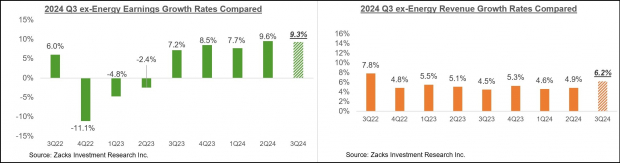

Weak growth in the Energy sector has impacted overall Q3 earnings growth. Without this decline, earnings across the remaining sectors would rise by +9.3%, compared to the +6.8% growth rate currently observed.

A further chart compares earnings and revenue growth rates, excluding the Energy sector, with results from recent periods.

Image Source: Zacks Investment Research

A Comprehensive Look at Earnings Trends

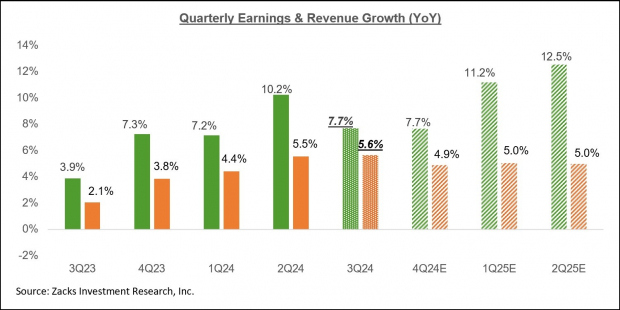

When evaluating Q3 earnings projections, the S&P 500 index is expected to report a +7.7% increase in total earnings from last year alongside a +5.6% rise in revenues.

Image Source: Zacks Investment Research

Shifts in sector performance highlight opposing influences on Q3 earnings growth. The Energy sector continues to weigh down results, while the Tech sector presents a strong counterbalance. In fact, without the Energy sector’s negative impact, overall earnings growth could be projected at +10.1% instead of +7.7%. Furthermore, if we disregard the substantial contributions from the Tech sector, the remaining S&P 500 members would only achieve a +2.9% growth rate.

Even more telling, excluding the top seven tech firms, earnings for the other 493 S&P 500 companies would only rise by +2.3% instead of +7.4%.

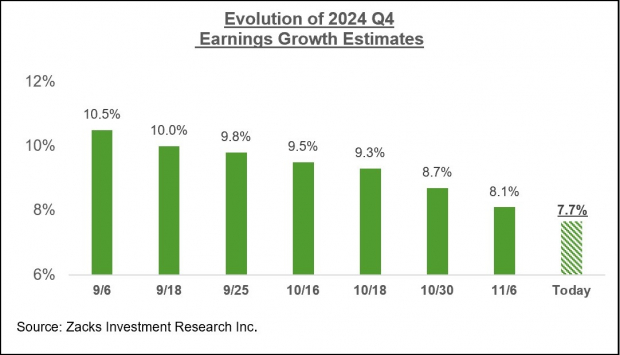

Looking forward to Q4 2024, projections indicate that total earnings for the S&P 500 are expected to rise by +7.7% compared to last year, with revenues also growing by +4.9%. Unlike the significant estimate reductions seen at the beginning of the Q3 earnings season, Q4 estimates remain relatively stable, as seen in the accompanying chart.

Image Source: Zacks Investment Research

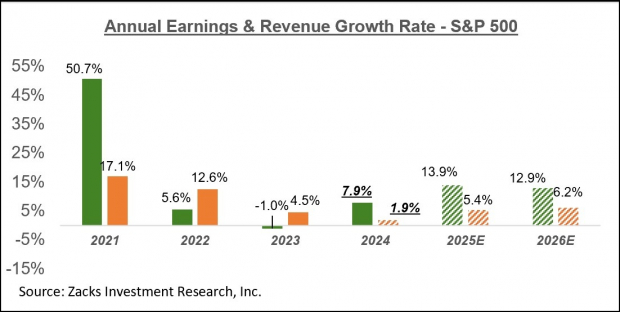

Furthermore, the broader earnings outlook suggests +7.9% growth this year, with expectations for double-digit growth well into 2025 and 2026.

Image Source: Zacks Investment Research

It’s important to note that this year’s projected earnings growth of +7.9% rises to +9.8% when excluding the collapses in the Energy sector.

Solar Stocks: A Growing Opportunity

As the tech industry and the economy shift away from fossil fuels, the solar sector is positioned for significant growth. With trillions being pumped into clean energy, analysts anticipate that solar will represent 80% of the renewable energy expansion in the coming years.

Venturing into this sector now could lead to lucrative investments, provided investors choose wisely among stocks. For those interested in identifying the top opportunities in solar energy, further insights can be found in our reports.

Learn about Zacks’ top solar stock picks.

Free Stock Analysis Report for Amazon.com, Inc. (AMZN)

Free Stock Analysis Report for Target Corporation (TGT)

Free Stock Analysis Report for Walmart Inc. (WMT)

Free Stock Analysis Report for Lowe’s Companies, Inc. (LOW)

Read further insights on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.