ExxonMobil: A Standout Dividend Stock in a Turbulent Market

The energy sector is known for its high-yield companies, often coupled with difficult payout histories. However, ExxonMobil (NYSE: XOM) shines as an exception.

The largest U.S.-based oil and gas company has just raised its dividend for the 42nd consecutive year to $0.99 per share each quarter. Investing $6,000 in Exxon stock could generate over $200 in annual passive income, potentially increasing further if the company continues to raise its dividend.

With shares less than 5% off its all-time high, here’s why Exxon stands out as a top dividend stock to consider.

Image source: Getty Images.

ExxonMobil’s Robust Performance

In its third-quarter 2024 results, Exxon delivered impressive earnings, achieving the highest liquids (oil and natural gas liquids) production in over 40 years. This increase was propelled by developments offshore from Guyana and the acquisition of Pioneer Natural Resources, which has expanded Exxon’s profitable Permian Basin operations. Year to date, the company has generated $18.89 billion in earnings and $26.35 billion in free cash flow (FCF), with an average production of 4.23 million barrels of oil equivalent per day. For comparison, the first three quarters of 2023 saw earnings of $17.16 billion, FCF of $28.13 billion, and 3.71 million boe/d.

The acquisition of Pioneer is helping to counteract lower oil and gas prices. Additionally, Exxon has focused on cutting costs and emphasizing quality over quantity in its investments. Notably, over half of its production now stems from “advantaged assets,” such as the high-margin areas offshore Guyana and the Permian Basin. Since 2019, it has achieved $11.3 billion in structural cost savings, including $600 million in the most recent quarter and $1.6 billion year-to-date. Exxon’s third-quarter report also indicated it is on track for cumulative savings of $15 billion through the end of 2027.

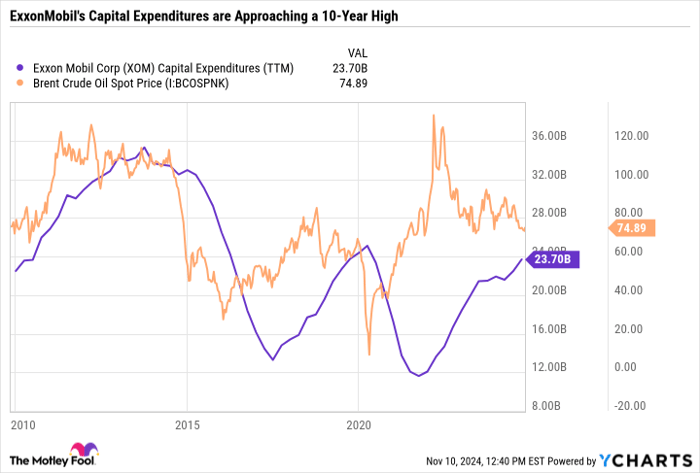

Exxon is aligning with its December 2023 corporate plan. The company set several short- and medium-term targets, including $15 billion in cost savings through 2027 and $23 to $25 billion in 2024 capital expenditures (capex). Importantly, over 90% of its planned upstream capital investments for the next five years are expected to yield returns of 10% or more, even with Brent crude prices at $35 per barrel. As of now, Brent prices are around $75.

The following chart illustrates ExxonMobil’s capex alongside the spot price of Brent Crude Oil:

XOM Capital Expenditures (TTM) data by YCharts

Historically, Exxon’s capex has tended to peak before declines in oil prices, later ramping back up with price surges. However, the company’s current production portfolio is more efficient and higher quality than in the past, enhancing its capital discipline.

Solid Financial Standing

At the end of the quarter, Exxon had $26.93 billion in cash and equivalents against $36.92 billion in long-term debt, totaling $42.6 billion in debt and resulting in a net debt of just $15.67 billion. Its net-debt-to-capital ratio stands at a mere 5%, demonstrating financial stability without heavy reliance on debt.

The company’s prudent capital management and strong asset base set the stage for significant returns to shareholders. Exxon is poised for a remarkable $19 billion in buybacks this year, alongside approximately $16.5 billion in dividends, contributing to a total capital return program of $35.5 billion. With a yield of 3.3%, Exxon offers significantly more passive income compared to the S&P 500, which yields about 1.3%.

Balanced Investment Opportunity

Even in uncertain oil price environments, Exxon generates enough free cash flow to invest in various avenues, including oil, gas, and low-carbon initiatives like carbon capture and storage. The planned $19 billion in buybacks for 2024 signals that Exxon has surplus capital beyond what is needed for its operations and growth. Should oil prices drop substantially, the company can halt buybacks without impacting its dividend history or ongoing business plans, a testament to its diversified model and structural cost efficiencies.

In summary, ExxonMobil is performing well and has set tangible goals for accountability. Investors may want to follow the upcoming virtual event on December 11, where the company will update its corporate plans and targets.

Should You Invest $1,000 in ExxonMobil Today?

Before making a decision to invest in ExxonMobil, it’s essential to consider the following:

The Motley Fool Stock Advisor analyst team recently identified the 10 best stocks for investors to consider now, and ExxonMobil wasn’t included. These selected stocks could offer high returns in the coming years.

Reflecting on when Nvidia was recommended on April 15, 2005… a $1,000 investment then would be worth approximately $899,361 today!

Stock Advisor provides a straightforward guide for investors, complete with portfolio-building advice, updates from analysts, and two new stock picks each month. Since its inception, the Stock Advisor service has outperformed the S&P 500 significantly.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.