Surging Growth Stocks: A Look into Rocket Lab and Nu Holdings

The stock market is currently favoring companies with strong growth potential. Momentum trading is thriving, with many growth stocks soaring over 100% this year.

This surge can be traced back to the artificial intelligence (AI) boom, which has significantly boosted returns for tech firms. Recent factors contributing to this bullish trend include the United States presidential election and the Federal Reserve’s decision to lower its benchmark interest rate.

Two standout growth stocks attracting investors are Nu Holdings (NYSE: NU) and Rocket Lab (NASDAQ: RKLB). Rocket Lab has impressively increased by 173% year-to-date (YTD), while Nu Holdings has risen by 91%.

Should you consider adding these stocks to your portfolio? Let’s explore further.

Rocket Lab: A Leader in Commercial Space Launches

As its name suggests, Rocket Lab is a company dedicated to rocket launches. Although it is smaller than SpaceX, which boasts a valuation exceeding $200 billion, Rocket Lab is establishing itself as a significant player in the space industry. It provides commercial rocket launches, which is a crucial service in today’s expanding space economy.

In addition to launching rockets, Rocket Lab is investing in space systems hardware such as capsules, energy sources, and materials. This strategy aims to enhance its customer offerings and develop software services and analytics in the future.

Rocket Lab’s revenue growth is remarkable. Last quarter, it reported a 71% increase in revenue year-over-year, totaling $106 million. Over the past three years, overall revenue has surged by 425%, making it one of the fastest-growing firms globally. Recently, the company completed its 54th mission using its Electron rocket and intends to increase its launch frequencies going forward.

As of the last quarter, Rocket Lab’s backlog has grown to $1 billion, driven by strong demand from both commercial and government sectors for launch services. However, considering its nearly 200% stock price increase this year, potential investors should be cautious. The stock carries a price-to-sales ratio (P/S) of 22, indicating that it is trading high relative to its earnings. Additionally, Rocket Lab operates with low gross margins of just 25%.

Thus, it may not be wise to ride the momentum and invest in Rocket Lab stock right now. Although the company is experiencing rapid growth, market expectations exceed what is likely attainable in the short term.

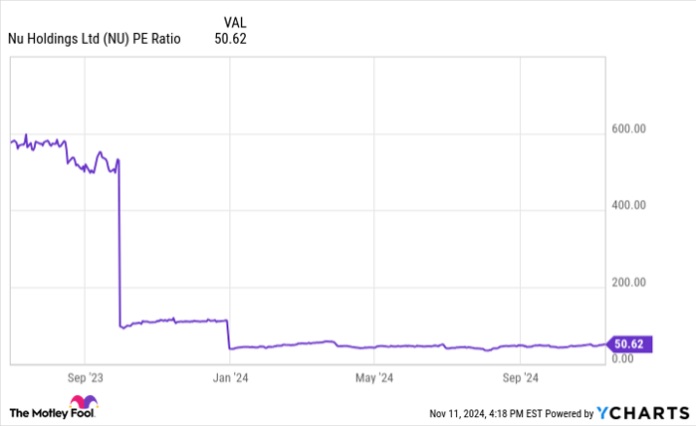

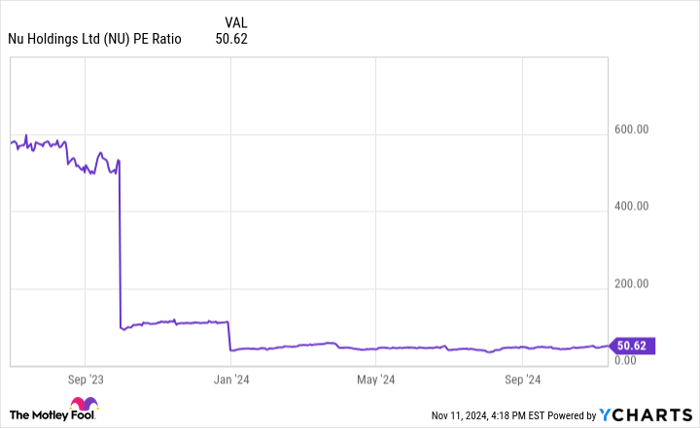

NU PE Ratio data by YCharts

Nu Holdings: Ruling Digital Banking in Latin America

The second remarkable growth stock is Nu Holdings, which operates Nu Bank. This digital bank is the dominant player in Brazil and is expanding into Mexico and Colombia. These countries, with large populations and outdated traditional banking systems, have welcomed Nu Bank’s innovative mobile app, attracting over 105 million customers across these markets. This achievement positions it as the largest digital bank outside of Asia based on customer count.

Last quarter, Nu Bank’s gross profit surged by 85% year-over-year on a foreign currency-neutral basis, reaching $1.4 billion. Unlike Rocket Lab, Nu Bank is profitable, reporting $487 million in generally accepted accounting principles (GAAP) net income last quarter. Its average revenue per customer continues to increase, fueled by an expanding credit card and lending operation; customer deposits have risen by 64% year-over-year, a key factor for any consumer banking business.

While Nu Bank is reaching maturity in Brazil, which could lead to slower growth there, opportunities remain abundant in Mexico and Colombia, where it has fewer than 10 million customers. Competitively, there are more markets to explore within Latin America.

Regarding stock valuation, Nu Bank has a trailing price-to-earnings ratio (P/E) of 50. This P/E provides insight into how profits correspond to stock price, differing from the P/S ratio. While this ratio is higher than the S&P 500 average of 30, Nu Holdings offers a more favorable investment prospect compared to Rocket Lab. It is growing rapidly, profitable, and has the capability to reinvest in its customer acquisition strategy throughout Latin America. For investors seeking high-growth stocks, Nu Holdings is worth considering.

Your Second Chance at a Potentially Profitable Investment

Do you ever feel like you missed out on purchasing top-performing stocks? Here’s an opportunity for you.

Our expert analysts occasionally identify a “Double Down” stock recommendation for companies they believe are on the cusp of a significant rise. If you’ve been hesitant, now might be the perfect moment to invest before the chance slips away. The performance speaks for itself:

- Amazon: A $1,000 investment in 2010 would be worth $23,818!*

- Apple: A $1,000 investment in 2008 would have grown to $43,221!*

- Netflix: A $1,000 investment in 2004 would have ballooned to $451,527!*

Currently, we’re issuing “Double Down” alerts for three promising companies, so don’t miss out on this opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Nu Holdings and Rocket Lab USA. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.