Ackman Bets Big on Fannie Mae and Freddie Mac After Trump’s Election Win

Many investors adjusted their portfolios based on predictions surrounding the U.S. presidential election. Notably, billionaire Bill Ackman and his firm, Pershing Square Capital Management, took significant positions in two stocks that they believed would thrive if former President Donald Trump won.

As it turns out, the general market surged following Trump’s victory. The stocks that Ackman focused on have outperformed many others, particularly those traded on over-the-counter exchanges. It appears that Ackman may once again be in a prime position to profit from his political bets. Let’s delve deeper into the specifics.

Big Wins for Fannie Mae and Freddie Mac

For the last 15 years, a select group of shareholders has been banking on the Federal National Mortgage Association (OTC: FNMA), also known as Fannie Mae, and the Federal Home Loan Mortgage Corporation (OTC: FMCC), commonly referred to as Freddie Mac, successfully emerging from government conservatorship through a recapitalization strategy. Both entities play crucial roles in the mortgage market by securitizing mortgages and marketing them to investors. This process helps banks and other lenders manage their mortgage portfolios effectively.

The government placed Fannie and Freddie into conservatorship amid the Great Recession, injecting approximately $190 billion into the organizations as they navigated the fallout of the subprime mortgage crisis. From 2012 to 2019, these government-sponsored enterprises (GSEs) have delivered around $292 billion in profits to the U.S. Treasury, which also maintains about $200 billion in senior preferred stock and warrants equating to 79.9% of total shares, set to expire in September 2028.

In 2019, an amendment to the Treasury’s agreement with Fannie and Freddie permitted them to start building capital. Simultaneously, the Federal Housing Finance Agency (FHFA) created regulatory capital requirements that the GSEs must meet to exit conservatorship. These moves hinted at a possible exit strategy, which could lead to a substantial capital raise.

During Trump’s initial term, he clearly expressed his desire to extricate the GSEs from conservatorship. Investors speculated that a victory for Trump would reignite these efforts as he ran for re-election.

Ackman, a well-known Trump supporter, and Pershing have contended for over a decade that both companies could benefit from greater independence. In Pershing’s 2023 annual report, they suggested that a Trump win could significantly affect the future of these GSEs:

The U.S. Presidential election in November 2024 may present the opportunity for a change in the status quo. Both companies’ stock price increases in 2023 and year to date reflect optimism around a potential reprivatization in the event former President Trump is reelected. The Trump administration had begun the process of releasing Fannie and Freddie from conservatorship, a process which would likely be completed in a future Trump administration.

The U.S. government would also stand to benefit financially from the GSEs’ exit from conservatorship, given their holdings of senior preferred stock and warrants, which could finance housing initiatives.

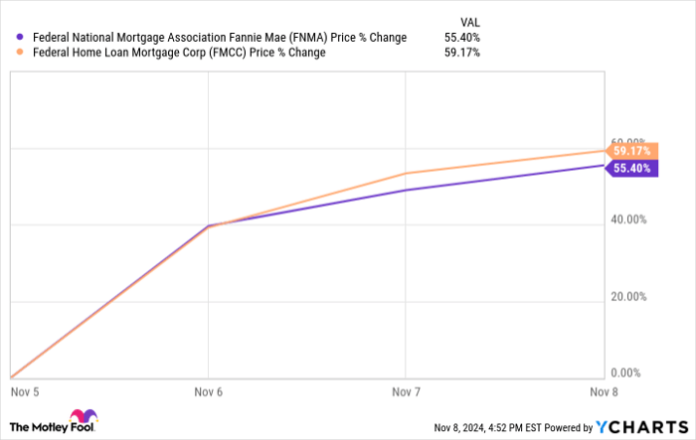

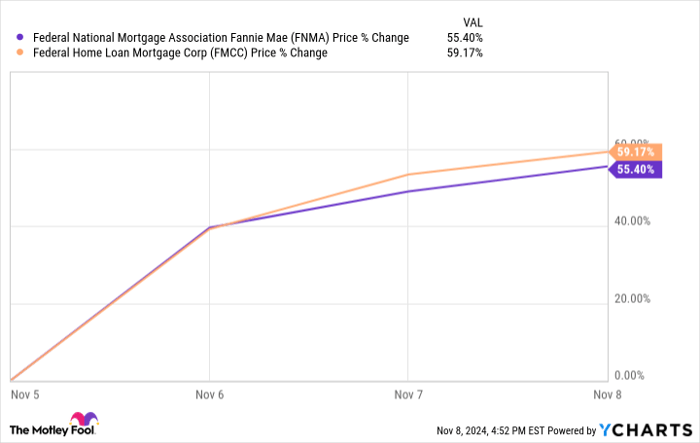

Following Trump’s victory, the shares of Fannie Mae and Freddie Mac surged, with junior preferred shares increasing nearly 88% since the election (prior to market opening on November 11).

FNMA data by YCharts

Ackman’s Investment Position

Back in 2013, Pershing acquired nearly a 10% stake in both Fannie and Freddie. Filings indicate that Ackman and his team purchased over 115 million shares of Fannie at an average price of $2.29 each and approximately 63.5 million shares of Freddie at an average price of $2.14.

After 2014, they no longer filed ownership stakes based on their belief that the common shares did not represent voting shares, leaving their subsequent positions unclear. The companies’ 2024 reports have indicated additional exposure via notional shares and swap transactions, likely related to hedges or exposure strategies rather than direct share ownership.

If we assume Ackman and Pershing maintain the same common shares as in 2014, their investments would reflect losses, despite the recent price surge. Estimated losses show about 5.7% on the Fannie Mae investment and nearly 11% on Freddie Mac, prior to November 11’s market opening.

However, this positions Ackman and Pershing advantageously to benefit from a Trump-led administration, especially as Fannie and Freddie push to meet their capital requirements swiftly. While a capital raise could expedite these efforts, it muddies the waters regarding existing Treasury claims on senior preferred stock and outstanding warrants. Understanding these dynamics will be critical for potential investors, as they could face significant dilution risks from the redemption of these senior shares.

Despite the complexities, if recapitalization proceeds without detrimental effects on common shares, both stocks could trade at multiples higher than their current prices. Investors might also consider junior preferred shares, which have outperformed since Trump’s election yet still trade at less than half their par value. Though the risks remain, Ackman stands to gain considerably if the situation unfolds favorably.

Should You Invest $1,000 in Federal National Mortgage Association Right Now?

Before purchasing stock in Federal National Mortgage Association, you should think carefully:

The Motley Fool Stock Advisor analyst team identified the 10 best stocks for investment right now, and Federal National Mortgage Association did not make the list. The stocks selected for this list could yield significant returns in the years ahead.

For instance, when Nvidia was featured on April 15, 2005, if you invested $1,000 at that time, it would now be worth $899,361!*

Stock Advisor delivers a streamlined approach to investing, providing insights on portfolio building, regular updates, and two fresh stock picks per month. The Stock Advisor service has outperformed the S&P 500 by more than four times since its inception in 2002.*

Discover the 10 stocks »

*Stock Advisor returns as of November 11, 2024

Bram Berkowitz has positions in Federal National Mortgage Association. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.