Home Depot and Disney Exceed Earnings Expectations Amid Market Stabilization

Two major players, Home Depot HD and Disney DIS, reported their quarterly earnings this week, both of which outperformed expectations. This achievement stands out as the broader market pauses after a recent rally linked to the presidential election.

The strong earnings reports prompt questions about whether now is the right time to invest in these iconic American companies.

Home Depot’s Q3 Financial Highlights

Benefiting from storm-related home renovations, Home Depot announced Q3 sales of $40.21 billion, a 6% increase from $37.71 billion in Q3 2022, and surpassing predictions of $39.36 billion. Impressively, Home Depot has exceeded sales expectations in three of its last four quarterly reports, achieving an average surprise of 0.9%.

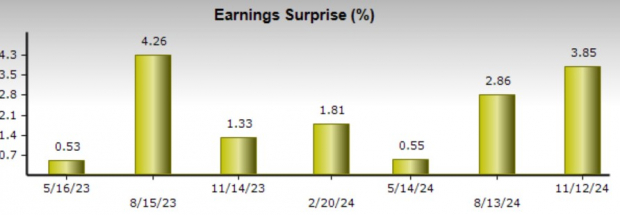

On the earnings side, the Q3 EPS was $3.78, slightly down from $3.81 previously, yet it exceeded the Zacks Consensus estimate of $3.64 by nearly 4%. As the leading home improvement retailer globally, Home Depot has consistently beaten earnings expectations for 19 consecutive quarters since August 2020, with an average surprise of 2.27% over the last year.

Image Source: Zacks Investment Research

Disney’s Q4 Financial Performance

Disney reported a 6% increase in sales for its fiscal fourth quarter, reaching $22.57 billion, compared to $21.24 billion the previous year. While the Q4 sales fell slightly short of estimates of $22.59 billion, Disney’s Q4 EPS of $1.14 exceeded expectations of $1.09.

Notably, earnings surged 39% from $0.82 per share in the prior year, largely due to cost-cutting measures, especially in its streaming division. Disney+ reached 123 million subscribers, exceeding Zacks expectations of 120 million, although this figure is down from 150 million a year earlier. Including ESPN+ and Hulu, total streaming users hit 200.6 million, securing Disney’s second place behind Netflix NFLX in total subscribers.

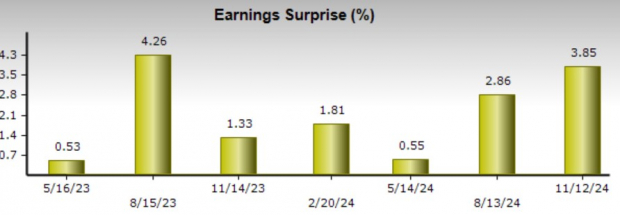

Disney has consistently outperformed earnings expectations for eight successive quarters, with an average EPS surprise of 13.56% over the last year.

Image Source: Zacks Investment Research

Stock Performance Comparison for DIS & HD

Market Performance

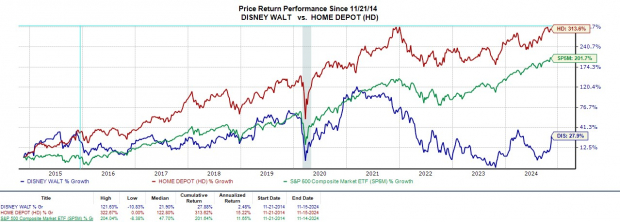

Following their earnings reports, Disney’s stock rose 27% this year, just ahead of the S&P 500 at 25%, and Home Depot’s gain of 17%. Historically, Home Depot shares have been the more rewarding investment, with a gain of over 300% in the last decade, surpassing the S&P 500’s 200% rise and Disney’s more modest 28% increase during that time.

Image Source: Zacks Investment Research

Valuation Insights

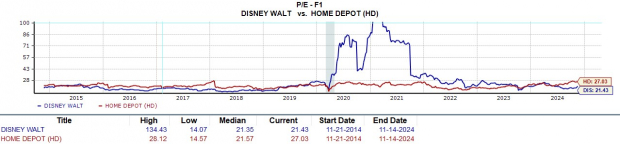

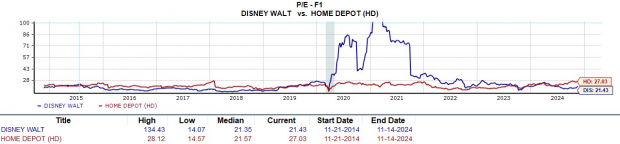

While Home Depot continues to show superior stock performance, Disney stands out in terms of valuation. Disney shares are currently trading at 21.4X forward earnings, a discount compared to the benchmark’s 25.2X and Home Depot’s 27X.

Additionally, Disney’s multiple is well below its peak of 134.4X and aligns with its decade median of 21.3X. Meanwhile, Home Depot trades slightly below its peak of 28.1X but above its median of 21.5X. Both companies exhibit strong sales multiples, each remaining under 2X sales.

Image Source: Zacks Investment Research

Dividend Policies for DIS & HD

After a three-year pause, Disney reinstated its dividend at the end of 2023, currently offering a yield of 0.82%. In contrast, Home Depot has maintained its dividend since 1987, boasting a payout of 2.22%, exceeding the S&P 500’s average of 1.2%.

Image Source: Zacks Investment Research

Conclusion

Both Disney and Home Depot continue to exceed earnings expectations, earning a Zacks Rank #3 (Hold) each. Future performance will largely depend on earnings estimate revisions in the coming weeks. Home Depot has demonstrated a strong track record of rewarding investors, while Disney’s return to growth is becoming increasingly persuasive.

Must-See:

Solar Stocks: A Bright Future Ahead

The solar sector is set for a significant rebound as technology companies and the broader economy shift away from fossil fuels to support the growing demand for artificial intelligence.

Over the next several years, clean energy investments are expected to reach trillions of dollars, with analysts forecasting that solar energy will represent 80% of the renewable energy growth. This presents a unique opportunity to tap into profitability in both the short and long term. However, selecting the right stocks is crucial.

Unlock Zacks’ top solar stock recommendation for free.

The Home Depot, Inc. (HD): Get a free stock analysis report here.

The Walt Disney Company (DIS): Access your free stock analysis report.

Netflix, Inc. (NFLX): Click here for your free stock analysis report.

Visit Zacks Investment Research for more insights.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.