Stocks Surge Amid AI Boom: What Investors Should Know

The S&P 500 has declared a bull market in January, with the index set for a second consecutive year of double-digit gains. Thus far in 2023, it has climbed 25%, following a 24% rise last year. This upward trajectory is being spearheaded by growth stocks, particularly those leveraging artificial intelligence (AI). Investors are flocking to these companies due to AI’s revolutionary potential, improving everything from household organization to corporate efficiency.

Notable stocks taking the lead in this AI race include Nvidia, (NASDAQ: NVDA), the leading AI chip designer, and Palantir Technologies, a software firm focused on AI, with their stock prices soaring about 200% and 250%, respectively. Additionally, tech powerhouses Amazon and Meta Platforms are also set to enjoy double-digit gains through their heavy AI investments.

This momentum has pushed a particular measure of stock valuations into rare territory. Let’s examine the implications and potential future scenarios.

Image source: Getty Images.

Understanding the S&P 500 Shiller CAPE Ratio

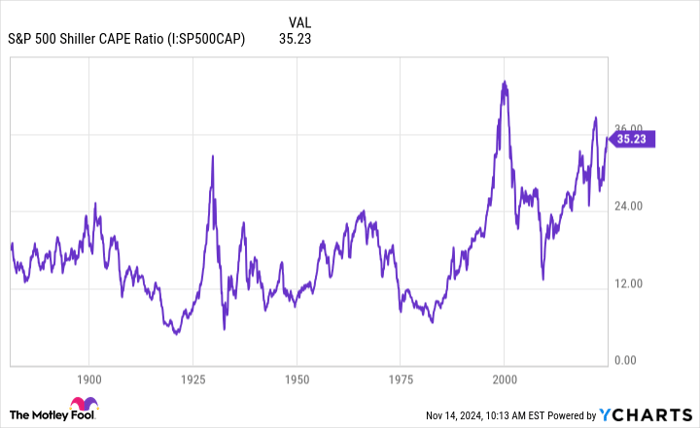

The focus here is the S&P 500 Shiller CAPE ratio. This tool, similar to the price-to-earnings (P/E) ratio, compares a company’s earnings to its price. However, it differs by adjusting for inflation and averaging earnings over a decade, providing a clearer snapshot of a stock’s value.

Currently, this ratio has surpassed 35, a threshold it has only crossed two other times since the S&P 500 was established as we know it in the late 1950s—once after the coronavirus crash and again in 2000 just before the dot-com bubble burst.

S&P 500 Shiller CAPE Ratio data by YCharts.

This indicates that the overall market is appearing expensive, reaching one of the highest valuation levels since the S&P 500 was formed. Historically, peaks in the Shiller CAPE ratio have often preceded declines in the S&P 500, leading to speculation about a similar occurrence in the near future.

However, it’s important not to panic over potential downturns. Timing such declines is unpredictable. Factors like ongoing excitement surrounding AI growth or recent economic optimism, particularly following an interest rate cut, might continue to bolster market momentum. Selling stocks in fear of a decline could result in missing out on significant upward moves.

Strong Stocks Can Endure Market Downtimes

A broader market decline does not automatically mean that every stock will suffer. Some investments might withstand or even thrive when the market dips. Not all positions will be adversely impacted, leading to better-than-expected portfolio performance during tough times.

Moreover, just because the overall market appears expensive doesn’t make every individual stock overpriced. Despite the high Shiller CAPE ratio, some stocks offer good value. For instance, tech leader Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is trading at only 22 times forward earnings estimates, suggesting it is undervalued compared to its historical performance and growth prospects.

Ultimately, a successful investment strategy focuses on long-term performance rather than short-term fluctuations. While markets will cycle through phases, investing in quality companies at reasonable prices and maintaining those investments over time can help mitigate fears of market declines. Generally, bull markets last longer than bear markets, giving quality stocks ample opportunity to perform well if held patiently.

Seize This Second Opportunity for Lucrative Investments

Do you sometimes feel you missed out on great buying opportunities with top-performing stocks? Here’s your chance.

Rarely, our team of analysts recommends a “Double Down” stock, indicating a company poised for growth. If you’re concerned you’ve missed the boat, now might be the perfect time to invest before it’s too late. The potential returns are compelling:

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $23,818!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $43,221!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $451,527!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and this opportunity might not come again anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.