“`html

Nvidia: Facing Challenges Ahead in the AI Race

Artificial intelligence (AI) has taken Wall Street by storm over the past two years. With AI-driven software and systems growing increasingly capable of performing tasks independently and learning new skills, this technology holds impressive long-term promise.

In Sizing the Prize, PwC analysts predict that AI will boost global GDP by 26% ($15.7 trillion) by 2030. Such a significant increase indicates that businesses across the AI spectrum stand to gain immensely.

Image source: Getty Images.

No company has benefitted more from the AI surge than semiconductor giant Nvidia (NASDAQ: NVDA). In less than two years, Nvidia has transformed from a $360 billion company to the most valuable publicly traded firm on Wall Street, with a market capitalization of $3.64 trillion.

As Nvidia plays a fundamental role in the AI race, investors are keenly awaiting the company’s operating results for the quarter ending October 27, set to be announced on November 20.

Despite high expectations for Nvidia, there are several reasons why its stock may face challenges following the upcoming report.

Understanding Nvidia’s Recent Growth

To grasp why Nvidia’s market value has surged by $3.3 trillion in under two years, it is essential to examine the company’s foundations.

Nvidia’s growth is largely driven by its hardware sales. Orders for the H100 graphics processing unit (GPU), often termed “Hopper,” as well as the successor Blackwell GPU architecture, are currently backlogged. Businesses are eager to capture early advantages, and Nvidia’s AI-GPUs provide unmatched computing power.

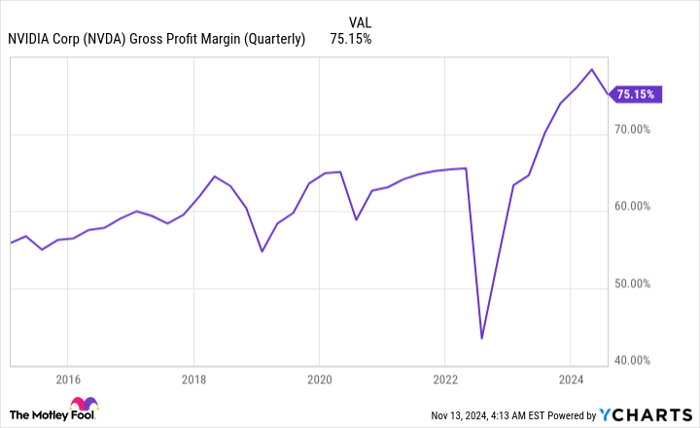

In tandem with increasing demand, Nvidia enjoys significant pricing power. While competing AI-GPUs typically range from $10,000 to $15,000, the Hopper commands prices between $30,000 and $40,000 per chip. This willingness to pay a premium for Nvidia’s products has driven its gross margin up to as high as 78%.

Additionally, the CUDA software platform has been vital in bolstering sales. CUDA provides developers the tools to create large language models and optimize GPU performance, effectively keeping Nvidia’s clients within its product ecosystem.

Given its potential revenue growth—from $27 billion in fiscal 2023 to an estimated $180 billion by fiscal 2026—it’s no surprise that investors are excited.

However, several factors suggest Nvidia may see its stock encounter turbulence soon.

Image source: Getty Images.

The Challenges Ahead for Nvidia

Nvidia is expected to exceed revenue and profit expectations in its fiscal Q3 results. Though the company has consistently outperformed earnings-per-share (EPS) estimates over the past seven quarters, simply beating forecasts may not suffice to maintain investor optimism.

First, Nvidia faces heightened competition. After dominating approximately 98% of GPU shipments to data centers during 2022 and 2023, Nvidia is likely to lose some market share to Advanced Micro Devices in 2024. AMD is ramping up production of its MI300X AI-GPU and has recently unveiled the MI325X, which is expected to enter production soon. Given Nvidia’s backlog and companies’ eagerness for first-mover advantages, some may opt for AMD’s AI hardware.

Moreover, internal competition could pose a more significant threat. Key customers such as Microsoft, Meta Platforms, Amazon, and Alphabet are developing their own AI chips for their data centers. These internally produced chips might be more attractive than Nvidia’s options due to cost-effectiveness and accessibility.

Nvidia’s gross margin expansion will likely prove unsustainable as GPU scarcity diminishes. NVDA Gross Profit Margin (Quarterly) data by YCharts.

Thirdly, Nvidia is still grappling with supply chain limitations. Its partner, Taiwan Semiconductor Manufacturing, is working to increase monthly production capacity to 80,000 wafers—crucial for packaging high-bandwidth memory in AI-enabled data centers. Relying on suppliers means Nvidia is unable to fulfill all orders, risking losses to both external and internal competitors.

Fourth, regulatory challenges impact Nvidia’s future. In 2022, U.S. officials restricted Nvidia’s ability to export its AI-GPUs to China, currently the second-largest economy. Furthermore, Nvidia’s modified AI chips, the A800 and H800, designed for China, also fell under export restrictions after being added to the prohibited list. With rising trade tensions, Nvidia’s prospects for revenue from AI hardware exports to China are diminishing.

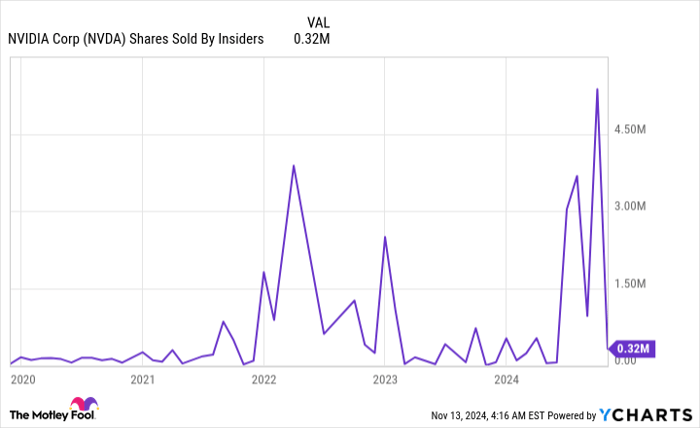

Insider selling has picked up in 2024. NVDA Shares Sold By Insiders data by YCharts.

Lastly, increased insider trading activity adds another layer of concern. Not a single executive or director has purchased Nvidia shares in the last 47 months. Although there can be various reasons for selling stock, the absence of buying activity may signal potential troubles ahead.

“`

Nvidia Faces Challenges Ahead of November 20

Investing in a company typically hinges on the belief that its stock will rise. However, the recent decisions made by Nvidia’s leadership indicate that they may not see their own stock as a good investment at this time.

Historical Patterns Suggest Caution

One significant concern surrounding Nvidia stock is rooted in history. For the past thirty years, investors have frequently overestimated how quickly new technologies gain traction. This pattern results in high growth expectations that often fall short over time.

Even with strong demand for Nvidia’s Hopper and Blackwell technologies, customers still lack clear strategies to profit from their AI investments. Simply put, while businesses are purchasing Nvidia products, they haven’t defined how to use them effectively. Historically, all new technologies require time to develop fully, and artificial intelligence will likely follow the same trend. Thus, I believe Nvidia’s stock may encounter difficulties as November 20 approaches.

A Second Chance to Invest Wisely

Do you ever feel like you missed the opportunity to invest in top stocks? It’s important you pay attention now.

Our team of expert analysts occasionally issues a strong recommendation called a “Double Down” stock for companies they believe are on the verge of significant growth. If you think you’ve lost your chance to invest, now may be the perfect moment to consider these opportunities. The performance history is compelling:

- Amazon: If you had invested $1,000 when we recommended it in 2010, you would have about $23,818 today!*

- Apple: An investment of $1,000 in 2008 would now be worth $43,221!*

- Netflix: Investing $1,000 back in 2004 would yield around $451,527 today!*

Currently, we are offering “Double Down” alerts for three remarkable companies, and such an opportunity may not come around again soon.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, which is owned by Amazon, is part of The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, is also on the board. Randi Zuckerberg, former director of market development at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is on the board as well. Sean Williams holds positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool recommends a number of stocks including Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The recommended options involve long calls on Microsoft. The Motley Fool upholds a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.