Understanding the Bull Market: S&P 500 and AI Stock Surge

In January, the S&P 500 confirmed its entry into a bull market, poised for a second year of strong performance with an impressive 25% increase this year following a 24% rise in 2023. Growth stocks, particularly in the booming field of artificial intelligence (AI), have been at the forefront of this surge. Investors are enthusiastic about AI’s capacity to reshape both personal lives and business efficiencies.

Leading Stocks in the AI Boom

Many of these standout companies have prioritized AI and enjoyed significant gains recently. Nvidia, the leading designer of AI chips, and Palantir Technologies, a software firm employing AI, have skyrocketed approximately 200% and 250%, respectively, this year. Major players like Amazon and Meta Platforms, which are also heavily investing in AI, are showing robust double-digit growth.

This surge in market activity has led to a key stock measure reaching a significant milestone, achieved only three times since the S&P 500 was established as a 500-company index in the late 1950s. Let’s delve into the details and what it might mean for the future.

Image source: Getty Images.

Breaking Down the S&P 500 Shiller CAPE Ratio

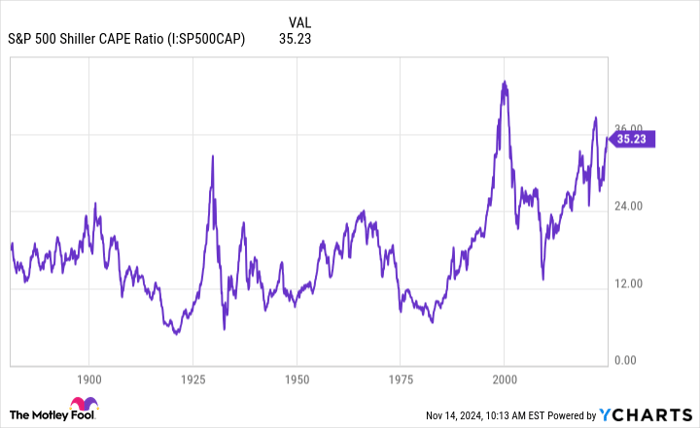

The key metric to consider is the S&P 500 Shiller CAPE ratio. Similar to the traditional price-to-earnings ratio, it provides insight into a company’s earnings relative to its price. However, the Shiller CAPE ratio accounts for inflation and considers a company’s earnings over the last ten years, offering a potentially clearer understanding of stock value.

Currently, the Shiller CAPE ratio has surpassed 35 for only the third time since the late 1950s. The previous instances occurred during market rallies following the coronavirus crash and in 2000, just before the dot-com bubble burst.

S&P 500 Shiller CAPE Ratio data by YCharts.

This indicates that the market, as a whole, appears expensive, reaching one of its highest valuation levels since the S&P 500’s current format began. History suggests that peaks in the Shiller CAPE ratio have been followed by declines in the S&P 500, hinting at a possible pullback ahead.

Despite these concerns, it’s essential to remember that predicting market downturns is incredibly challenging. Factors such as ongoing excitement about AI growth or a positive economic outlook, particularly after a recent interest rate cut, might sustain this upward trend. Selling stocks out of fear could mean missing out on potential gains.

Resilience of Strong Stocks in Tough Times

It’s also crucial to note that a general stock market decline doesn’t necessarily mean all stocks will decline. Some may perform well or even thrive during market downturns. Not every stock in your portfolio is equally vulnerable to market shifts, and certain holdings could exceed expectations.

Additionally, while the overall market may seem costly, some individual stocks remain undervalued. For instance, tech leader Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) trades at just 22 times its projected earnings, an attractive valuation considering its past performance and bright future prospects.

Lastly, when it comes to investing, it’s vital to prioritize long-term success over short-term fluctuations in stock prices. Markets experience cycles of rising and falling stocks. Historical trends indicate that well-chosen quality stocks typically outlast bear market phases, rewarding long-term investors.

Considering an Investment in Nvidia

If you’re thinking about investing in Nvidia, pause to consider this:

The Motley Fool Stock Advisor analyst team recently identified what they consider the 10 best stocks for today’s investors, and Nvidia was not included. The stocks that did make the list are projected to deliver significant returns in the years to come.

Reflect on Nvidia’s past; if you had invested $1,000 when it first appeared on the Stock Advisor list on April 15, 2005, it would be worth an astonishing $899,361 today!*

Stock Advisor offers a simplified roadmap for investors, consisting of portfolio-building guidance and regular analyst updates, providing two new stock picks every month. Over its lifetime, the Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

Explore the 10 recommended stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.