Positioning Your Portfolio for 2025: Opportunities with Alphabet and PayPal

As 2025 draws near, it’s essential for investors to consider their portfolio strategies for the upcoming year. Many fund managers often adjust their holdings before the new year, which can trigger a “Santa Claus rally.” This phenomenon frequently leads to increased stock prices in December, making it crucial for individual investors to strategize their next moves now.

1. Alphabet: A Steady Bet in a Changing Market

Alphabet, the parent company of Google, maintains a significant presence in the search engine industry. Earlier this year, some analysts raised concerns that Alphabet may lose its competitive edge. However, those worries now appear exaggerated. The company has displayed remarkable adaptability, successfully introducing features like the generative AI-powered search summary, which helps it fend off competition effectively.

In addition to its search capabilities, Alphabet’s Google Cloud division is thriving. The demand for cloud services has spiked as clients seek enhanced computing power for AI development. This segment has recorded a 35% year-over-year revenue increase, reaching $11.4 billion.

Overall, Alphabet’s revenue for the third quarter rose 15% year over year, totaling $88.3 billion. Remarkably, its stock is trading at about 22 times forward earnings, notably lower than the S&P 500 index, which is at 24.6 times forward earnings. This disparity suggests that Alphabet’s stock may garner investor attention as they seek out affordable options with robust growth potential.

2. PayPal: Signs of Recovery and Growth Potential

Over the past three years, PayPal has struggled to gain traction in the market. Its stock price peaked at over $300 per share in mid-2021 but has been on a downward trend since mid-2024. However, recent performance shows promise, with the stock climbing 50% since July.

New CEO Alex Chriss, who took the reins in September 2023, is steering a transformation focused on efficiency and core strengths. This strategic shift is already yielding positive results, as recent quarters have shown notable improvements in its operations.

In the third quarter, PayPal experienced its first growth in active accounts since early 2023, paired with an uptick in transaction margins. This modest growth contributed to a 6% year-over-year revenue increase. Notably, operational income rose by 19% to $1.4 billion, indicating a positive trend in profitability.

Using its strong cash flow, PayPal is aggressively repurchasing shares, having retired 28 million shares in just one quarter. With approximately 1 billion shares outstanding, this means that nearly 3% of its shares were bought back in that time. Most companies would find such an achievement impressive over a year, but PayPal is executing it more rapidly, which reflects management’s commitment to the stock’s value.

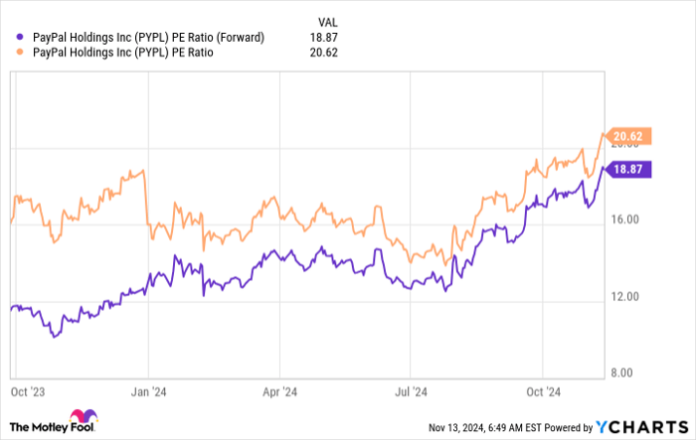

This aggressive repurchase strategy is viable due to a healthy balance sheet and an attractive stock price — around 12 times forward earnings and 14 times trailing earnings at the start of Q3. While the recent rally has made the stock less cheap, opportunities for growth remain as it still lags behind the S&P 500’s valuation.

There is potential for PayPal’s upward trend to continue into the end of the year, making it a compelling option for investors looking to buy now.

Should You Invest $1,000 in Alphabet Right Now?

Before making any investments in Alphabet, keep this in mind:

The Motley Fool Stock Advisor analyst team has identified what they consider the 10 best stocks for investors to focus on right now, and Alphabet didn’t make the list. The stocks that did are predicted to generate substantial returns in the coming years.

For context, if you had invested $1,000 in Nvidia when it was included in their recommendations on April 15, 2005, you’d now have $899,361!*

Stock Advisor offers a straightforward roadmap for successful investing, complete with portfolio-building advice, regular analyst updates, and two new stock picks each month. The service has achieved more than quadrupled the returns of the S&P 500 since its inception in 2002.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

Suzanne Frey, an executive at Alphabet, is on The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and PayPal. The Motley Fool holds positions in and recommends Alphabet and PayPal. The Motley Fool also recommends the following options: long January 2027 $42.50 calls on PayPal and short December 2024 $70 calls on PayPal. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.