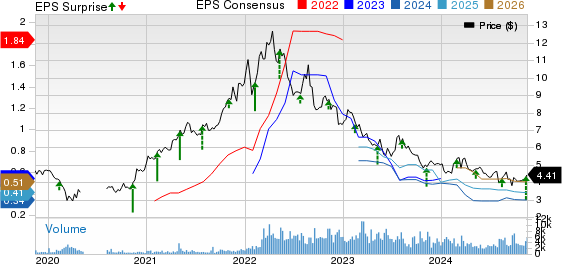

ICL Group Reports Mixed Results for Q3 2024

ICL Group Ltd ICL reported a profit of $113 million, or 9 cents per share, for the third quarter of 2024. This is a decrease from $137 million, or 11 cents per share, for the same period last year. Excluding one-time items, adjusted earnings per share remained stable at 11 cents, surpassing the Zacks Consensus Estimate of 8 cents.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

In the same quarter, sales fell approximately 6% year-over-year, totaling $1,753 million. This figure, however, exceeded the Zacks Consensus Estimate, which was $1,732.7 million.

Sales Performance by Segment

Sales in the Industrial Products segment increased by 16% from last year, reaching $309 million, with an EBITDA rise of about 55% to $65 million. This growth was supported by market share gains in flame retardants.

Conversely, the Potash segment saw a significant decline, with sales dropping around 26% year-over-year to $389 million and EBITDA declining by 27% to $120 million. This downturn was attributed to falling potash prices and decreased sales volumes.

The Phosphate Solutions segment experienced a 3% drop in sales to $577 million while enjoying a 19% increase in EBITDA, which reached $140 million.

Lastly, the Growing Solutions segment’s sales declined by 2% to $538 million, despite an impressive rise in EBITDA of roughly 73% to $64 million.

Financial Overview

At the end of the quarter, ICL reported cash and cash equivalents totaling $393 million, demonstrating a year-over-year increase of about 28%. The company’s long-term debt decreased nearly 7% to $1,845 million.

Operating activities generated net cash of $408 million during the quarter.

Updated Financial Guidance

ICL has adjusted its full-year 2024 guidance, now expecting specialties-driven EBITDA between $0.95 billion and $1.05 billion, up from the prior estimate of $0.8 billion to $1 billion. The company plans to maintain annual potash sales volumes at 4.6 million metric tons, consistent with 2023 levels.

Despite facing challenges from geopolitical uncertainties, ICL remains committed to enhancing its innovative product portfolio and executing targeted efficiency measures.

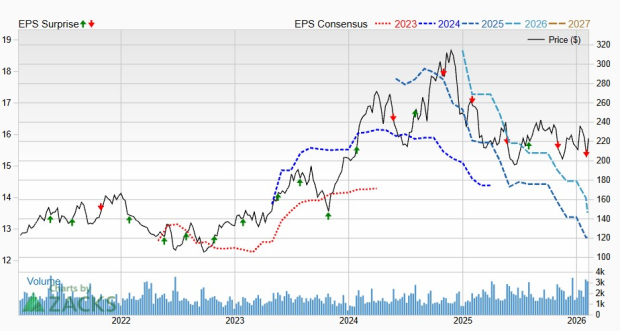

ICL Stock and Industry Performance

Over the past year, ICL’s shares have declined by 12.7%, which is comparable to the broader Fertilizers industry, which saw a 13.8% downturn.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

ICL’s Zacks Rank and Industry Updates

ICL holds a Zacks Rank #3 (Hold). Interested readers can view the complete list of Zacks #1 Rank (Strong Buy) stocks here.

DuPont de Nemours, Inc. DD reported adjusted earnings of $1.18 per share in the third quarter, exceeding the Zacks Consensus Estimate of $1.04. The company raised predictions for its full-year 2024 operating EBITDA and adjusted earnings.

The Chemours Company CC achieved adjusted earnings of 40 cents for the third quarter, surpassing the Zacks Consensus Estimate of 32 cents. However, CC anticipates a mid-to-high single-digit decline in consolidated net sales for the fourth quarter, with expected consolidated adjusted EBITDA falling in the high teens to low 20% range compared to Q3 2024.

PPG Industries, Inc. PPG recorded third-quarter adjusted earnings of $2.13, just below the Zacks Consensus Estimate of $2.15. The company projects flat organic sales along with adjusted earnings at the lower end of the $8.15 to $8.30 range for the full year 2024.

Must-See: Solar Stocks on the Rise

The solar industry is set to rebound as the economy shifts towards clean energy, positioning it to play a crucial role in the upcoming AI revolution.

Trillions of dollars are projected to be invested in clean energy in the coming years, with solar estimated to account for 80% of this expansion. This points to significant opportunities for investors in the near future. Choosing the right stocks will be critical.

Discover Zacks’ top solar stock recommendations FREE.

PPG Industries, Inc. (PPG): Free Stock Analysis Report

DuPont de Nemours, Inc. (DD): Free Stock Analysis Report

ICL Group Ltd. (ICL): Free Stock Analysis Report

The Chemours Company (CC): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.