Tesla Faces Strong Competition as TSMC and Broadcom Loom Large

Tesla (NASDAQ: TSLA) is the eighth-largest company globally, boasting a market capitalization of over $1.05 trillion. As it stands, Tesla’s stock has struggled against the performance of the S&P 500 for much of 2024. However, in a surprising turn, shares have surged nearly 50% in the past month, partly fueled by the outcome of the U.S. elections and speculation regarding CEO Elon Musk’s potential advantages with President-Elect Donald Trump.

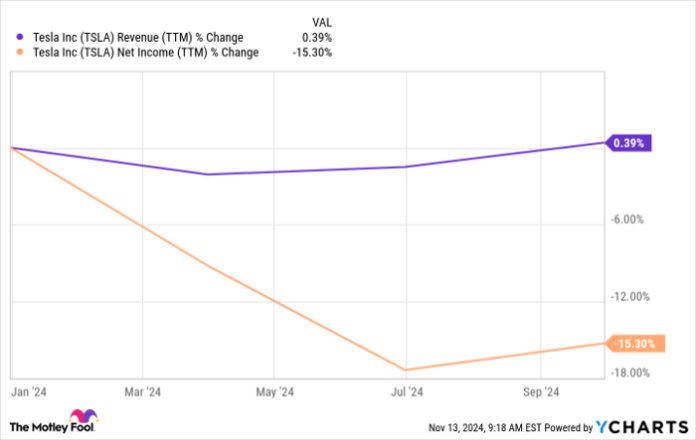

While the stock sees short-term gains, Tesla’s recent financial results are a cause for concern.

Data by YCharts.

The underwhelming stock performance this year is tied to increasing competition, which has negatively impacted Tesla’s delivery figures. Additionally, investors were not impressed with the recent Cybercab reveal. Analysts forecast that Tesla’s earnings will grow by about 4% annually over the next five years, pointing to a potentially rocky growth path ahead.

Given this outlook, it’s plausible that Tesla may soon be surpassed on the list of the world’s largest companies. Taiwan Semiconductor Manufacturing (NYSE: TSM) and Broadcom (NASDAQ: AVGO) are rapidly closing the gap. Both firms are expected to enjoy robust growth driven by high demand for their semiconductor products.

1. Taiwan Semiconductor Manufacturing: A Growing Force

Currently ranked as the world’s 10th largest company, Taiwan Semiconductor Manufacturing (TSMC) has a market cap of around $995 billion. This impressive standing stems from its 62% share in the semiconductor foundry sector, as reported by Counterpoint Research, greatly overshadowing the 13% held by its nearest competitor, Samsung.

TSMC’s leadership in semiconductor manufacturing enables it to capitalize on the burgeoning demand for chips, particularly within artificial intelligence (AI) sectors. The company produces chips for major tech firms such as Nvidia, Apple, AMD, and Qualcomm, all of which benefit from the expansive applications of AI across devices like smartphones and servers.

In 2024, TSMC has showcased remarkable growth, with revenue jumping 31% year-over-year in the first ten months. The company projects a 30% increase in full-year revenue to $90 billion, a significant rebound from a 9% decline in the previous year. Predictions indicate sustained growth with revenue increasing at roughly 20% annually in the coming years.

Data by YCharts.

Moreover, analysts foresee TSMC’s earnings growing at a compelling 26% annual rate over the next five years. Currently, TSMC is trading at 34 times earnings, a significant discount compared to Tesla’s multiple of 90, making it an attractive option for investors.

2. Broadcom: Capitalizing on AI Opportunities

Broadcom is following a similar trajectory, thriving alongside the increasing demand for AI chips. It focuses on creating application-specific integrated circuits (ASICs) and is recognized as a critical player in the AI chip market, second only to Nvidia.

In the third quarter of fiscal 2024 (ending August 4), Broadcom’s sales of custom AI chips surged 3.5 times compared to the previous year. This growth trajectory is expected to continue as the company dominates the custom AI chip sector with a market share of approximately 55% to 60%, per JPMorgan.

JPMorgan estimates Broadcom could see revenue between $20 billion and $30 billion from custom AI chips, with potential growth rates reaching 20% annually. Notably, Broadcom has secured major clients like Meta Platforms and Alphabet, and according to a recent Reuters report, OpenAI is considering collaboration with Broadcom for in-house chip development.

Broadcom’s networking division is also seeing substantial growth due to rising demand for AI data centers, with revenue expanding 43% year-over-year in fiscal Q3, driven by the deployment of AI clusters by large cloud service providers.

With solid growth drivers at play, Broadcom’s earnings are anticipated to rise 20% annually over the next five years, significantly outpacing Tesla’s projected growth. Having a market cap of $813 billion, Broadcom is only 27% shy of Tesla’s valuation and ranks as the 11th largest company worldwide, positioned closely behind TSMC.

Like TSMC, Broadcom stands ready to potentially surpass Tesla in market cap within the next five years, owing to its stronger earnings growth and leading position in the AI chip industry.

Investment Opportunities: Time to Consider

Have you ever felt like you missed out on the most promising stocks? Now might be your chance to reconsider your investment strategy.

Our team of analysts occasionally identifies stocks they believe are set to make a significant impact, known as “Double Down” recommendations. If you feel like you’ve already lost your opportunity to invest, this could be the right moment to act.

- Amazon: If you had invested $1,000 when we made our recommendation in 2010, it would now be worth $22,819!*

- Apple: A $1,000 investment based on our 2008 recommendation would be worth $42,611!*

- Netflix: Investing $1,000 when we recommended it in 2004 would yield $444,355!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not present itself again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

JPMorgan Chase is an advertising partner of Motley Fool Money. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, JPMorgan Chase, Meta Platforms, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.