Shares of Meta Platforms (META) have seen a slight dip today following the European Union’s historic antitrust fine against the company. Meta has been fined nearly 800 million euros ($841 million) for what the EU has termed “abusive practices” related to its Marketplace classified ads. The European Commission determined that Meta unfairly used its popular social network, Facebook, to benefit Marketplace. They discovered that Meta automatically linked Marketplace to Facebook and gathered ad data from competing platforms to enhance its own services.

Margrethe Vestager, the EU’s executive vice president for competition, remarked that Meta’s actions negatively impacted other online advertising services. In response, Meta denied any claims of “competitive harm” and stressed that users have the choice to engage with Marketplace. The company intends to appeal this ruling.

Ongoing Regulatory Challenges for Meta

This investigation into Marketplace is just one of the many regulatory hurdles Meta faces in the European Union. Although this marks the first antitrust fine imposed by the EU, it is not the first punishment Meta has received. Last year, the company was hit with a 1.2 billion euro fine for breaching privacy laws. Additionally, Meta is still under scrutiny concerning issues related to child safety and the integrity of elections.

Wall Street’s View: Buy or Sell META?

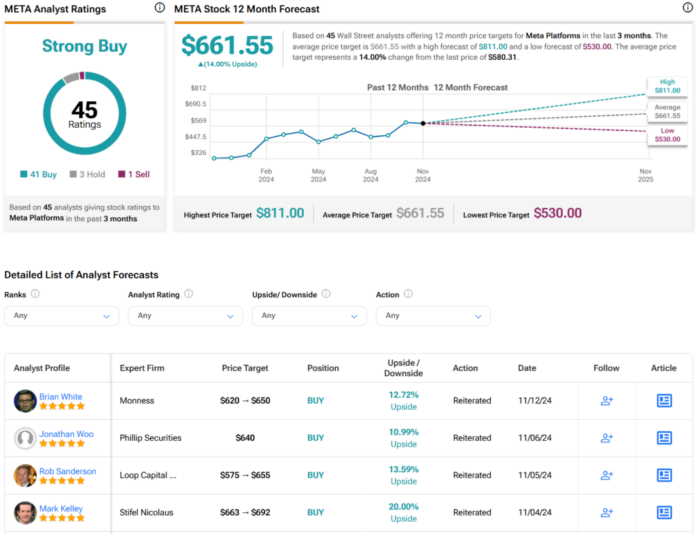

Analysts on Wall Street hold a Strong Buy consensus rating for META stock, with a breakdown of 41 Buys, three Holds, and one Sell assigned over the past three months, as illustrated in the graphic below. Following a remarkable 74% increase in its share price over the past year, the average price target for META stands at $661.55 per share, suggesting a potential upside of 14%.

See more META analyst ratings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.