“`html

Palantir Technologies Soars Amid Strong Growth but Faces Valuation Concerns

Shares of Palantir Technologies (NYSE: PLTR) have experienced impressive growth over the past few years. Recently added to the S&P 500, the stock has skyrocketed 247% year to date as of this writing.

Impressive Revenue Growth and Profit Margins

Palantir’s revenue saw a year-over-year growth rate of 30% in the third quarter, an increase from 27% in the previous quarter. This exceeded management’s guidance by more than four percentage points. Notably, the company is starting to achieve more balanced growth between its commercial and government sectors, a shift from a year ago when commercial customers were increasing rapidly while government business lagged.

The firm reported a 54% increase in U.S. commercial revenue year-over-year, while government revenue grew by 40%. This marks the strongest growth for the government segment in 15 quarters. In September, Palantir secured a nearly $100 million contract to enhance its Maven Smart System across military services over the next five years.

For commercial clients, Palantir is delivering significant value. The company closed over 104 deals exceeding $1 million last quarter. For instance, Trinity Rail achieved a $30 million increase in profits by using Palantir’s artificial intelligence platform (AIP).

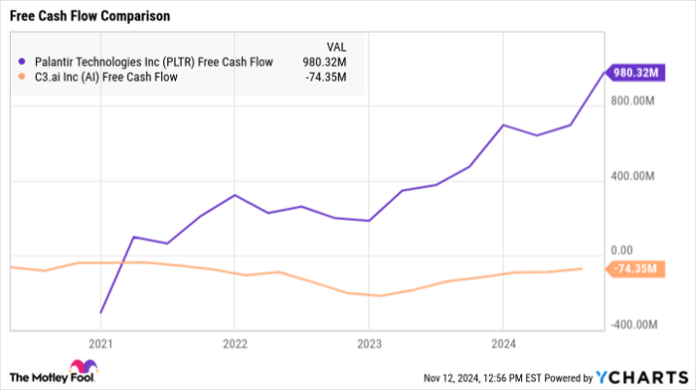

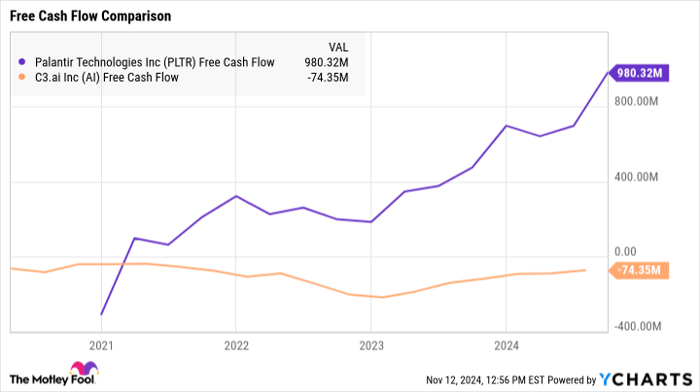

In a competitive landscape with players like C3.ai, Palantir is not only outpacing growth but also managing to maintain a substantial profit margin. The adjusted free cash flow reached $435 million in Q3, yielding a trailing-12-month free-cash-flow margin of 39% of revenue.

Data by YCharts.

Concerns Over High Valuation

It’s important to be cautious about labeling any stock as overvalued. Remember the case of Amazon during the dot-com bubble? Many investors deemed its stock overpriced, yet today its market cap has surged from $25 billion to around $2 trillion.

While some premium may be warranted for Palantir, it’s crucial to consider valuation. The current $135 billion market cap appears high compared to its $2.6 billion in revenue and $980 million in free cash flow. Given Palantir’s volatile trading history, the high valuation may predispose it to a potential pullback.

For now, it might be wise to explore other investment opportunities while monitoring Palantir’s development. This approach allows for a more advantageous entry if its valuation adjusts in the future.

Seize Your Chance with Insightful Stock Recommendations

Do you ever feel like you’ve missed out on investing in major successful stocks? If so, you might want to pay attention now.

Occasionally, our team of analysts identifies certain companies as “Double Down” recommendations, indicating that they are on the verge of substantial gains. If you’re concerned you’ve missed your opportunity, the time to act could be now:

- Amazon: A $1,000 investment when we doubled down in 2010 would now be worth $22,819!*

- Apple: A $1,000 investment when we doubled down in 2008 would now stand at $42,611!*

- Netflix: A $1,000 investment when we doubled down in 2004 would have soared to $444,355!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and this opportunity may not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Palantir Technologies. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`