“`html

Enphase Energy Unveils New AI Tool Amid Year of Struggles

Enphase Energy Inc. ENPH recently announced an innovative addition to its Solargraf software: an artificial intelligence (AI)-powered do-it-yourself (DIY) permitting feature specifically for its U.S. customers. This new function is designed to automate the complicated solar and battery permitting process, potentially cutting the time needed for solar permit plan creation by up to 95%.

With the introduction of this DIY permit plan, the Solargraf platform evolves into a comprehensive solution for designing solar and battery systems, generating proposals, and securing permits. This optimization not only boosts installers’ productivity but also helps reduce costs by streamlining cycle times and operational expenses through an automated workflow.

Expectations for the Solargraf platform with the new feature are high, as it aims to help solar installers work more efficiently. This could attract more investors to consider adding ENPH stock to their portfolios. To determine whether now is a good time to invest, let’s analyze the stock’s year-to-date performance, long-term outlook, and associated risks to facilitate informed decision-making.

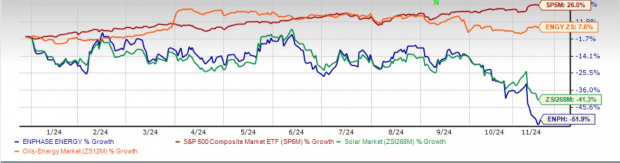

ENPH Stock Underperforms Compared to Peers

So far this year, Enphase Energy’s shares have dropped 51.9%, significantly underperforming the Zacks Solar industry’s decline of 41.3% and contrasting with the overall Zacks Oil-Energy sector’s gain of 7.6%. Meanwhile, the S&P 500 has climbed 26% during the same timeframe.

Other companies in the sector have also struggled. For instance, Emeren Group SOL, Sunrun RUN, and SolarEdge Technologies SEDG have experienced declines of 30.1%, 44.4%, and 86.3%, respectively, this year.

ENPH Year-to-Date Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Challenges Behind ENPH Stock’s Decline

Enphase Energy has been adversely affected by weak demand in both the United States and Europe, which has taken a toll on the company’s product sales and operational results. Evidence of this struggle can be seen in ENPH’s latest third-quarter 2024 results, particularly considering the company’s standing as a leading U.S. solar microinverter manufacturer.

In the most recent quarter, revenues plummeted by 30.9% year over year, driven by a staggering 56% drop in microinverter shipments. This consistent poor performance over the last few quarters has contributed significantly to the steep year-to-date decline in ENPH’s stock price.

Prospects for ENPH Stock Recovery

Despite some cautious signs of demand improvement in the U.S. and Europe, the broader effects of these challenges are expected to persist. The recent decision by the U.S. Central Bank to lower interest rates may provide some temporary relief to ENPH’s bottom line. However, near-term expectations for Enphase’s operational results remain mixed.

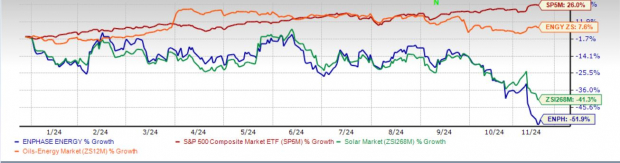

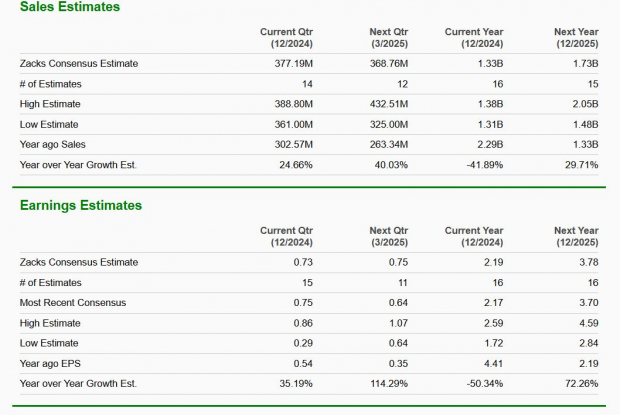

The Zacks Consensus Estimate for ENPH’s fourth-quarter 2024 revenues suggests an increase of 24.7%, while earnings are expected to rise by 35.2% compared to the previous year. Yet, the forecasts for 2024 revenue and earnings indicate more disappointing trends. The reduction in earnings estimates reflects declining investor confidence in the stock. However, there is a silver lining; the consensus for ENPH’s long-term earnings growth rate stands at 9.7%, hinting at potential recovery in future years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

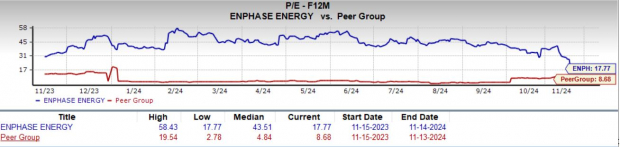

In terms of valuation, ENPH’s forward 12-month price-to-earnings (P/E) ratio stands at 17.77X, higher than its peer group’s average of 15.57X. This indicates that investors are paying a premium for ENPH stock in relation to its expected earnings growth compared to similar companies.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Important Risks Before Investing in ENPH

The global supply chain for semiconductors and electronic components crucial to Enphase’s products has faced major disruptions recently. Such constraints affect component availability, lead times, and costs, increasing the chances of cancellations or delays in supply commitments for Enphase Energy.

In the U.S., factors such as rising interest rates, elevated channel inventory, and the transition from Net Energy Metering 2.0 (“NEM 2.0”) to Net Energy Metering 3.0 (“NEM 3.0”) in California have contributed to a downturn in demand. Similarly, in Europe, utility rate drops and regulatory changes have weakened customer demand. The company anticipates these challenges will continue impacting its operational results, affecting fourth-quarter and full-year 2024 outcomes.

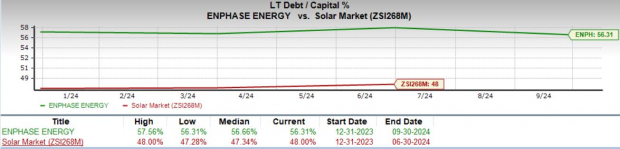

Additionally, ENPH is burdened with high levels of debt, illustrated by its long-term debt-to-capital ratio of 56.31X, which is considerably above its industry average of 48X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion: A Cautious Approach to ENPH

In summary, potential investors should exercise caution and refrain from adding ENPH stock to their portfolios at this time, given its premium valuation, disappointing performance so far this year, and significant debt levels.

Nonetheless, for those already invested in ENPH, monitoring the company’s future performance and broader market conditions will be crucial.

“`

Unlocking Growth: Why Solar Stocks Are Attracting Attention

Solar Industry Set for Growth Amid Energy Transition

Investors in Zacks Rank #3 (Hold) companies may find long-term growth prospects appealing. For those interested, you can explore today’s Zacks #1 Rank (Strong Buy) stocks here.

Investing in Clean Energy: A Historic Shift

The solar market is poised to rebound as technology firms and economies shift away from fossil fuels to support the growth of artificial intelligence. Trillions of dollars are expected to flow into clean energy over the next few years. Analysts predict that solar energy will represent an impressive 80% of this renewable energy growth, which presents significant investment opportunities.

To capitalize on these trends, selecting the right stocks is crucial. As the world increasingly embraces renewable solutions, the potential for financial returns in this sector looks promising.

Discover Zacks’ hottest solar stock recommendation FREE.

Stay updated with the latest insights from Zacks Investment Research. Today, you can download 5 Stocks Set to Double by clicking on this free report.

For those interested in specific companies, consider the following options:

- Emeren Group Ltd. Sponsored ADR (SOL)

- Enphase Energy, Inc. (ENPH)

- SolarEdge Technologies, Inc. (SEDG)

- Sunrun Inc. (RUN)

For an in-depth understanding, read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.