Warren Buffett’s Enduring Faith in Visa: A Stock for the Ages

Warren Buffett is often celebrated as one of the most successful investors ever, and his insights carry significant weight on Wall Street.

Throughout his career, Buffett has emphasized the importance of investing in companies that one can hold onto for the long term—ideally forever. His own portfolio reflects this philosophy, featuring several quality buy-and-hold candidates.

One standout example is Visa (NYSE: V). This financial services leader fits many of the criteria Buffett seeks. Let’s explore why Visa is a compelling long-term investment.

Visa’s Business Model: Simple and Clear

One of Buffett’s investment principles is to put money into businesses that are easy to understand. This guideline is vital; without a solid grasp of a company’s operations, an investor may struggle to predict stock performance and potential risks.

Visa’s business is straightforward: it operates a payment network that connects merchants to banks issuing credit cards, ensuring smooth transactions between them.

Visa’s network supports various payment methods, including credit cards and mobile payments, charging a fee for each transaction. While there are complexities to its operations, the basic framework is accessible. Investors can easily deepen their understanding with a bit of research.

The Competitive Moat

Buffett prefers investing in companies with strong competitive advantages, often referred to as “moats.” These advantages help companies stand out amidst competition and can lead to exceptional long-term returns.

Visa benefits from the network effect: its platform becomes more valuable as more people use it. While businesses aren’t required to accept Visa cards, rejecting them would mean turning away countless potential customers.

This creates a strong incentive for merchants to join Visa’s ecosystem. Additionally, the more businesses that accept Visa, the more attractive it becomes to consumers. Visa and Mastercard essentially share a duopoly in this market, making it difficult for rivals to gain a foothold. Furthermore, Visa has kept pace with technological advancements, solidifying its leading position.

Dividends Enhance Long-Term Gains

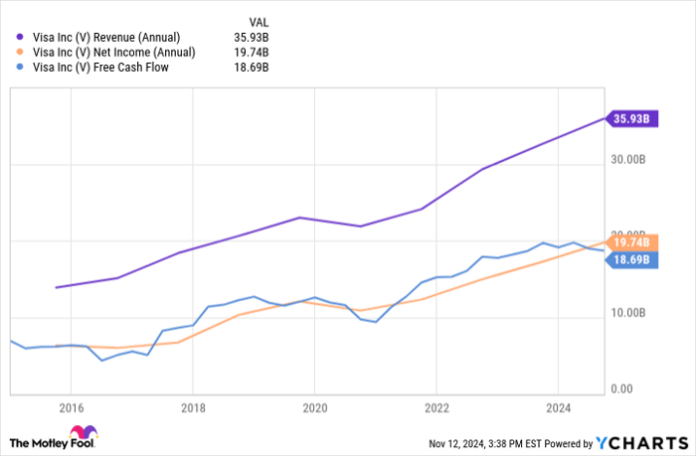

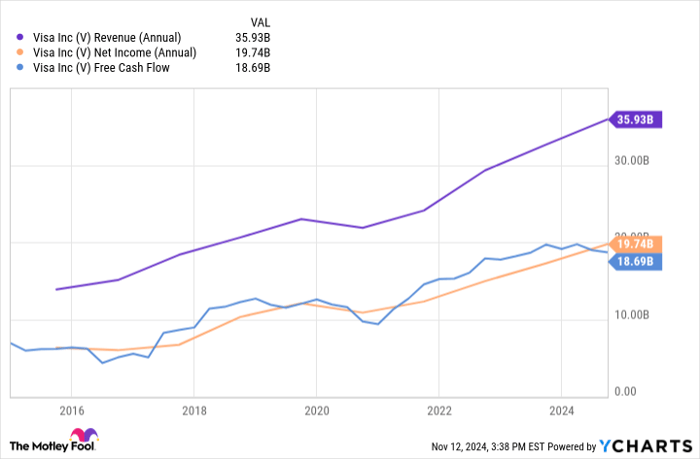

Visa has demonstrated consistently impressive financial performance over the last decade, with growth in revenue, net income, and free cash flow.

V Revenue (Annual) data by YCharts

Strong financials enable Visa to return value to shareholders through dividends. Buffett is known for his appreciation of dividends, particularly the benefits of reinvesting them to harness the power of compounding over time.

Over the past decade, Visa has increased its dividends by nearly 392%, maintaining a modest payout ratio of just 21.36%. Some argue that Visa could have raised its dividends even more, given its conservative payout strategy.

With plenty of room for further increases, Visa’s strong dividend program adds another layer of appeal, making it a solid candidate for long-term investors.

Long-Term Holding Strategy

This article hasn’t covered every aspect of Visa’s business, such as its capacity to replace cash and check transactions with digital payments or its substantial profit margins. However, the fundamental reasons presented strongly advocate for the stock.

Buffett’s long-standing investment in Visa highlights its potential to deliver outsized returns to those who buy and hold the stock today.

Is Investing $1,000 in Visa Right for You?

Before adding Visa to your portfolio, consider this:

The Motley Fool Stock Advisor analyst team has recently identified their picks for the 10 best stocks to invest in right now—and Visa did not make the list. The chosen stocks are anticipated to deliver impressive returns in the near future.

For context, consider how Nvidia was spotlighted on April 15, 2005… if you had invested $1,000 at that time, you’d have $870,068 today!*

Stock Advisor offers investors a clear path to success, providing guidance on building a portfolio, regular analyst updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Mastercard and Visa. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.