DraftKings: A Valuable Investment Opportunity Amid Stock Price Decline

Investors often seek opportunities within established companies, especially when their stock prices dip. Currently, DraftKings (NASDAQ: DKNG) is down 43% from its peak, presenting a potential bargain for growth-focused investors.

Steady Growth Despite Challenges

DraftKings initially gained popularity as a fantasy sports platform and expanded into online sports betting after the Supreme Court lifted the federal ban in 2018. Since then, it has entered 25 of the 38 states that permit some form of sports betting, including Washington D.C. More states are inching toward legalization, recognizing the significant tax revenues involved.

However, the company has faced some difficulties recently. Last quarter, it reported a 39% increase in revenue, reaching nearly $1.1 billion, but fell short of analysts’ expectations of $1.11 billion. While an adjusted loss of $0.17 per share was better than the projected $0.18 loss, the decline in monthly revenue per user—from $114 to $103—was more significant than analysts had expected.

The positive reaction to DraftKings’ third-quarter report stemmed from its impressive sales growth and reduced losses. Year-over-year, the adjusted loss per share was nearly cut in half, with a 30% expected revenue growth in the coming year matching analyst predictions.

Understanding the Stock’s Decline

Despite the company’s positive growth and performance, why is DraftKings stock still down 43% from its high in 2021? The stock experienced significant volatility between late 2021 and early 2022, with the overall bear market contributing to a staggering 85% decline.

A key factor in this drastic swing was timing. DraftKings went public in April 2020, amid the COVID-19 pandemic, a period marked by investor enthusiasm for new ventures. During the early months of the pandemic, the company enjoyed explosive growth as sports briefly halted, but reality set in by the end of 2021 when its unprofitability became clear.

In 2022, as additional states legalized online betting, it became evident that further growth would take time. While DraftKings’ growth potential remains significant, the market had responded unfavorably earlier than warranted.

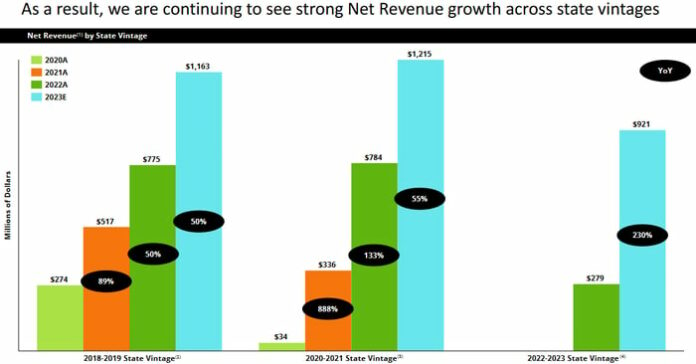

Image source: DraftKings 2023 Investor Day Presentation.

Investments resulting from expanding state operations have driven DraftKings’ stock performance upward in 2023.

Potential for Continued Growth

The growth journey is far from over. The American Gaming Association highlights that 38 states permit some form of sports betting, although not all offer it online. The online gambling market is expanding as consumer awareness and state legislation continue to progress.

Market research firm Straits Research forecasts that the global online sports wagering industry will grow at over 11% annually through 2032, a trend aligned with predictive models by Mordor Intelligence.

DraftKings anticipates significant benefits from this growth; during its November 2023 Investor Day presentation, the company projected $7.1 billion in annual revenue by 2028, with $2.1 billion in EBITDA.

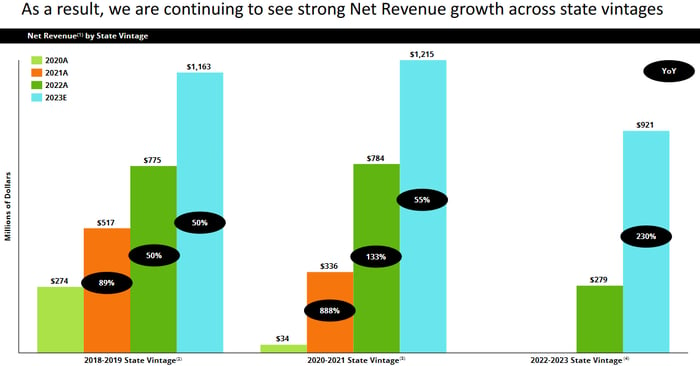

Image source: DraftKings 2023 Investor Day Presentation.

For context, DraftKings expects to generate just under $5 billion in revenue this year, with an adjusted EBITDA of approximately $260 million. Investors should overlook the recent underwhelming quarterly results and focus on the company’s longer-term growth potential—these factors have led many to become increasingly optimistic about this stock.

Despite its recent fluctuations, DraftKings shares are still priced over 20% below the analysts’ average target of $50.80. Notably, three-quarters of analysts covering this stock rate it not just as a buy, but a strong buy, indicating solid support for new investments.

A Second Chance for Smart Investors

Have you ever regretted missing out on a successful stock? Now might be the perfect time to consider investing in DraftKings.

Occasionally, our team of experts issues a “Double Down” stock recommendation on companies poised for significant growth. If you’re worried about missing your chance, investing now could yield rewarding results. Historical examples illustrate the potential:

- Amazon: A $1,000 investment made when we recommended it in 2010 would now be worth $22,819*.

- Apple: If you invested $1,000 when we doubled down in 2008, it would be valued at $42,611*.

- Netflix: A $1,000 stake from 2004 would have surged to $444,355*.

Our latest “Double Down” alerts include three extraordinary companies, providing a rare opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.