Solid Energy Stocks to Consider for Long-Term Gains

The stock market has soared this year, with most sectors, including energy, showing strong performance. In fact, the average energy stock in the S&P 500 has risen over 10% this year.

Despite the overall rally, some energy stocks remain attractive for investors. Notable mentions include Chevron (NYSE: CVX), MPLX (NYSE: MPLX), and Occidental Petroleum (NYSE: OXY). Here’s a closer look at why these stocks are worth considering for high returns.

Chevron: A Strong Player with Challenges

Reuben Gregg Brewer (Chevron): Chevron is a leader among integrated energy companies, boasting a market cap of $275 billion. Its operations span upstream (production), midstream (pipelines), and downstream (chemicals and refining) sectors. The company maintains financial health with a low debt-to-equity ratio of roughly 0.17, one of the best in its category. Plus, it has over three decades of consistent annual dividend increases.

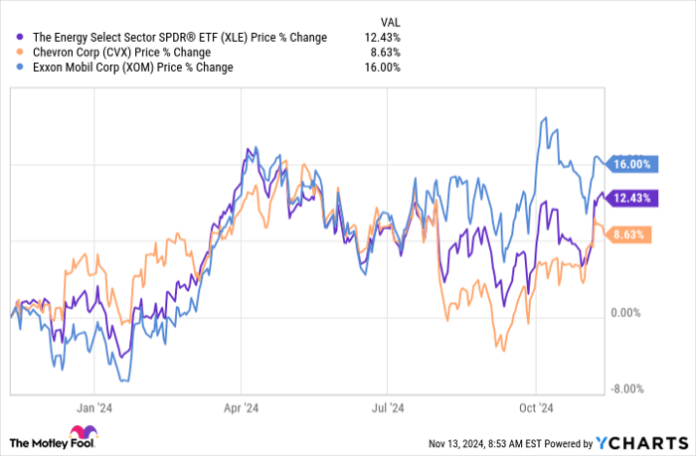

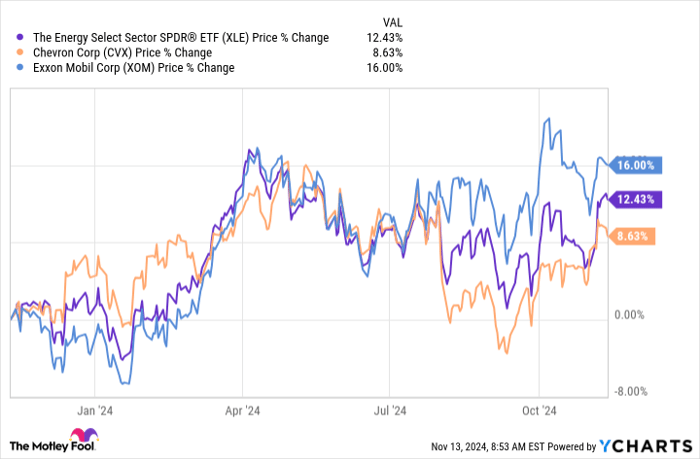

XLE data by YCharts.

However, Chevron’s stock performance has lagged in the past year, particularly compared to ExxonMobil, its closest U.S. rival. This delay is partly due to Chevron’s ongoing efforts to acquire Hess, complicated by Exxon’s partnership with Hess on a major oil project. Investors may be cautious, fearing that a failed acquisition could weaken Chevron’s growth prospects.

That said, long-term investors should look beyond these short-term challenges. If the Hess deal falls through, Chevron can seek other acquisition opportunities. Therefore, the current underperformance could present a buying opportunity, especially with its appealing 4.2% dividend yield.

MPLX: Strong Growth Potential Ahead

Matt DiLallo (MPLX): MPLX units have appreciated by around 25% this year, yet the master limited partnership (MLP) continues to be an attractive investment.

Despite this year’s gains, MPLX offers a high yield exceeding 8%, maintained by a low valuation at about 10 times earnings and steady distribution growth. It recently raised its distribution by 12.5%, marking three consecutive years of double-digit increases.

MPLX’s financial stability positions it well for ongoing distribution growth. It generated enough cash in the first nine months of this year to cover distributions, capital expenditures, and more. Furthermore, with a low 3.4 leverage ratio, the company is well below the 4.0 times level that its cash flows could support.

The MLP is actively expanding its midstream operations, which is essential for enhancing capacity and cash flow. With several projects on the docket, MPLX shows promise for growth through 2026, making it a solid investment option that balances income with growth at a reasonable value.

Occidental Petroleum: A Strategic Turnaround

Neha Chamaria (Occidental Petroleum): Occidental Petroleum shares have struggled this year, trading 15% lower as of now. Concerns arose regarding the impact of declining oil prices, especially for a company with substantial debt. However, investors may be overlooking Occidental’s recent strategic moves.

In its third quarter, Occidental reported robust profits despite falling commodity prices, thanks to increased production following its acquisition of CrownRock for approximately $12 billion, including debt. This acquisition is anticipated to significantly boost its cash flows. In Q3, the company achieved its highest operating cash flow of the year.

More importantly, Occidental is committed to divesting assets and repaying about $4.5 billion in debt within a year of acquiring CrownRock. The company has already repaid $4 billion of that in the third quarter, just two months after closing the deal.

Due to the CrownRock acquisition, Occidental also raised its production forecasts for the Permian Basin, suggesting that strong cash flows and debt reduction efforts will continue, enhancing its financial position moving forward.

A Fresh Opportunity for Investors

If you’ve ever felt like you missed out on lucrative investments, here’s your chance to reconsider.

Sometimes, financial analysts identify “Double Down” stock opportunities—companies they believe are poised for significant growth. If you’re worried you’ve already missed the investment boat, take a closer look at these stocks before it’s too late. The potential returns are significant:

- Amazon: A $1,000 investment from 2010 would be worth $22,819 now!

- Apple: A $1,000 investment from 2008 would have grown to $42,611!

- Netflix: A $1,000 investment from 2004 would be worth $444,355!

Currently, three more “Double Down” alerts are out, presenting a chance for outstanding returns.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Matt DiLallo has positions in Chevron. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron and Occidental Petroleum. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.