Palantir Technologies Inc., Palantir (NYSE: PLTR), has reached a significant milestone in the financial landscape. After witnessing its stock price surge over 250% this year, the company has surpassed the iconic defense contractor Lockheed Martin in market capitalization. Capitalizing on strong revenue growth and increasing profits, Palantir’s recent Q3 earnings have boosted its stock by 40% in just one month.

With investors growing increasingly optimistic about Palantir’s potential, the question arises: What does the future hold for this rapidly expanding company?

Palantir Emerges Among Top Defense Contractors

Currently valued at $136 billion, Palantir stands as one of the largest defense contractors globally. For comparison, Lockheed Martin’s market capitalization is $134 billion, while competitors like RTX Corporation have valuations slightly higher than Palantir’s.

So, what accounts for this rise? The company provides modern software solutions for various branches of the U.S. military and government agencies, replacing outdated systems or filling in gaps where none existed. The need for advanced software ensures that the U.S. government secures a top-tier provider to maintain its strategic advantages. This focus has led to impressive revenue growth from government contracts, with U.S. government revenue climbing 40% year-over-year last quarter.

However, Palantir doesn’t solely rely on government contracts. Recently, the company has broadened its reach, supplying software and AI solutions to numerous large enterprises. While the U.S. government is a substantial client, Palantir aims to tap into a vast market of potential corporate customers who can benefit from its advanced analytical tools.

Revenue and Customer Gains on the Rise

Increasing demand from both government and corporate sectors has allowed Palantir to boost its revenue growth significantly. The company’s U.S. commercial revenue soared by 54% year-over-year last quarter, reaching $179 million. Combined with solid growth from government contracts and modest challenges in international sales, overall revenue rose 30% year-over-year to $726 million in the third quarter.

The rate of customer acquisition has also seen impressive growth. Palantir welcomed 629 customers by the end of Q3, reflecting a 39% year-over-year increase and a 6% rise since the previous quarter. While this may seem small, it’s important to remember that Palantir focuses on the largest enterprises seeking custom solutions. With 104 deals exceeding $1 million closed in the last quarter, the company expects to see growth in revenue-generating customers in the upcoming years. Therefore, continuous growth in customer count should correlate with revenue growth, making it a critical metric for investors to monitor.

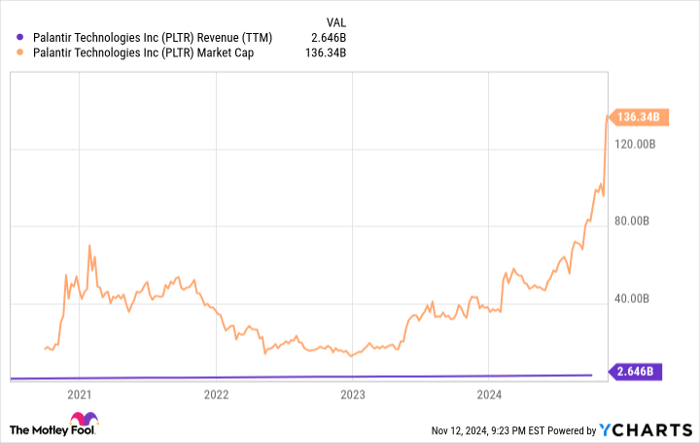

PLTR Revenue (TTM) data by YCharts

Future Outlook for Palantir’s Stock

While Palantir’s business is showing promise, investors need to evaluate the stock itself critically. Growth and value go hand in hand, meaning it’s essential to consider not only the speed of revenue growth but also the stock’s price.

On the positive side, Palantir continues to enjoy robust profit margins, with a GAAP net income of $144 million last quarter translating to a 20% margin. If revenue growth experiences a slowdown, there is potential for profit margins to exceed 30% due to the low variable costs inherent to software businesses.

Palantir generated $2.65 billion in revenue over the last year. If we optimistically project continued strong growth over the next five years, this figure could reach $10 billion. While ambitious, it isn’t out of reach. With a projected 30% net margin, that would result in $3 billion in annual earnings.

Given its current market cap of $136 billion, achieving such earnings would position Palantir’s stock at a price-to-earnings ratio (P/E) of 45 in five years, a substantial valuation after reflecting on considerable growth forecasts and margin improvements. Ultimately, it’s crucial for investors to consider the price they pay for shares, as even a stellar business like Palantir may see its stock performance lag if valuations remain high.

Don’t Miss This Investment Opportunity

Have you ever felt like you missed out on investing in top-performing stocks? If so, this might be your moment.

Occasionally, our team of expert analysts issues a “Double Down” stock recommendation for companies poised for significant growth. If you’re feeling like time is running out to invest, this could be the ideal opportunity.

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $22,819!

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $42,611!

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $444,355!

We are currently issuing “Double Down” alerts for three exceptional companies—this opportunity may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool recommends Lockheed Martin and RTX. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.