“`html

Analyzing Celsius Holdings: Challenges and Future Prospects

It’s been a challenging year for Celsius Holdings (NASDAQ: CELH), with the stock trading down more than 70% from earlier highs. While the energy drink maker has faced setbacks recently, its long-term outlook appears promising.

Let’s delve into the factors contributing to the drop in Celsius’ stock price and explore why it may rebound strongly in the coming years.

Factors Behind Celsius’ Stock Struggles

Celsius’ stock struggled for two main reasons this year. Firstly, growth began to normalize after a significant distribution deal with PepsiCo in 2022. This agreement greatly increased Celsius’ visibility in the crucial convenience store sector, leading to impressive but unsustainable revenue growth throughout 2023. As the company faced tougher comparisons to these gains, growth slowed unexpectedly. The reported growth fell from 95% in Q4 2023 to 37% in Q1 2024, catching many investors off guard and leading to a steep decline in stock value.

Additionally, convenience stores, having penetrated the market effectively, started to see diminished foot traffic. For instance, 7-Eleven announced it would close over 400 stores due to a 7.3% drop in traffic in August. Shifts in consumer behavior, driven by inflation, high interest rates, and job market fluctuations, contributed to this decline.

These challenges in the convenience store industry resulted in only 1% growth for the energy drink sector this year, a stark contrast to the 8% growth experienced in 2023.

Image source: Getty Images.

Potential for Recovery

Despite the recent stock struggles, there is optimism surrounding Celsius as a potential rebound candidate for next year and beyond. Insights from the National Association of Convenience Stores tradeshow suggest that retailers anticipate improved sales moving forward. Last quarter, the company dealt with inventory mismatches; however, these issues are expected to resolve soon.

Younger consumers continue to favor the Celsius brand. A survey by Piper Sandler involving 13,500 teenagers revealed that 35% named Celsius as their favorite energy drink. With Celsius holding approximately 12% of the U.S. market share, there remains significant opportunity to capture market segments currently dominated by Red Bull and Monster Beverage (NASDAQ: MNST).

Furthermore, Celsius excels in non-traditional retail channels like Amazon and big-box retailers such as Costco Wholesale. The company also emphasizes innovation, having introduced the Celsius Essentials lineup aimed at the larger 16-ounce energy drink market, with a focus on performance to attract more male consumers. Notably, sales from this new line have been supplementary rather than cannibalizing sales from existing products.

International expansion represents another key opportunity for Celsius. In the last quarter, only 7% of Celsius’ sales came from overseas, in stark contrast to the 38% of Monster’s energy drink sales generated from international markets. This discrepancy highlights a significant growth opportunity ahead.

While Celsius has made some inroads in Scandinavian markets like Sweden and Finland, it just entered the U.K. and Ireland through fitness channels and select gyms. Additionally, Celsius is pursuing markets in Australia, France, and New Zealand, while Monster has successfully penetrated diverse global markets.

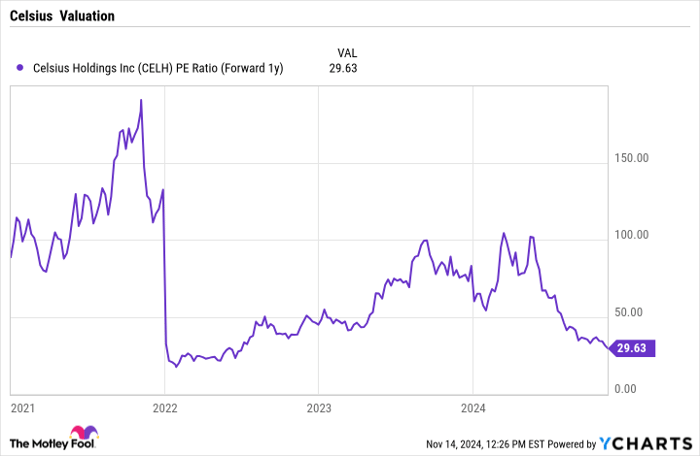

Currently, Celsius’ stock is trading at a forward price-to-earnings (P/E) ratio of just under 30 times next year’s estimates.

CELH PE Ratio (Forward 1y) data by YCharts

This valuation reflects a reasonable price if Celsius can capture a larger share of the younger consumer segment and leverage its promising international prospects.

Successful international expansion was a critical factor in Monster’s significant stock gains, and Celsius is still in its early stages. With a market cap of $6.4 billion compared to Monster’s $55 billion, Celsius has the potential to become a major player in this space if it can replicate Monster’s success.

A Second Chance for Investment

Do you ever feel like you’ve missed out on investing in top-performing stocks? If so, it’s worth paying attention now.

Occasionally, our expert team of analysts issues a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you’re concerned about missing your investment opportunity, now might be the best time to buy before conditions change. Here’s how previous recommendations have performed:

- Amazon: a $1,000 investment from our 2010 recommendation would now be worth $22,819!*

- Apple: $1,000 invested following our 2008 recommendation would have grown to $42,611!*

- Netflix: a $1,000 investment from our 2004 recommendation would now be worth $444,355!*

Currently, we’re releasing “Double Down” alerts for three outstanding companies, and such opportunities may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, and Monster Beverage. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`