Analysts Predict Positive Outlook for iShares Morningstar U.S. Equity ETF

ETF Channel has analyzed the underlying holdings of various ETFs, focusing on the iShares Morningstar U.S. Equity ETF (Symbol: ILCB). We compared the current trading prices against average 12-month forward target prices set by analysts. Based on this analysis, the estimated target price for ILCB is $89.68 per unit.

Current Trading Scenario and Potential Upside

As of now, ILCB is trading at $81.18 per unit, indicating a potential upside of 10.48% if it reaches the analysts’ average target. Notable underlying holdings contributing to this positive outlook include Astera Labs Inc (Symbol: ALAB), RenaissanceRe Holdings Ltd. (Symbol: RNR), and nVent Electric PLC (Symbol: NVT). Astera Labs, for example, is currently priced at $86.45 per share, whereas analysts predict it could rise by 16.83%, hitting $101.00 per share. Similarly, RNR is expected to grow 14.06% from its current price of $260.18, projecting a target of $296.75. nVent Electric also shows potential with a target of $82.57, reflecting a 13.39% increase from its recent price of $72.82.

Performance Review: Recent Trends

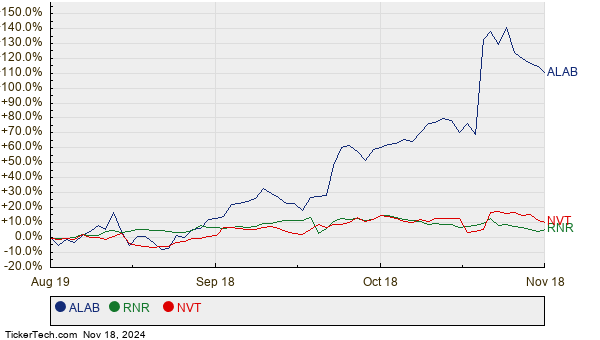

Displayed below is a chart illustrating the 12-month price trends of ALAB, RNR, and NVT:

Analyst Target Overview

The following table summarizes the current analyst target prices for the discussed companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Morningstar U.S. Equity ETF | ILCB | $81.18 | $89.68 | 10.48% |

| Astera Labs Inc | ALAB | $86.45 | $101.00 | 16.83% |

| RenaissanceRe Holdings Ltd. | RNR | $260.18 | $296.75 | 14.06% |

| nVent Electric PLC | NVT | $72.82 | $82.57 | 13.39% |

The Analyst Perspective

As market conditions evolve, analysts’ predictions raise questions: Are these targets realistic, or do they reflect an overly optimistic view of the stocks’ futures? Understanding whether analyst forecasts are justified by recent developments in the companies and their sectors is crucial for investors. A higher target price can signal positive expectations, but it may also foreshadow potential downgrades if the targets don’t align with market realities.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of WINS

• CDVI Options Chain

• Funds Holding DZK

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.