Analysts See Potential Growth for Vanguard Large-Cap ETF and Key Holdings

In our analysis of various ETFs, we examined the trading prices of their underlying assets compared to projected analyst target prices. For the Vanguard Large-Cap ETF (VV), the implied target price stands at $295.60 per share.

Current Price and Analysts’ Outlook

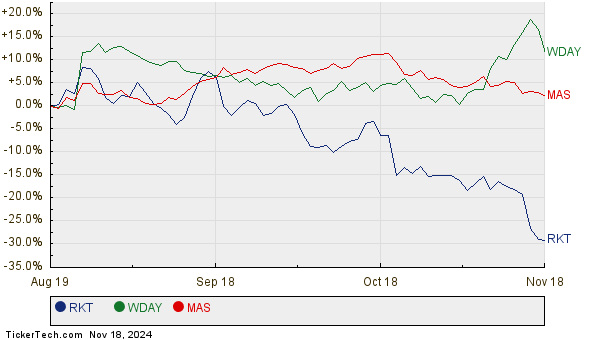

With VV currently priced around $269.45 per share, analysts believe there’s a possible upside of 9.70%. Noteworthy among VV’s holdings are Rocket Companies Inc (RKT), Workday Inc (WDAY), and Masco Corp (MAS), which all show potential for growth based on their analyst targets. RKT, trading at $13.60 per share, has an average target of $15.62, indicating a 14.89% upside. WDAY shows an 11.51% upside, with a recent price of $259.41 and a target of $289.28. Similarly, MAS has a current share price of $78.42, with an expected target of $87.22, reflecting an 11.22% upside. Below is a chart detailing the twelve-month performance of RKT, WDAY, and MAS:

Summary of Analyst Targets

Here’s a table summarizing the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Large-Cap ETF | VV | $269.45 | $295.60 | 9.70% |

| Rocket Companies Inc | RKT | $13.60 | $15.62 | 14.89% |

| Workday Inc | WDAY | $259.41 | $289.28 | 11.51% |

| Masco Corp. | MAS | $78.42 | $87.22 | 11.22% |

Investors’ Considerations

As investors look at these targets, they must consider whether analysts are being realistic or overly optimistic about future stock prices. A high target price could suggest confidence in future growth but might also lead to reductions in targets if not aligned with recent developments in the industry or the companies themselves. Careful analysis and further research are crucial for making informed investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Best Dividend Paying Stocks Analysts Like

• CX market cap history

• Top Ten Hedge Funds Holding FPO

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.