Nvidia (NASDAQ: NVDA) has consistently outperformed the market in recent years. This impressive performance stands out even more when considering long-term trends.

As we approach 2025, Nvidia will face new challenges alongside possible growth opportunities. Will the stock continue to soar?

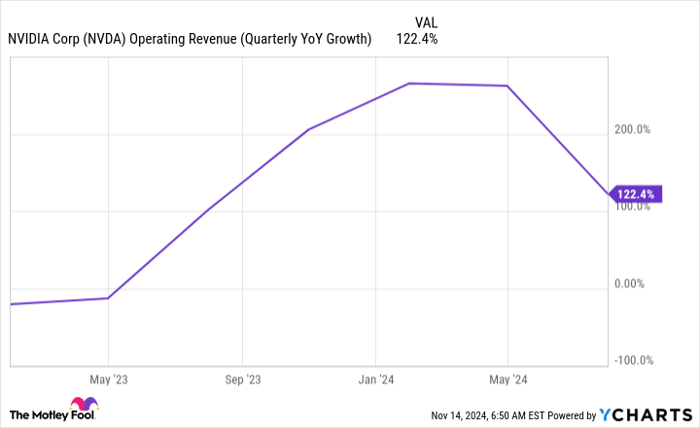

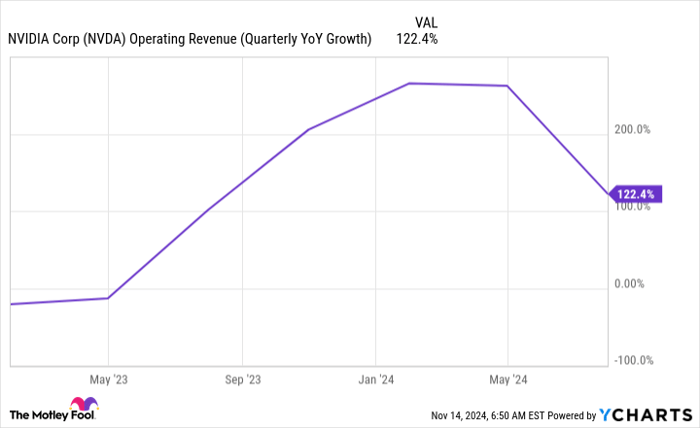

A Shift in Revenue Growth for Nvidia

2025 is expected to look different for Nvidia compared to 2023 and 2024. After experiencing remarkable growth, the year-over-year revenue comparisons will now start from a higher baseline, making future percentage increases seem less dramatic.

In the past couple of years, Nvidia achieved extraordinary growth, with quarterly revenues sometimes tripling year over year.

NVDA Operating Revenue (Quarterly YoY Growth) data by YCharts.

This impressive growth was largely fueled by a boom in artificial intelligence (AI) technology. As cloud service providers rush to develop efficient AI models, they are rapidly increasing their computing capabilities. Nvidia’s graphics processing units (GPUs) are considered top-tier for AI processing, giving the company a significant advantage during this period of expansion.

Yet, these cloud services are still in the midst of expanding their infrastructures.

Meta Platforms has indicated that its capital expenses will increase significantly in 2025 compared to 2024. Furthermore, major cloud providers like Microsoft, which operates the second-largest cloud service Azure, are also ramping up their spending. During a recent quarterly call, CFO Amy Hood noted: “We expect capital expenditures to increase on a sequential basis due to our cloud and AI demand signals.”

Since Nvidia’s top clients are signaling higher capital expenditure (capex) for 2025, Nvidia’s sales are likely to continue growing next year. The burning question remains: will this be sufficient to sustain the stock’s impressive momentum?

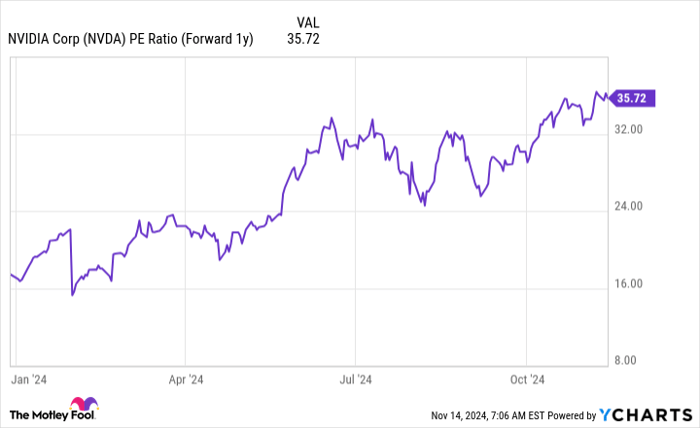

Potential Challenges Ahead for Nvidia

Nvidia will face a significant challenge: its valuation. Much of the future success seems already reflected in its current stock price, which may hinder further growth.

Nvidia’s stock currently trades for 35.7 times its expected earnings for the fiscal year 2026, ending in January 2026. Such a valuation could be concerning if it were based on trailing earnings, as it hinges on Nvidia meeting Wall Street’s expectations consistently over the next five quarters while maintaining a steady stock price.

NVDA PE Ratio (Forward 1y) data by YCharts.

Moreover, the massive demand for AI computing power could potentially stabilize toward the end of 2025 as cloud providers may feel they have enough processing power to meet their needs.

Yet, it seems unlikely that either of these issues will materialize just yet. It remains difficult to predict how much computing power will be needed to fully maximize these AI models, and it seems unlikely that we will reach that peak in 2025. We are only beginning to integrate these AI models, and many still face challenges.

The increasing demand for AI computing power will likely extend beyond 2025, which alleviates some concerns about declining GPU requests.

Regarding Nvidia’s valuation, there might be a slight decrease due to expected “slower” growth, although analysts following the company project revenue growth of 44% for 2025. While this access to lower growth may frictionally affect Nvidia’s stock gains, it does not imply a significant decline into market lagging territory.

Although Nvidia’s stock may not triple like it did in 2023 and 2024, the growth outlook remains optimistic with an expectation of at least a 10% increase in 2025. This makes the stock a potential opportunity for investors to consider before the new year begins.

Seize This Second Chance for Potential Profits

Have you ever thought you missed the opportunity to buy into outstanding stocks? Now is the time to reconsider.

On rare occasions, our expert analysts recommend a “Double Down” stock—a company they believe is on the verge of significant growth. If you fear you’ve missed out, now might be the best time to invest again before it’s too late. The numbers illustrate the potential:

- Amazon: A $1,000 investment from our recommendation in 2010 would be worth $22,819!*

- Apple: A $1,000 investment from our recommendation in 2008 would be worth $42,611!*

- Netflix: A $1,000 investment from our recommendation in 2004 would be worth $444,355!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Meta Platforms. The Motley Fool has positions in and recommends Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.